Quick Business Lines of Credit: Fast Funding Solutions

Nathan Allen

Photo: Quick Business Lines of Credit: Fast Funding Solutions

Introduction to Business Lines of Credit

A business line of credit serves as a flexible financial tool designed to meet the varying needs of businesses seeking rapid access to capital. Unlike traditional loans that provide a lump sum of money, a line of credit allows business owners to withdraw funds as needed, up to a pre-approved limit. This characteristic makes it especially beneficial for managing cash flow fluctuations, covering unexpected expenses, or seizing immediate growth opportunities. The adaptability of a line of credit can provide significant advantages in today's dynamic business environment.

Access to quick funding is crucial for businesses of all sizes. When unforeseen circumstances arise, such as urgent inventory purchases or repair costs, having a line of credit readily available can alleviate financial stress. Many entrepreneurs find that they face gaps in cash flow, particularly in seasonal industries, and this financial product offers a safety net to bridge those gaps. With a business line of credit, funds become accessible without the lengthy approval processes associated with traditional financing methods, enabling prompt action when opportunities or challenges arise.

The importance of business lines of credit extends beyond mere convenience they can be essential to a company’s growth strategy. Companies looking to innovate or expand may require quick access to funds for new initiatives. Furthermore, building a positive relationship with a lender through regular usage of a line of credit can enhance a business's overall financial profile, potentially leading to improved terms on future loans. In this sense, business lines of credit not only serve immediate financial needs but also contribute to long-term strategic planning and sustainability.

How Business Lines of Credit Work

A business line of credit is a flexible funding solution that allows businesses to draw funds up to a specified limit, similar to a credit card. Unlike traditional loans, where a lump sum is provided upfront and repaid in fixed installments, a line of credit offers a more adaptable approach to financing. Upon approval, businesses can access only the amount they need, when they need it, ensuring efficient cash flow management.

With a business line of credit, the borrowing business is granted a limit, which dictates the maximum amount they can withdraw. Interest is charged only on the amount drawn, not the entire available credit limit. This feature substantially differentiates it from conventional loans, where interest is calculated on the total borrowed amount from the onset. For instance, if a business has a line of credit of $100,000 and draws $30,000, interest accrues solely on the $30,000 utilized rather than the full $100,000 limit.

Repayment structures can vary significantly. Many providers offer flexible repayment terms that align with the business's revenue cycles. For example, repayments can be scheduled monthly, or based on a daily calendar, enabling businesses to manage cash flow more effectively. Additionally, some lines of credit may include interest-only payment periods, which can further ease financial pressure during slower revenue months.

Interest rates for business lines of credit can fluctuate, often ranging from variable to fixed rates, influenced by market conditions and the borrowing business's creditworthiness. Generally, borrowers can expect lower rates with good credit scores, which enhance their ability to leverage this financial tool efficiently. In summary, a business line of credit stands out for its accessibility, flexibility, and tailored repayment options tailored to suit individual business situations.

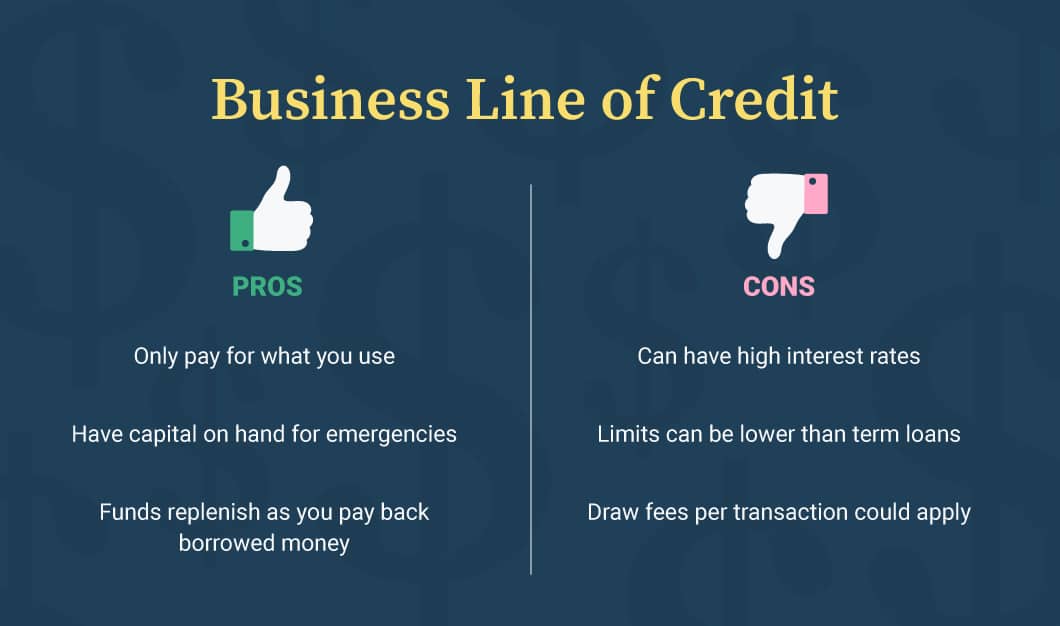

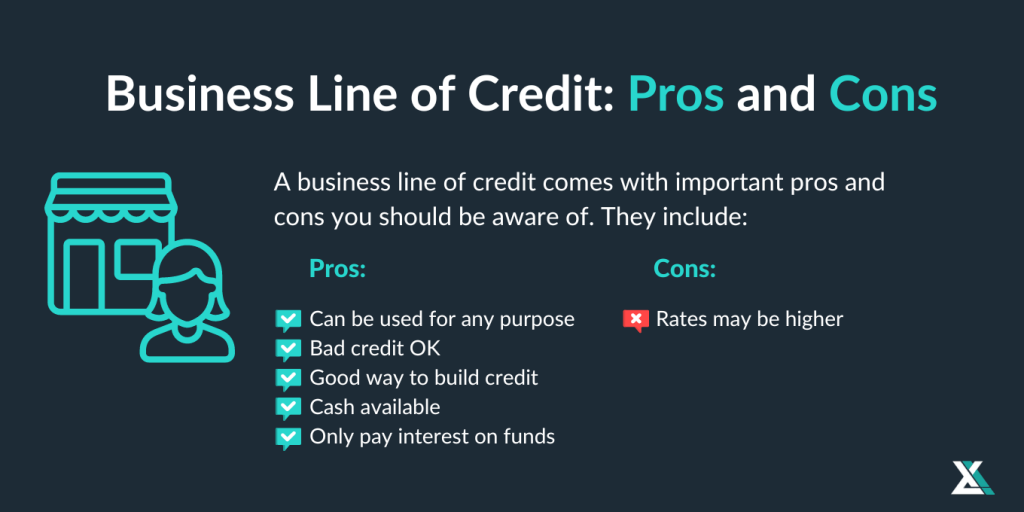

Advantages of Quick Business Lines of Credit

Quick business lines of credit offer numerous advantages to entrepreneurs and small business owners seeking financial agility. One of the primary benefits is their inherent flexibility. Unlike traditional loans, which often have fixed amounts and rigid repayment terms, a line of credit allows businesses to borrow only what is necessary up to a predetermined limit. This means that funds can be accessed for various needs whether for unexpected expenses or to seize immediate opportunities without the pressure to deploy the entire amount at once.

Another significant advantage is the ease of accessing funds. Many financial institutions provide online applications that can be completed quickly, enabling businesses to secure funding in a matter of days, or even hours. This rapid funding process is critical for small businesses that might need to act swiftly to cover operational costs or invest in inventory. Additionally, the use of a business line of credit can help manage cash flow effectively. Access to quick funds can bridge cash shortages caused by delays in customer payments or seasonal fluctuations, ensuring that day-to-day operations continue smoothly.

Moreover, utilizing a line of credit can contribute to building business credit. By consistently borrowing and repaying amounts within the credit line, businesses demonstrate financial responsibility and credibility to lenders. This can enhance their credit profiles, making them more attractive for future financing opportunities. Case studies have indicated that companies leveraging their lines of credit effectively not only maintained operational stability but also enjoyed increased chances of securing larger financing solutions for expansion projects or other significant investments.

Eligibility Criteria for Business Lines of Credit

Obtaining a business line of credit can provide essential financial flexibility for companies seeking to manage cash flow, fund unexpected expenses, or invest in growth opportunities. However, lenders typically set certain eligibility criteria that potential borrowers must meet to qualify. Understanding these requirements can significantly enhance a business's chances of approval.

One of the primary factors lenders assess is the credit score of the business owner and, in some cases, the business itself. Generally, a credit score of 650 or higher is preferred, as it indicates a history of responsible borrowing and timely repayments. For businesses that are relatively new or lack a significant operational history, personal credit scores may play a more vital role in determining eligibility.

Business financials are another critical component lenders often review bank statements, profit and loss statements, and balance sheets. These documents help assess the company's financial stability and cash flow. A healthy debt-to-income ratio often recommended to be below 40% can enhance a business's application by demonstrating its capacity to manage existing obligations while taking on additional credit.

The operational history of the business also matters. Lenders typically favor established businesses that have been operational for at least six months to a year. This track record signals reliability and minimized risk from the lender's perspective. Furthermore, being in a reputable industry can positively influence the lending decision.

To prepare for applying for a business line of credit, companies should ensure they have organized financial statements, maintain good credit scores, and cultivate a solid business plan. A comprehensive understanding of the potential lender's specific requirements is also advantageous. With these steps, businesses can approach the application process more confidently and improve their chances for approval.

Types of Business Lines of Credit

Business lines of credit serve as a crucial financial tool, providing flexibility and immediate access to funds for various operational needs. The two primary types of business lines of credit available are secured and unsecured lines, each with distinct features, advantages, and potential drawbacks.

Secured lines of credit require collateral, such as property or equipment, to back the credit line. This form of credit typically offers higher credit limits and lower interest rates due to the reduced risk for lenders. Businesses with valuable assets can leverage these to gain favorable funding terms. However, the main downside is the potential loss of assets if the business fails to repay the borrowed amount. Secured lines are usually ideal for businesses with significant collateral who prefer to minimize borrowing costs but are comfortable with the risk of asset forfeiture.

On the other hand, unsecured lines of credit do not necessitate collateral, making them accessible to a wider range of businesses, particularly startups and those without significant assets. While this type of line is generally easier to obtain, it often comes with lower credit limits and higher interest rates due to the heightened risk for lenders. Unsecured lines of credit are advantageous for business owners needing short-term financing for cash flow management or unexpected expenses without the need to pledge assets. However, businesses may face stricter qualification criteria based on creditworthiness.

Both types of business lines of credit can play essential roles in managing a company's financial health, depending on individual needs and the specific circumstances of the business. By understanding the characteristics of secured and unsecured lines, business owners can choose the most appropriate solution to meet their funding requirements effectively.

How to Apply for a Quick Business Line of Credit

Applying for a quick business line of credit can be a streamlined process if approached methodically. The initial step involves thorough preparation of necessary documentation. Financial institutions typically require certain documents to assess your creditworthiness. These may include personal and business tax returns, income statements, and a detailed business plan. Additionally, having your business credit report on hand can facilitate the process, as it allows you to identify and address any potential issues beforehand.

Once your documents are organized, the next crucial aspect is choosing the right lender. Various lenders offer quick business lines of credit, including traditional banks, online lenders, and credit unions. Each of these options comes with its own set of terms, interest rates, and approval times. It is advisable to conduct thorough research to compare different lenders and understand their offerings. Reading customer reviews and checking the lender's reputation can also provide valuable insights into their reliability and service quality.

The application process itself can vary based on the chosen lender. Generally, it begins by filling out an application form, which is often available online. Be prepared to provide detailed information about your business, including its revenue, industry, and any existing debts. Some lenders may also require a personal guarantee, so understanding the implications of this requirement is essential.

While navigating the application process, there are common pitfalls to avoid. One key mistake is failing to review your financial documents for accuracy, as discrepancies can lead to delays or denials. Another is underestimating the importance of maintaining a good credit score taking steps to improve your credit health prior to applying can significantly enhance your chances of approval. By following these steps and being well-prepared, you can increase the likelihood of securing a quick business line of credit, ultimately providing your business with the financial flexibility it needs.

Managing Your Business Line of Credit Effectively

Managing a business line of credit is essential for maintaining financial health and ensuring the long-term sustainability of an enterprise. One of the first steps in managing this type of funding is to establish a robust budgeting plan. A well-structured budget helps businesses decide when and how much to draw from the line of credit, preventing unexpected financial strain. By planning expenditures meticulously, entrepreneurs can ensure that they are utilizing their credit facilities only when necessary, thus preserving cash flow.

Another important aspect is to avoid over-reliance on credit. While a line of credit can provide temporary financial relief during lean periods, businesses should use it judiciously. Regularly tapping into a credit line for operational expenses can result in a cycle of debt that is challenging to escape. Instead, businesses should strive to balance their use of credit with other financing options, such as retained earnings or traditional loans, to build a stable financial foundation.

Timely repayments are crucial for managing a business line of credit. Paying down the borrowed amount promptly not only helps avoid accumulating interest but also positively influences a company's credit score. This improved credit rating can yield better borrowing terms in the future, further enhancing a business's financial strategies. Establishing reminders or automated payments can help ensure that debt obligations are met without delay.

Furthermore, businesses need to monitor their credit utilization. A line of credit is a valuable tool, but keeping track of how much has been drawn and how much remains is critical. High utilization rates can impact credit scores negatively, signaling potential financial distress to lenders. By being mindful of credit usage and making timely adjustments as necessary, businesses can maintain a healthy financial profile while maximizing the benefits of their lines of credit.

Common Misconceptions About Business Lines of Credit

Business lines of credit are becoming increasingly popular as a flexible funding solution. However, various misconceptions regarding their structure and usage could discourage potential applicants. One prevalent myth is that business lines of credit are only for large, established companies. In reality, many lenders offer lines of credit designed specifically for small to medium-sized enterprises. These financing solutions can be tailored to meet the financial needs of businesses at different stages of growth.

Another misconception is that accessing a business line of credit incurs exorbitant costs. While it is true that fees and interest rates can vary significantly among lenders, business lines of credit can often be more cost-effective compared to traditional loans. Borrowers typically only pay interest on the amount drawn, not the total credit limit. This characteristic enables greater financial flexibility as businesses can only utilize the funds as needed, which can ultimately minimize costs over time.

It is also important to address the belief that having a business line of credit will negatively impact a company's credit rating. While it is true that lenders evaluate credit scores during the application process, a well-managed line of credit can actually bolster a business's credit profile when used responsibly. Timely repayments can demonstrate a company's financial reliability, potentially leading to enhanced creditworthiness and more favorable borrowing terms in the future.

Lastly, some entrepreneurs think that acquiring a business line of credit is a lengthy and complicated process. While there are application requirements, many online lenders offer streamlined applications that expedite the approval process. As a result, businesses can quickly gain access to essential funds when they require them. By debunking these common misconceptions, businesses can make more informed decisions regarding the utilization of lines of credit as a funding option.

Conclusion and Call to Action

In today's fast-paced business environment, quick access to funding is essential for growth and sustainability. A business line of credit offers a flexible financing solution that allows enterprises to manage cash flow, seize immediate opportunities, and navigate unexpected expenses. By providing businesses with a predetermined credit limit, this financial instrument empowers owners to draw funds as needed, thus ensuring a more efficient allocation of resources.

Throughout this discussion, we have highlighted several critical advantages of implementing a business line of credit. These include the ability to withdraw funds quickly, reduced interest rates compared to alternative financing methods, and the convenience of only paying interest on the amount drawn. Additionally, a business line of credit can enhance a company's credit profile, making it easier for enterprises to access additional funding sources in the future.

For business owners considering this funding option, it is crucial to assess their specific needs and evaluate potential lenders carefully. Each financial institution may offer different terms, interest rates, and repayment plans. To ensure a successful financing strategy, business owners should seek out options that align closely with their operational goals and cash flow patterns. Furthermore, by maintaining transparent communication with lenders and monitoring the line of credit’s use, businesses can maximize the benefits of this financial tool.

As you contemplate the potential of a business line of credit for your enterprise, we encourage you to engage further. Share your experiences, insights, or questions in the comments section below. Additionally, explore our other resources to deepen your understanding of business financing needs. Your thoughts could provide valuable perspectives for fellow entrepreneurs navigating similar paths in their financial journeys.

For You ✨

View All

February 16, 2025

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10