Understanding Senior Secured Financing Options

Nathan Allen

Photo: Understanding Senior Secured Financing Options

Introduction to Senior Secured Financing

Senior secured financing refers to a borrowing structure where lenders provide funds to a borrower, backed by specific collateral. This form of financing is characterized by its secured nature, meaning that in the event of default, lenders have a prioritized claim over the pledged assets. Understanding senior secured financing is crucial, as it represents a vital component of the overall lending landscape and serves various industries in facilitating growth and stability. In the realm of finance, the distinction between secured and unsecured financing is paramount. Secured financing is backed by the borrower's assets, which can include real estate, equipment, or inventory, offering lenders a degree of security and reducing their risk. Conversely, unsecured financing lacks this collateral and is often associated with higher interest rates, as lenders face greater risk without an asset to claim in case of default. As such, senior secured financing typically features more favorable loan terms, including lower interest rates and longer repayment periods, making it an attractive option for borrowers. The importance of senior secured financing cannot be understated. It plays a significant role in capitalizing businesses, providing necessary resources for expansion, acquisitions, or refinancing purposes. Investors particularly favor this type of financing due to its relative safety, as the risk of loss is mitigated by the assets securing the loan. Furthermore, the structure of senior secured financing often allows for greater flexibility in financial strategy, empowering companies with the ability to leverage their assets effectively. Knowing the mechanics of this type of financing equips borrowers with the insights needed to navigate their financial options intelligently.

Types of Senior Secured Financing

Senior secured financing encompasses a range of financial instruments that provide companies with access to capital while minimizing risks for lenders. Understanding the key types of these financing options is vital for businesses looking to navigate their capital needs strategically. One of the most prevalent types of senior secured financing is traditional bank loans. These loans typically involve secured term loans backed by the company's assets, which may include real estate, machinery, or inventory. For instance, a manufacturing firm might approach a bank to secure a loan, offering its equipment as collateral. The primary advantage of traditional bank loans is their relatively lower interest rates compared to unsecured lending, making them an attractive option for businesses with solid credit histories. Another significant category is asset-backed loans (ABL). These loans specifically use the assets of the borrower as collateral. A common example includes a retail company leveraging its inventory to secure funds for expansion. ABLs allow businesses to access liquidity while only pledging specific assets, thus freeing up other resources. This type of financing can enhance cash flow without relinquishing ownership or equity in the business. Mezzanine financing serves as a unique blend of debt and equity financing. It generally comes into play when higher-risk capital is needed, often in conjunction with a senior loan. A typical example of this would be a growing firm raising funds for an acquisition, where the mezzanine lender agrees to provide financing in exchange for equity options or warrants. This type of financing can be advantageous because it tends to be less demanding in terms of collateral however, it often carries higher interest rates and may dilute ownership. These various types of senior secured financing cater to different business needs and risk tolerances, making them invaluable tools in the financial landscape for companies seeking to optimize their capital structure.

Benefits of Choosing Senior Secured Financing

Senior secured financing presents a variety of benefits that make it an appealing option for businesses seeking to optimize their funding strategies. One of the primary advantages is the lower interest rates typically associated with this type of financing. Since senior secured loans are backed by collateral, lenders face significantly reduced risk. This reduction in risk is often reflected in the interest rates offered, allowing borrowers to save considerable amounts over the life of the loan. For instance, data from financial institutions indicates that borrowers can enjoy interest rate reductions ranging from 1% to 3% compared to unsecured loan offerings. Another critical benefit of senior secured financing is the higher borrowing limits. Lenders are generally willing to extend larger amounts of credit when a loan is secured against valuable assets. This increased availability of capital allows businesses to finance significant projects, manage cash flow, or invest in growth opportunities without excessive limitations. Case studies have shown that companies leveraging senior secured loans have successfully navigated large-scale expansions, affirming the potential for improved organizational performance through strategic funding. Moreover, senior secured financing also reduces risk for lenders. Since the loans are secured by collateral, in the event of default, lenders have a claim on the assets securing the loan, thereby improving their position in the recovery process. This assurance makes lenders more amenable to working with borrowers, leading to potentially more favorable terms and conditions for the financing. By improving overall lending security, senior secured loans foster a relationship of trust between borrowers and lenders, which can lead to further opportunities for financing in the future. In conclusion, the advantages of senior secured financing including lower interest rates, higher borrowing limits, and reduced lender risk make it an essential consideration for businesses aiming to secure effective and efficient funding solutions.

Factors to Consider When Seeking Senior Secured Financing

When considering senior secured financing, potential borrowers must evaluate several critical factors to ensure they make informed decisions. One primary consideration is the borrower’s creditworthiness. Lenders typically assess credit scores, credit histories, and financial stability to gauge the risk associated with issuing a loan. A strong credit profile not only enhances the likelihood of loan approval but can also lead to more favorable interest rates, which ultimately affects the cost of borrowing. Another essential factor is the loan-to-value (LTV) ratio. This metric compares the loan amount to the appraised value of the collateral that secures the loan. A lower LTV ratio signifies less risk for the lender, as it indicates that the borrower has substantial equity in the asset. Generally, a loan-to-value ratio of 80% or lower is viewed favorably, as it signifies that the borrower has a vested interest in the collateral. Thus, potential borrowers should aim to provide adequate equity to improve their chances of obtaining senior secured financing. The type of collateral offered also plays a pivotal role in the senior secured financing process. Traditional forms of collateral include real estate, equipment, or inventory, which can be liquidated in the event of default. Lenders prefer tangible assets that hold intrinsic value and can be readily converted into cash. Additionally, market conditions, such as interest rate trends and economic cycles, can significantly influence borrowing costs and financing terms. In times of economic uncertainty, lenders may tighten their credit standards, making it crucial for borrowers to stay informed about the prevailing market environment. By thoroughly assessing these factors, potential borrowers can better evaluate their eligibility and readiness to pursue senior secured financing options. Understanding creditworthiness, LTV ratios, collateral types, and market conditions will empower borrowers to make strategic financial decisions that align with their objectives.

Legal Aspects and Documentation Involved

Understanding the legal aspects and documentation involved in senior secured financing is essential for both lenders and borrowers. The process encompasses an array of agreements and formalities that set the foundation for a successful transaction. Among the key documents required is the loan agreement, which outlines the terms and conditions of the financing. This document specifies the amount borrowed, interest rates, repayment schedules, and any covenants that the borrower must adhere to throughout the term of the loan. Additionally, the loan agreement will typically include provisions that detail what happens in the event of a default. Another critical element of senior secured financing is the security agreement. This document establishes the security interests in the collateral, which serves to protect the lender's rights in case of non-compliance or default by the borrower. The types of collateral can vary widely, ranging from real estate to inventory, and defining the nature of these interests ensures clarity in the event of enforcement actions. Regulatory compliance is also a significant concern within senior secured financing. Parties must be aware of both federal and state regulations that govern secured transactions, including the Uniform Commercial Code (UCC) provisions. Compliance with UCC regulations helps in correctly perfecting the security interest, which is vital for the lender’s priority claim over the collateral in case of bankruptcy or insolvency proceedings. Ensuring that all legal documentation is meticulously drafted and reviewed cannot be overstated. Involving experienced legal counsel during this phase significantly reduces the risks associated with misunderstandings or inadvertent omissions. Legal advisors play a pivotal role in navigating the complexities of financial agreements and ensuring that all legal requirements are satisfied, thereby fostering a smoother funding process. The interplay between the legal framework and financing options necessitates careful consideration and strategic planning.

Common Challenges and How to Overcome Them

When navigating the landscape of senior secured financing, borrowers often encounter several common challenges. Understanding these obstacles and employing effective strategies can significantly enhance the chances of securing the necessary funds. One prevalent issue is valuation disputes. Often, lenders and borrowers may disagree on the valuation of the collateral being put up for the loan. This disparity can lead to complications in securing financing, as a lower valuation could reduce the amount a lender is willing to provide. To mitigate this, borrowers can engage an independent appraiser to conduct a professional valuation prior to negotiations. This unbiased assessment can serve as a solid foundation for discussions, minimizing potential conflict. Another challenge is meeting lender requirements, which can vary widely depending on the institution and the specific risk profile of the borrower. Lenders typically have a set of criteria that borrowers must fulfill to be considered for senior secured loans. This might include maintaining a certain debt-to-equity ratio or demonstrating consistent cash flow. Borrowers can address these requirements by conducting a thorough review of their financial situation before approaching lenders. This proactive approach allows borrowers to address potential weaknesses and gather the necessary documentation that aligns with lender expectations. Additionally, timing can be a critical factor in securing financing. Delays in obtaining approvals or completing documentation can jeopardize opportunities. Therefore, maintaining an organized approach throughout the application process is essential. Utilizing financial advisors can provide insights into streamlining the process, ensuring effective communication with lenders. In summary, while challenges in securing senior secured financing are common, borrowers can overcome them through strategic preparation, transparent communication, and professional assistance. By taking these proactive steps, the likelihood of a successful financing outcome increases significantly, facilitating a smoother journey towards securing the necessary funds.

Real-Life Case Studies of Senior Secured Financing

Senior secured financing has been instrumental in the growth and stability of various businesses across industries. An examination of notable case studies reveals how this form of financing can be effectively leveraged for different purposes. One of the significant examples can be found in the private equity sector, where a firm secured a senior loan to finance the acquisition of a manufacturing company. With a clear repayment strategy anchored on the predictable cash flow generated by the business, the financing not only facilitated the acquisition but also provided the necessary capital for post-acquisition growth initiatives. In another instance, a real estate development company used senior secured financing to fund a large-scale residential project. The developers obtained a senior mortgage secured by the property itself. This approach allowed them to access lower interest rates while ensuring that their project had the financial backing required for timely completion. With the project’s successful launch, the developers were able to repay the financing ahead of schedule, demonstrating the effectiveness of senior secured financing in the real estate market. Moreover, the case of a technology startup illustrates how senior secured financing can support innovation and growth. The startup managed to acquire a senior secured credit facility, allowing them to invest in research and development while reducing operational cash flow pressures. This financing option provided the startup with leverage during a critical period, leading to significant advancements in their product offerings. As the startup began generating increased revenue, they efficiently repaid the financing, highlighting the pivotal role that senior secured loans can play in a company’s lifecycle. These case studies clearly indicate that senior secured financing is not merely a financial tool but a strategic asset that, when applied wisely, can lead to sustainable growth and long-term success for businesses in diverse sectors.

The Future of Senior Secured Financing

The landscape of senior secured financing is evolving rapidly due to several emerging trends, including technological advancements and significant shifts in the financial market. These factors collectively indicate a transformative future for this specific financing option. Key among the changes is the integration of technology into the lending process. Fintech innovations, such as blockchain and artificial intelligence, are streamlining operations by enhancing transaction transparency and risk assessment. This shift is not only improving the efficiency of loan origination but is also helping lenders make more informed decisions regarding creditworthiness and the terms of the loans they provide. Additionally, the increased availability of data has enabled lenders to employ more sophisticated analytical strategies, thereby leading to more tailored financing options for borrowers. The advent of data analytics allows for the identification of patterns and trends that can enhance risk management practices and reduce default rates. As lenders become more adept at leveraging these insights, the overall appeal of senior secured financing may rise among both borrowers and investors. Market dynamics also play a crucial role in shaping the future. With interest rates fluctuating and uncertainty stemming from global economic shifts, senior secured financing may appeal more to investors seeking stability. Predictive analytics suggests that demand for this type of financing will increase, especially in industries that are traditionally considered riskier, as businesses look for ways to secure funding without sacrificing asset ownership. Expert opinions within the financial sector indicate that environmental, social, and governance (ESG) considerations will increasingly impact senior secured financing decisions. As sustainability becomes a focal point, there is a growing expectation for lenders to include ESG factors in their valuation models. This could lead to innovative financing structures that align with socially responsible investing. In summary, the future of senior secured financing is poised for significant change, driven by technology and evolving market conditions. Key players in the financial sector must adapt to these trends to capitalize on the opportunities that lie ahead.

FAQs About Senior Secured Financing

Senior secured financing represents an essential aspect of corporate finance, often utilized by businesses seeking a robust capital structure. Numerous inquiries arise regarding this financing option, and addressing them can provide clarity to potential borrowers and investors alike. One common question pertains to the definition of senior secured financing itself. This type of funding involves loans or credit facilities that are secured by collateral. In the event of a default, lenders have preferential rights to the assets pledged, which significantly reduces their risk. Furthermore, the term “senior” indicates that this financing takes precedence over other forms of debt, such as subordinated loans or unsecured debt. Another frequent inquiry concerns the differences between secured and unsecured loans. Secured loans require the borrower to pledge specific assets, thereby lowering the lender’s risk and potentially leading to more favorable terms such as reduced interest rates. Conversely, unsecured loans do not require collateral, posing a higher risk to lenders and often resulting in higher interest rates. Potential borrowers often ask about the eligibility criteria for obtaining senior secured financing. Typically, lenders assess the creditworthiness of the borrowing entity, the value of the collateral, and the purpose of the loan. Companies with established credit histories and viable collateral usually stand a better chance of securing favorable financing terms. Additionally, some may wonder about the impact of senior secured financing on a company's balance sheet. While this financing can provide timely capital for growth or stability, excessive reliance on debt can lead to a high leverage ratio, potentially raising concerns among investors and affecting overall financial health. With this understanding, businesses can navigate the complexities of senior secured financing with greater confidence, ensuring they make informed decisions that align with their financial goals.

Conclusion and Call-to-Action

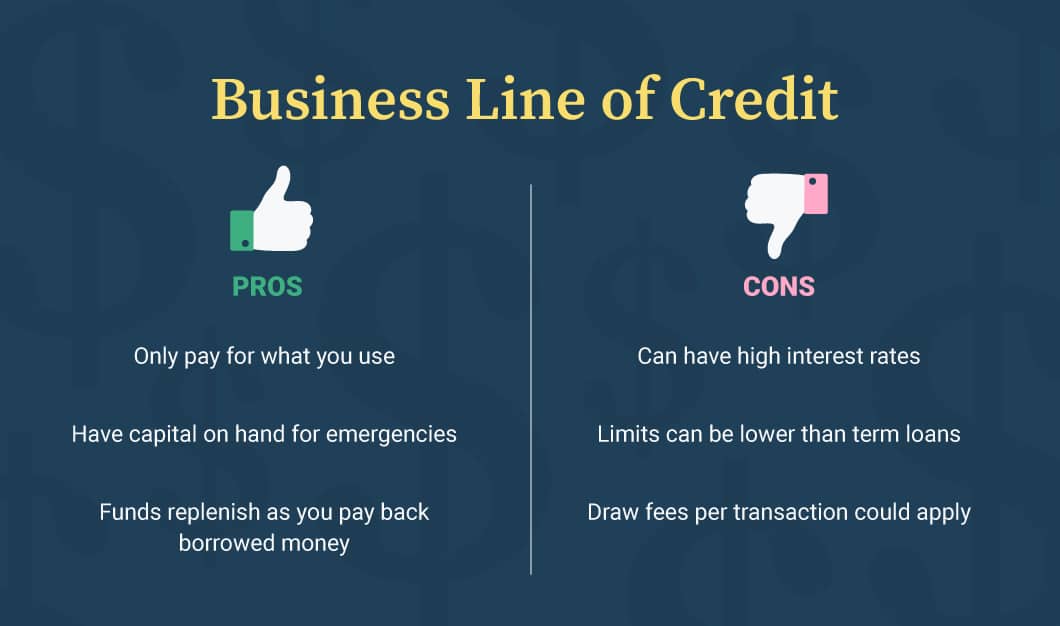

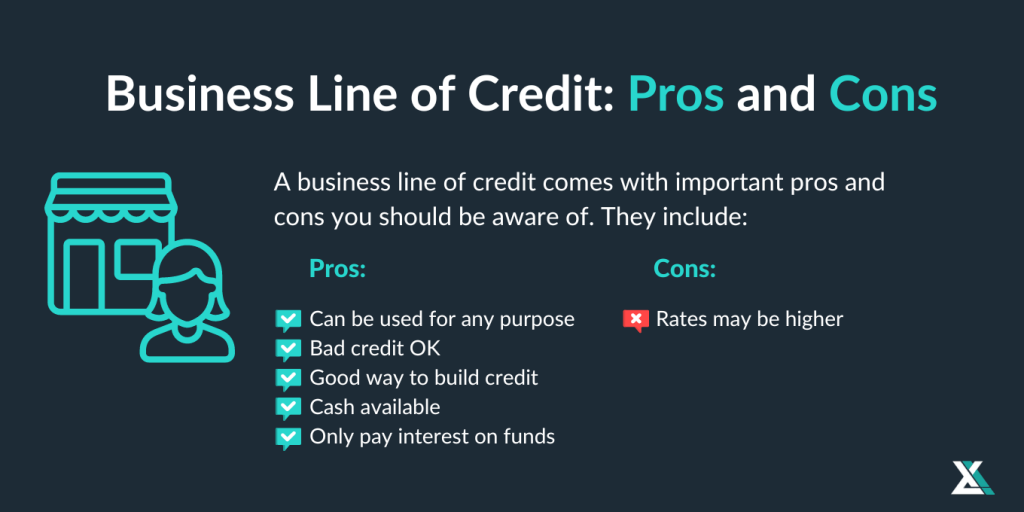

In examining the various senior secured financing options available, it becomes evident that these financial instruments can play a crucial role for businesses and individuals seeking capital. Senior secured loans, often characterized by their priority in the event of liquidation, provide borrowers with a safety net that is largely absent in unsecured financing. This type of funding not only enhances the ability to secure necessary funds but also often comes with more favorable interest rates due to reduced risk for lenders. Moreover, the flexibility of senior secured financing, particularly in structures such as revolving credit facilities, allows borrowers to manage cash flow more effectively. By understanding the intricacies of these financing options, entities can better utilize their resources, optimize their capital structure, and pursue growth opportunities without the debilitating constraints that can accompany less secure forms of borrowing. As we reflect on the key takeaways of this guide, it is crucial for potential borrowers to assess their unique financial situations and consider how senior secured financing can align with their strategic goals. Navigating this financial landscape can seem daunting however, being informed about the various options available will empower borrowers to make knowledgeable decisions. We encourage our readers to evaluate their own experiences and insights regarding senior secured financing, as these discussions can enrich understanding and foster a collaborative learning environment. We invite you to share your thoughts and experiences in the comments below. Whether you have questions or have successfully navigated the world of senior secured financing, your input can help others in their journey. Let’s engage in a meaningful dialogue that enhances our collective understanding of this vital financial resource.

For You ✨

View All

February 16, 2025

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10