Citizens Line of Credit: Financing Your Vivint System

Nathan Allen

Photo: Citizens Line of Credit: Financing Your Vivint System

Introduction to Citizens Line of Credit

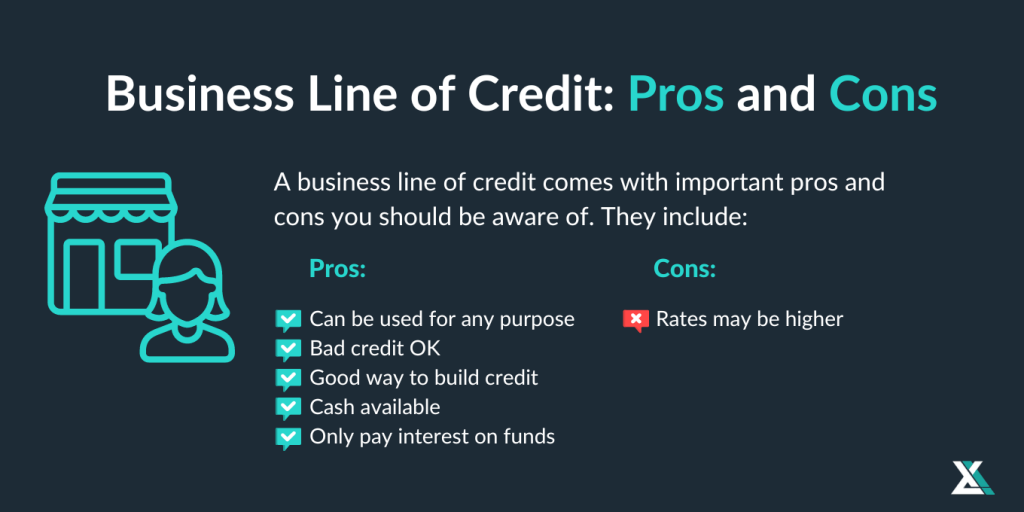

A Citizens Line of Credit is a flexible financial product designed to provide homeowners with access to funds that can be utilized for various purposes, including home improvement projects and the installation of security systems, such as those offered by Vivint. This type of credit line imparts a degree of financial freedom, enabling individuals to draw on funds as needed, rather than applying for a lump-sum loan that requires immediate repayment. By offering a predefined limit, a Citizens Line of Credit allows for efficient financial planning and management.

The primary purpose of a Citizens Line of Credit is to assist homeowners in managing and financing significant expenditures without the constraints of traditional loan structures. For example, when considering the installation of a Vivint system an investment that enhances home security and monitoring many homeowners might find themselves in need of flexible financing options. A line of credit permits them to engage in this investment while maintaining control over their budget and cash flow management.

This financial solution can be especially beneficial for those uncertain about the total costs associated with home improvements. With a Citizens Line of Credit, individuals can withdraw funds incrementally, covering expenses as they arise whether it be purchasing smart home devices or installation services. Moreover, it often offers competitive interest rates, which can make it an appealing option compared to high-interest credit cards or personal loans.

As homeowners evaluate the merits of installing a Vivint system, considering a Citizens Line of Credit can streamline the decision-making process. By understanding how this credit offering works and its significance in financing home projects, individuals can make informed choices that enhance their living spaces and provide peace of mind through improved security features.

Understanding Vivint Systems

Vivint systems represent a sophisticated fusion of smart home technology designed to elevate both security and convenience within residential environments. As a comprehensive home automation solution, Vivint offers an array of devices, including security cameras, smart locks, and various home automation features, all seamlessly integrated for optimal user experience. The primary aim of these systems is to enhance home safety and streamline everyday tasks through intelligent automation.

At the heart of Vivint’s offerings are its security cameras, which utilize advanced motion detection technology, high-definition video, and night vision capabilities. These cameras provide homeowners with real-time monitoring and alerts, allowing them to observe their property remotely through a mobile app. This empowers users to quickly respond to potential threats, thereby significantly increasing the overall safety of their homes.

In addition to security cameras, Vivint smart locks add a layer of convenience and control. These locks enable homeowners to manage entry points to their residences through mobile applications, making it possible to lock and unlock doors remotely. This feature is particularly beneficial for families with children or frequent guests, providing peace of mind and eliminating the worry associated with physical keys. Moreover, users can even grant temporary access codes to guests, ensuring secure and monitored entry into their homes.

Home automation features within Vivint systems further complement the security and convenience aspects. From controlling lighting and thermostats to enabling remote management of appliances, these technologies enhance daily living by offering ease of access and energy efficiency. Smart home integration fosters an intuitive approach to managing household tasks, making it a valuable investment.

Overall, understanding Vivint systems reveals their integral role in creating safer, more convenient living spaces through cutting-edge technology designed for modern-day lifestyles.

Why Financing Your Vivint System Makes Sense

Financing a Vivint system presents numerous advantages that can significantly enhance fiscal flexibility for homeowners. One prominent benefit is improved cash flow management. By opting for financing, homeowners can spread the cost of the home security system over a more extended period. This strategy allows for better budgeting, thus preventing a significant financial outlay all at once, which can strain personal finances. Instead of exhausting savings or expenditures, consumers can allocate funds across different essential areas while enjoying the benefits of a security system immediately.

Additionally, many financing options offer promotional incentives that can reduce the overall cost of financing. Such offers may include low or zero-interest rates for an introductory period, enabling homeowners to pay off their system without incurring hefty interest charges. This presents an opportunity to manage expenses effectively while still enjoying the security provided by the Vivint system. By capitalizing on these promotional offers, consumers can make strategically sound financial decisions that align with their overall economic goals.

Moreover, utilizing a home equity line of credit (HELOC) presents another viable financing avenue. This method allows homeowners to leverage the equity built up in their homes, potentially securing lower interest rates compared to traditional financing methods. By tapping into this resource, individuals can affordably manage the installation costs of a Vivint system while maintaining financial stability. Financing in this manner not only makes smart use of available resources but also enhances a homeowner's ability to invest in improving their property's safety and security without overwhelming their budget.

In conclusion, financing a Vivint system enhances cash flow management, allows homeowners to make the most of promotional offers, and offers access to valuable home equity. Such methods create a financially sound pathway to securing residential safety.

How to Apply for a Citizens Line of Credit

Obtaining a Citizens Line of Credit can be a streamlined process if you follow the appropriate steps. First and foremost, ensure you meet the eligibility requirements set by Citizens Bank. These criteria often include having a stable income, a good credit score, and being at least 18 years old. After confirming your eligibility, the next step is to gather the necessary documentation. This typically includes proof of identity, employment verification, income statements, and any other financial documents that demonstrate your creditworthiness.

Once you have your documentation ready, you can begin the application process. Citizens Bank offers several avenues for application: online through their website, via their mobile app, or in person at a local branch. Completing the application online is often the quickest method, as it provides immediate submission and feedback. Be prepared to furnish all required information accurately to avoid delays in processing your application.

During the application process, you will be asked to provide details regarding your financial situation, such as your income, existing debts, and other financial obligations. This information enables Citizens Bank to assess your risk profile and determine your eligibility for the line of credit. It is advisable to be transparent about your financial status to improve your chances of approval.

After submitting your application, consider following up with customer service if you have not received a response within the specified timeframe. Additionally, to increase your chances of approval, it is beneficial to maintain a good credit utilization ratio and rectify any discrepancies on your credit report before applying. Ultimately, preparing thoroughly and understanding the process will position you favorably for securing a Citizens Line of Credit to finance your Vivint system.

Evaluating Your Financial Situation

Before deciding to finance your Vivint system through a Citizens Line of Credit, it is crucial to conduct a thorough evaluation of your financial health. Understanding various financial metrics will not only help you make an informed decision but also ensure that you are prepared for any long-term financial commitments. Key areas to focus on include your credit score, debt-to-income ratio, and personal budgeting.

Your credit score plays a significant role in determining your eligibility for financing options. Lenders typically use this score to assess the risk of extending credit to borrowers. A higher score indicates a stronger ability to repay debts, making you a more attractive candidate for financing. It is advisable to check your credit report for any inaccuracies and take steps to improve your score if necessary. Simple actions, such as paying bills on time and reducing outstanding debts, can increase your creditworthiness significantly.

Another important factor to consider is your debt-to-income (DTI) ratio. This metric compares your total monthly debt payments to your gross monthly income. A low DTI ratio indicates that a smaller portion of your income is allocated to debt repayment, which suggests a healthier financial state. Most lenders prefer a DTI ratio of 36% or lower. If your ratio exceeds this threshold, it may be worth assessing your existing debt and exploring ways to reduce it before taking on additional financing.

Lastly, personal budgeting is an essential component of evaluating your financial situation. Create a comprehensive budget that outlines your monthly income, expenses, and savings goals. This will help you determine how much you can realistically afford to allocate towards financing your Vivint system without jeopardizing your financial stability. By assessing these fundamental aspects of your financial health, you can make informed choices and ensure a positive financing experience.

Utilizing Your Line of Credit Wisely

Establishing and managing a line of credit for purchasing your Vivint system can facilitate home security improvement. However, it is essential to utilize this financing option wisely to ensure it enhances rather than detracts from your financial stability. The first aspect to consider is budgeting for repayments. A realistic budget not only accounts for the principal and interest but also includes any additional costs associated with maintaining the Vivint system. By integrating these factors into your monthly budget, you can prevent unforeseen expenses from impacting your financial health.

Ensuring timely payments is another critical strategy when utilizing a line of credit. Payment history significantly influences your credit score, and late payments can lead to increased interest rates or withdrawal of your line of credit. Set reminders or automate payments to keep track of due dates. This proactive approach not only maintains your credit score but also fosters financial discipline, positioning you better for future borrowing needs.

Avoiding unnecessary debt is equally important when managing your line of credit. While it may be tempting to utilize the full limit available for additional purchases, it's wise to exercise caution. Only borrow what is necessary for your Vivint system and related expenses, keeping your future financial commitments in mind. Regularly monitor your line of credit usage and strive to pay off any borrowed amounts as swiftly as possible to reduce interest payments, thereby safeguarding your financial resources.

By adhering to these strategies, you can effectively manage your line of credit, ensuring that your investment in a Vivint system contributes positively to your overall financial landscape.

Understanding Interest Rates & Repayment Terms

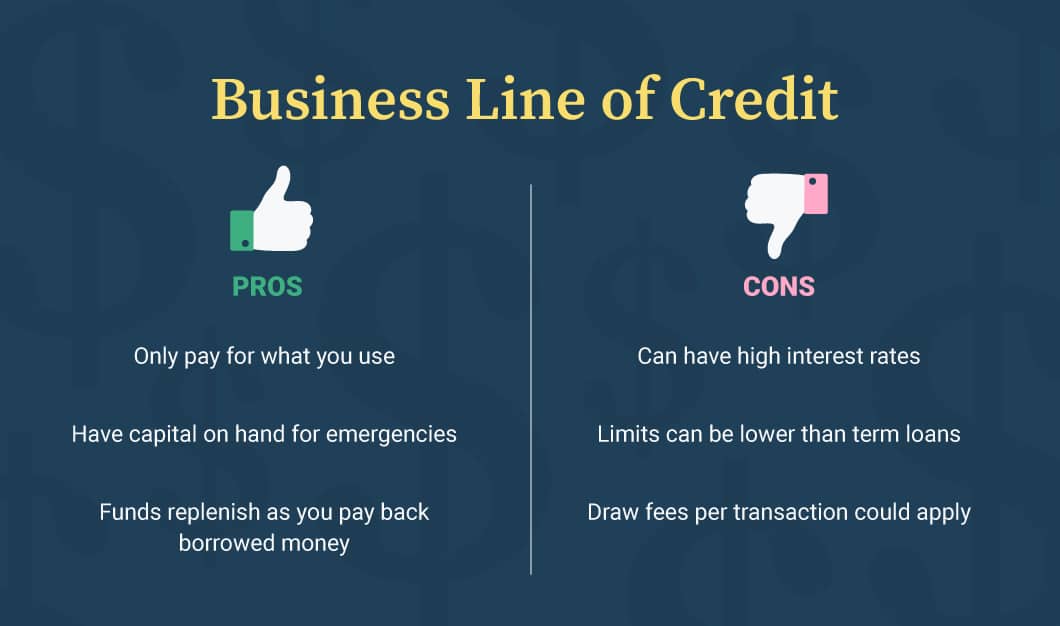

The interest rates associated with the Citizens Line of Credit can significantly influence the overall cost of financing your Vivint system. By understanding these rates, borrowers can better manage their repayment options and financial goals. Interest rates can be categorized as either fixed or variable. A fixed interest rate remains constant throughout the life of the loan, making budgeting easier for borrowers since they can anticipate their monthly payments without fear of fluctuations. This stability can be particularly beneficial for homeowners investing in a security system, allowing them to plan their finances with confidence.

Conversely, a variable interest rate can change over time, typically tied to a benchmark interest rate. While initial rates may be lower compared to fixed rates, the variability introduces a level of unpredictability in repayments. For borrowers who anticipate both short-term and long-term financing needs, weighing the pros and cons of fixed versus variable rates is crucial. Fixed rates may afford peace of mind, whereas variable rates may offer lower initial costs but could potentially increase in the future.

When considering repayment terms, it's essential to understand how these rates affect the total amount that will be paid over the life of the credit line. Generally, longer repayment periods can lead to lower monthly payments, making them more manageable. However, this can also result in paying more interest over time. Detailed analysis of both interest rates and terms can ultimately guide borrowers in making informed decisions regarding their Citizens Line of Credit, ensuring they can finance their Vivint system effectively while minimizing long-term financial burden.

Real-Life Examples and Case Studies

Homeowners across the nation have successfully utilized a Citizens Line of Credit to finance their Vivint smart home systems, ensuring enhanced security and convenience in their daily lives. For instance, in a suburban community in Texas, the Johnson family found themselves increasingly concerned about home security following several neighborhood incidents. After researching various options, they chose the Vivint system, which offered comprehensive surveillance and smart home integration.

To facilitate the purchase, the Johnsons applied for a Citizens Line of Credit. This allowed them to spread the cost of their Vivint system over manageable monthly payments, making it financially feasible without compromising their budget for other necessities. Their decision not only provided the security they were longing for but also contributed to a peace of mind that had been previously missing. They reported feeling more secure in their home, frequently noting the Vivint app's convenience in monitoring their property remotely.

Another illustrative example comes from the Gomez family in California. They decided to invest in a Vivint system after realizing the potential savings from smart energy management features, such as automated lighting and thermostat controls. They approached Citizens Bank for a line of credit, which allowed them to cover both the upfront costs of the system and installation. They later discovered significant savings on their energy bills due to the increased efficiency of their home, showcasing the long-term benefits of their investment.

These case studies illustrate the versatility and value of a Citizens Line of Credit in financing a Vivint system. Potential applicants can find reassurance in the knowledge that many have navigated similar journeys, achieving both financial comfort and enhanced home security. The experiences highlight key takeaways, such as the importance of assessing monthly budgeting and identifying long-term savings opportunities when considering intelligent home solutions like Vivint.

Frequently Asked Questions about Citizens Line of Credit and Vivint Systems

Understanding the Citizens Line of Credit in relation to financing Vivint systems is crucial for potential customers. One common question revolves around eligibility requirements. Generally, individuals seeking a line of credit need to have a decent credit score, typically in the range of 650 or higher. Other factors, such as income level and existing debts, may also play a significant role in determining eligibility. It's advisable to check with Citizens Bank for specific criteria as these may vary by individual circumstances.

Another prevalent inquiry concerns the impact of utilizing the Citizens Line of Credit on one’s credit score. Financing a Vivint system through this line of credit can affect your credit utilization ratio, which is a vital component of credit scores. Utilizing a considerable portion of the available credit may lead to a temporary dip in your score. However, making consistent, on-time payments can ultimately help improve your credit score over time, showcasing responsible credit management.

Prospective users often question the process of obtaining and utilizing the Citizens Line of Credit for a Vivint system. The application process is typically straightforward, beginning with an online application where users provide their personal and financial information. Upon approval, funds can be accessed as needed, giving customers the flexibility to finance their Vivint security installations or upgrades at their own pace.

Moreover, it's essential to understand how this line of credit integrates with the overall financing of Vivint systems. Vivint offers various payment plans, and using the Citizens Line of Credit can allow customers to manage their payments more effectively, enabling them to install smart home technology without significant upfront costs. This flexibility often makes it a popular choice among users looking for home security solutions.

Conclusion and Next Steps

Throughout this article, we have explored the advantages of utilizing a Citizens Line of Credit to finance your Vivint system. By leveraging this form of credit, homeowners can effectively manage the costs associated with securing a reliable and advanced home security system. The strength of the Citizens Line of Credit lies not just in its flexibility, but also in its potential to help individuals maintain their financial stability while making important home improvements.

One of the most significant benefits of financing a Vivint system with a Citizens Line of Credit is the opportunity to install high-quality security features without the burden of upfront costs. Such financing options can enable customers to choose from a diverse range of Vivint products, from smart security cameras to comprehensive alarm systems, ensuring a tailored solution that meets specific needs. Moreover, this financing method can help spread payments over time, making it easier to invest in home security and peace of mind.

Taking the next step toward enhancing your home’s security with Vivint is simple. Start by evaluating your financial situation and considering how a Citizens Line of Credit can fit into your budget. For those who are ready to apply, the process is straightforward and can pave the way for securing the essential tools for home protection. If you are still unsure about which Vivint system is right for you, consider visiting the official Vivint website or speaking with a representative to discuss product options and services available.

Lastly, we encourage you to leave your thoughts and comments below. Sharing your experiences can provide valuable insights for others looking to finance their Vivint systems. Whether it’s feedback on your financing journey or a discussion about the benefits of Vivint products, your contributions can enhance our community's knowledge and support. Embrace the opportunity to safeguard your home today.

For You ✨

View All

February 16, 2025

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10