Top Strategies for Secured Business Funding

Nathan Allen

Photo: Top Strategies for Secured Business Funding

Introduction to Secured Business Funding

Secured business funding is a financial strategy that involves obtaining funds by pledging collateral, such as property, inventory, or other assets. This form of funding serves as a safeguard for lenders, significantly reducing their risk. Due to this lower risk, secured business funding typically comes with more favorable terms, including lower interest rates, which can be essential for both startups and established businesses seeking to expand their operations.

Understanding the landscape of business funding is crucial for entrepreneurs. Many businesses face the challenge of accessing capital, whether for initial start-up costs, ongoing operational expenses, or growth initiatives. Secured funding offers a robust alternative compared to unsecured funding, where loans depend solely on creditworthiness and do not require collateral. By leveraging assets, businesses can bolster their chances of approval, enabling them to address financial needs more effectively.

The importance of secured business funding cannot be overstated it empowers entrepreneurs to acquire the necessary resources while mitigating the inherent risks associated with business ventures. For startups, having a feasible funding option that minimizes personal financial exposure is particularly beneficial, as it allows them to secure necessary investments to develop their products and services. Established businesses can utilize this type of funding to enhance operational efficiency or invest in new ventures with a cushion of collateral backing their loans.

In a competitive business environment, recognizing the advantages of secured funding can prove pivotal. It enables companies to maintain a healthy cash flow, make timely investments, and ultimately foster growth. Understanding how secured business funding operates and its distinct benefits lays the groundwork for making informed financial decisions that can contribute to long-term business success.

Understanding Secured Funding: Key Concepts

Secured funding refers to the financial support that a business obtains by pledging an asset as collateral. This collateral acts as a form of security for the lender, ensuring that the loan will be backed by a tangible item or financial resource. Common types of collateral include real estate, equipment, inventory, and accounts receivable. By understanding the nuances of secured funding, business owners can navigate their financing options more effectively.

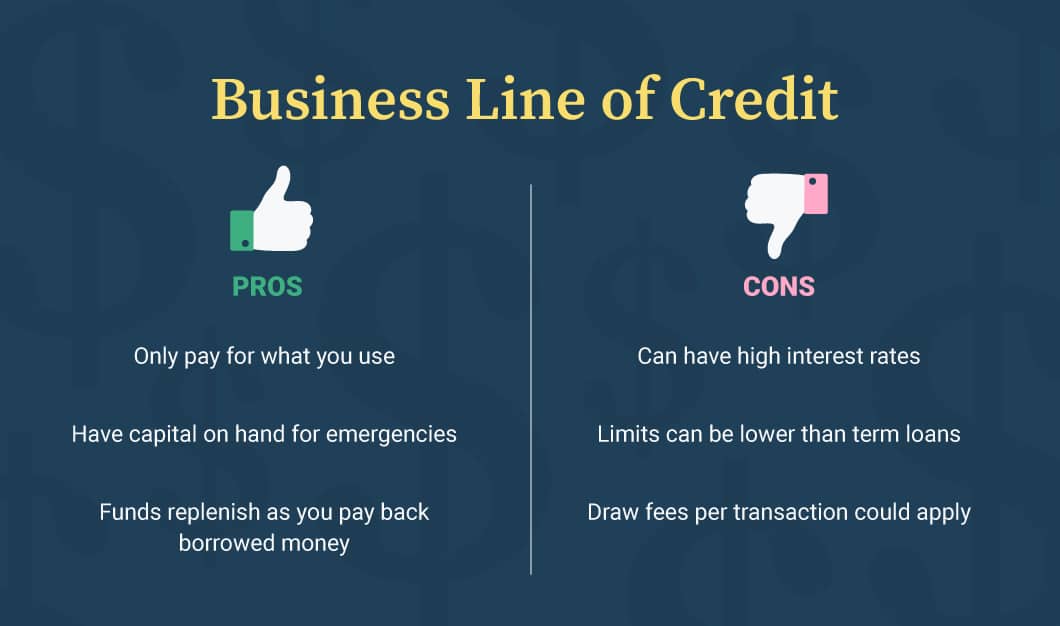

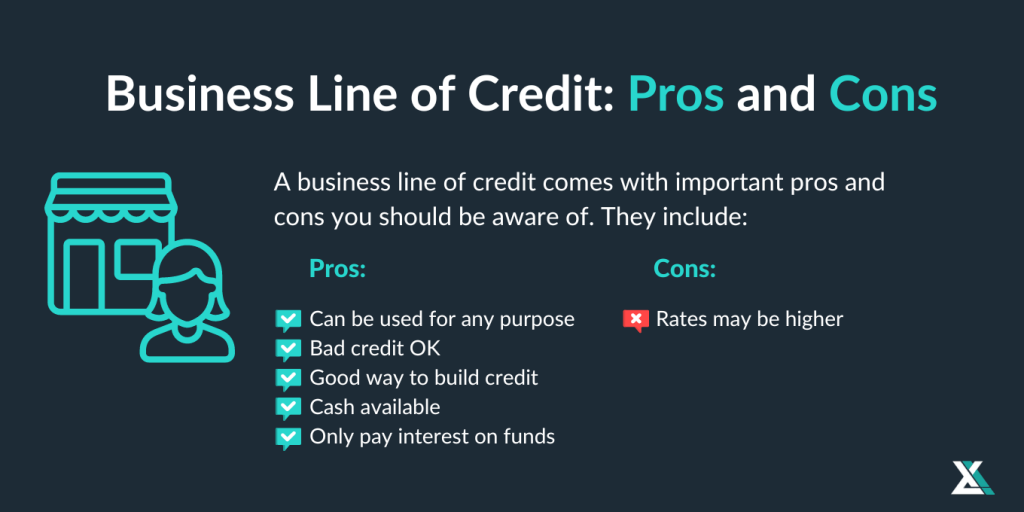

One of the critical differences between secured and unsecured loans lies in the risk involved. Secured loans require the borrower to put up collateral, which reduces the lender's risk. Consequently, secured loans often come with lower interest rates compared to unsecured loans. Additionally, businesses seeking secured funding may find their chances of approval improves significantly, as lenders feel more confident in recovering their capital through the pledged asset if repayment is not met. This security can make secured funding an attractive option for many businesses looking to expand or invest.

While secured funding offers numerous benefits, potential risks should not be overlooked. The most significant risk is the possibility of losing the pledged asset if the borrower fails to repay the loan. This can result in the loss of vital equipment or even the business's bricks and mortar. Moreover, businesses may feel pressured to make consistent payments to avoid default, which could strain cash flow, especially during lean periods. It is crucial for business owners to carefully evaluate their financial situation and ensure they can meet the repayment terms before committing to secured funding.

Comfort with these key concepts of secured funding can empower business owners to engage confidently with lenders and create a sustainable funding strategy for their enterprise. By weighing the advantages and disadvantages, businesses can make informed decisions that align with their financial goals.

Identifying Suitable Collateral

In the realm of secured business funding, identifying appropriate collateral is crucial for ensuring a successful financing arrangement. Collateral serves as an assurance to lenders, reducing their risk by providing assets that can be claimed in the event of default. Various types of assets can be utilized as collateral, including real estate, machinery, inventory, and accounts receivable.

Real estate is often considered one of the most reliable forms of collateral. Properties such as commercial buildings or land are typically valued based on market conditions and location. Businesses can assess the worth of their real estate by conducting market analyses or appraisals. Machinery also holds significant value, especially in manufacturing sectors. The depreciation rate of machinery should be considered, as it affects the overall asset valuation. Ensuring machinery is operational and well-maintained can enhance its appraisal value.

Inventory, which encompasses goods held for sale, serves as another potential form of collateral. Businesses should assess their inventory by cataloging items and calculating the wholesale value. This provides lenders with a clear understanding of potential recovery if the loan were to default. Similarly, accounts receivable can be used as collateral. This type refers to outstanding invoices that a business expects to collect. The reliability of this collateral depends on the debtor’s payment history thus, evaluating the creditworthiness of clients can aid in establishing its worth.

To effectively evaluate which assets may be most suitable for securing funding, enterprises should perform a thorough risk assessment and build an asset inventory database. Engaging with financial professionals can also offer insights into the valuation process. A comprehensive understanding of asset valuation not only strengthens a business’s collateral portfolio but also enhances its negotiating power with potential lenders.

Preparing a Strong Funding Application

When seeking secured business loans, a strong funding application is paramount to success. The application serves as a comprehensive representation of your business and its potential, making it essential to present this information clearly and compellingly. One of the most critical components of the funding application is the business plan. This document should outline your business objectives, target market, competitive analysis, and a marketing strategy. A well-structured business plan not only conveys your vision but also demonstrates your preparedness to operate the business successfully in a competitive landscape.

Another vital element is the inclusion of accurate financial statements. Lenders typically require current balance sheets, income statements, and cash flow projections, all providing insight into the financial health of your business. These documents should be meticulously prepared, illustrating historical performance and realistic projections that showcase potential growth. For instance, including detailed forecasts that account for seasonal fluctuations can aid in reinforcing the viability of your business model.

Your credit history also plays a significant role in the evaluation process. A solid credit record can significantly enhance your chances of securing a favorable loan. It is advisable to review your credit report in advance to identify and rectify any discrepancies. This proactive approach speaks volumes about your commitment to maintaining financial integrity.

Finally, tailoring your funding application to meet specific lender criteria can markedly increase approval chances. Research the lender’s requirements and preferences, and customize your application accordingly. Highlighting aspects such as industry experience, previous achievements, or unique market advantages can create a persuasive narrative. By focusing on these critical components, you not only improve your application's effectiveness but also enhance your overall presentation, increasing the likelihood of obtaining secured business funding.

Choosing the Right Funding Sources

When seeking secured business funding, it is crucial to identify and select the right funding sources to meet your financial needs effectively. Several options are available, each with their own advantages and disadvantages. The most common sources include traditional banks, credit unions, online lenders, and private investors.

Traditional banks are a popular choice for businesses seeking secured loans. They often offer competitive interest rates and favorable repayment terms, especially for established businesses with a good credit history. However, obtaining a loan from a traditional bank can be a lengthy process, involving extensive documentation and strict eligibility criteria. Additionally, banks may not be as flexible as other sources in accommodating unique business situations.

Credit unions provide another viable option for secured business funding. They generally have lower interest rates compared to traditional banks and offer a more personalized service. However, it is important to note that credit unions often require membership, which can limit access for some borrowers. The process may also have its own set of qualification requirements, albeit typically more lenient than those of conventional banks.

Online lenders have gained popularity in recent years due to their quick application processes and less stringent requirements. They provide a range of funding options tailored to various business needs. However, the interest rates from online lenders may be higher than those offered by traditional institutions, so it is vital to carefully evaluate the total cost of borrowing. Lender reputation is also crucial businesses should thoroughly research lender reviews and ensure they align with industry standards.

Lastly, private investors can be an alternative source for secured funding, allowing businesses to potentially secure larger amounts of capital. While investor relationships can bring valuable expertise and networks, the potential loss of business control should be carefully considered. By comparing each funding option's pros and cons, businesses can better align their funding needs with the most suitable sources available.

Building Strong Relationships with Lenders

Establishing robust relationships with lenders is a critical aspect of securing business funding. These relationships can significantly influence the outcomes of financial negotiations, making it imperative for business owners to engage with lenders proactively. One essential strategy for nurturing these connections is effective communication. Regularly reaching out to lenders, whether through emails, phone calls, or in-person meetings, is crucial to keep them informed about the developments within your business. This openness fosters trust, as lenders appreciate transparency regarding your financial situation and future plans.

Additionally, when approaching lenders, it is essential to employ adept negotiation techniques. Understand the specific needs and preferences of your lenders, which can vary significantly across institutions. Tailoring your funding proposals to accommodate these preferences increases the likelihood of favorable terms. For instance, if a lender focuses on sustainable business practices, demonstrate how your business aligns with these values in your pitch. By doing so, you exhibit a willingness to collaborate, which can strengthen your relationship and potentially lead to better funding outcomes.

Fostering trust and rapport also hinges on demonstrating reliability. Meeting deadlines for documentation and keeping lenders updated about your business’s performance can go a long way in establishing credibility. Additionally, consider creating opportunities for informal interactions, such as attending events hosted by lenders or participating in industry networking functions. Such engagements can strengthen your relationship on a personal level, which may translate into more favorable funding decisions.

In conclusion, building strong relationships with lenders requires strategic approaches that prioritize effective communication, informed negotiation techniques, and personal rapport. By embracing these strategies, business owners can create a supportive network that enhances their funding prospects over time.

Navigating Legal and Compliance Issues

When seeking secured business funding, understanding the legal and compliance landscape is crucial for mitigating risks and ensuring a smooth borrowing process. Companies must familiarize themselves with the terms outlined in loan agreements, which serve as the foundational contracts governing the funding relationship. These agreements typically detail essential elements such as interest rates, repayment schedules, and collateral requirements. Proper interpretation of these terms helps businesses comprehend their rights and obligations as borrowers.

Defaulting on a loan carries significant implications, ranging from legal actions to damage to credit ratings. Borrowers should be aware of the consequences that arise from not meeting repayment obligations, which can result in seizure of collateral or even bankruptcy in severe cases. It is advisable to stay informed about the default clauses in loan agreements and to explore options for renegotiation or extension in case of financial difficulties.

Moreover, understanding regulatory considerations is key in the secured funding process. Various federal and state regulations, such as the Truth in Lending Act (TILA) and the Equal Credit Opportunity Act (ECOA), aim to protect borrowers from unfair practices. Compliance with these regulations is not only a legal requirement but also builds trust between lenders and borrowers. Businesses should implement best practices to ensure compliance, including thorough documentation of all transactions, clear communication with lenders, and ongoing monitoring of financial performance.

Establishing a proactive approach to legal and compliance issues can significantly enhance a company's chances of securing funding while minimizing potential setbacks. Engaging legal counsel during the application process can provide valuable insights into navigating complex agreements and regulatory frameworks, ensuring that businesses are well-prepared for any legal challenges that may arise. Overall, prioritizing compliance throughout the funding process will bolster a company’s financial health and credibility in the eyes of potential lenders.

Managing Risks Associated with Secured Funding

Secured funding can be a viable option for businesses seeking to enhance their financial capabilities. However, it is essential for companies to understand and manage the various risks attached to securing loans against collateral. One primary risk is the potential loss of assets if the business is unable to meet repayment obligations. This necessitates a thorough risk assessment prior to committing to secured funding. Businesses should evaluate their financial health, market conditions, and the viability of the collateral they plan to offer.

Protecting collateral is crucial in minimizing risks associated with secured financing. Businesses must ensure that the items used as collateral are adequately maintained and insured to preserve their value. By doing so, firms can safeguard against unexpected losses that could exacerbate financial difficulties. Furthermore, maintaining a careful accounting of the collateral's worth can aid in negotiating better loan terms and ensuring that lenders have a clear understanding of the assets at stake.

Cash flow management is another vital aspect of mitigating risks linked to secured funding. Companies should establish and maintain robust financial management practices that enable them to monitor incoming and outgoing funds diligently. By forecasting cash flow needs and ensuring adequate liquidity, businesses can position themselves to avoid defaults on loans. A proactive approach allows organizations to make informed decisions about when to utilize secured funding and how to allocate those resources efficiently.

Having contingency plans in place is essential to addressing potential cash flow disruptions. Businesses should consider scenarios that might impact their ability to repay loans, such as economic downturns, changes in market demand, or unexpected operational challenges. By preparing for these contingencies, businesses can devise strategies to navigate difficult periods without jeopardizing their secured assets. Ultimately, effective risk management in secured funding involves a combination of prudent financial practices, ongoing assessment, and strategic planning.

Conclusion and Call to Action

In this blog post, we have explored several top strategies for secured business funding, highlighting the importance of securing financial resources for the growth and sustainability of a business. By leveraging assets for loans, considering real estate as collateral, and exploring inventory financing options, entrepreneurs can significantly increase their chances of obtaining favorable funding. Each of these methods serves the dual purpose of providing immediate liquidity and facilitating the long-term objectives of the business.

Secured funding offers numerous benefits, including lower interest rates, more flexible terms, and a higher likelihood of approval compared to unsecured loans. These advantages can empower businesses to focus on their core operations without the added pressure of financial uncertainty. Additionally, utilizing secured financing can open new avenues for expansion and innovation, bolstering a company’s competitive edge in the marketplace.

Therefore, assessing available options for secured business funding is crucial for any entrepreneur aiming to optimize their financial strategy. We encourage readers to take proactive steps by researching potential secured funding mechanisms, evaluating their business assets, and consulting with financial experts to determine the most appropriate options for their unique situations. Exploring alternative financing solutions can increase the likelihood of finding a suitable match for your business needs.

We invite you to engage with us further by sharing your thoughts or personal experiences with secured business funding in the comments section below. What strategies have worked for you, or what challenges have you faced? Your insights could provide valuable guidance for others in the entrepreneurial community. Additionally, feel free to explore our resources on this topic for more in-depth information and support. Together, we can build a network of informed business owners committed to responsible and effective funding strategies.

Frequently Asked Questions (FAQ)

Secured business funding is a common avenue for entrepreneurs seeking financial support. It is essential to understand the nuances of this funding type, particularly how it differs from unsecured loans. Secured loans require the borrower to present collateral, which can include assets such as real estate, equipment, or inventory. This collateral provides lenders reassurance against the risk of default, potentially resulting in lower interest rates compared to unsecured loans, which do not require any collateral but often attract higher rates due to increased risk.

Another common question revolves around determining the right collateral for securing a business loan. The choice of collateral should ideally reflect the amount being borrowed and should be something the borrower can afford to lose if repayment is not met. It is advisable to analyze the market value of potential collateral items. Assets that are easily liquidated tend to be more favorable from a lender's perspective, as they can recover funds in cases of default. Business owners should also consider the emotional and functional impact of using specific assets as collateral to ensure they are prepared for any potential outcomes.

As for what to expect during the funding process, it typically involves several steps, including application, documentation, appraisal of the collateral, and finally the approval and disbursement. After submitting an application, lenders will perform a thorough assessment of financial responsibility and collateral value. Borrowers should be ready to provide financial statements, tax returns, and possibly business plans. Understanding these stages can prepare business owners for a smoother funding experience, ensuring that they have the necessary information at hand to address lender inquiries promptly. With proper preparation and knowledge, navigating secured business funding can be a manageable process.

For You ✨

View All

February 16, 2025

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10