Securing a Business Line of Credit for Small Businesses

Nathan Allen

Photo: Securing a Business Line of Credit for Small Businesses

Introduction to Business Lines of Credit

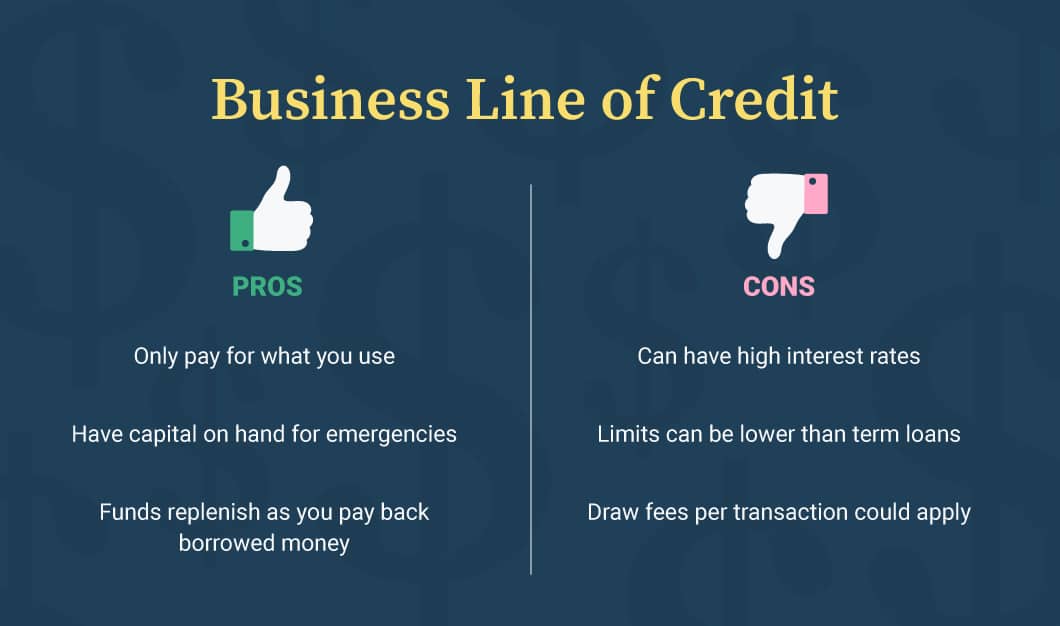

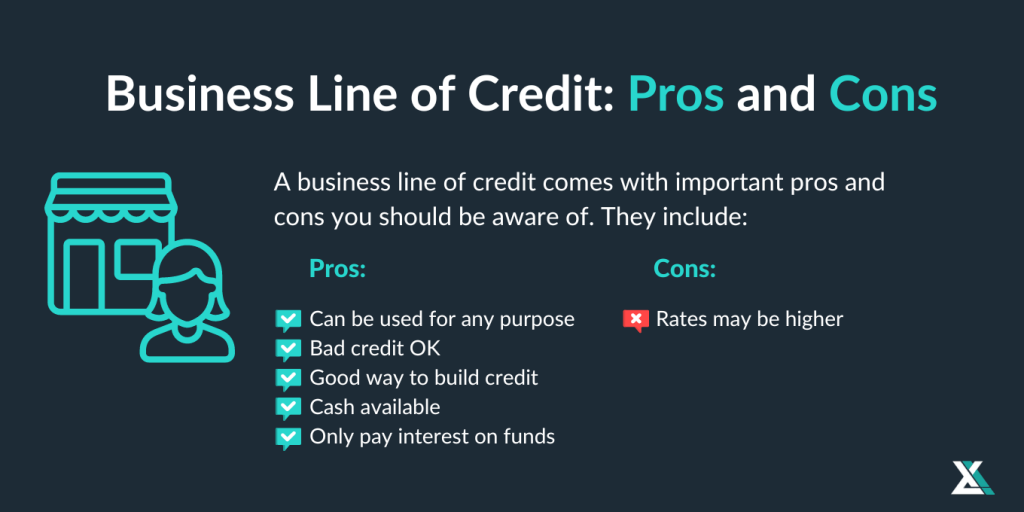

A business line of credit is a versatile financial product designed to provide small businesses with access to working capital as needed. Unlike traditional loans, which offer a lump sum amount that is repaid in fixed installments over a specified period, a line of credit operates similarly to a credit card. Businesses are granted a maximum borrowing limit and can withdraw funds from this limit whenever necessary, allowing for greater flexibility in managing cash flow. This feature is particularly beneficial for small businesses that may face fluctuating revenue or seasonal demands.

One of the primary advantages of a business line of credit is its flexibility. With a traditional loan, funds are obtained all at once, and interest begins to accrue immediately, even if the money is not used right away. In contrast, with a line of credit, interest is only paid on the amount drawn, not the total available limit. This structure allows businesses to borrow only what they need, when they need it, thus optimizing their cash flow management. Additionally, small business owners can use the funds for various unexpected expenses, such as equipment repairs, inventory purchases, or operational costs, without the pressure to access large sums of money at once.

Moreover, a business line of credit can serve as a financial safety net, ensuring that small businesses can navigate unforeseen challenges without jeopardizing their operational capacity. By maintaining this line of credit, businesses are better equipped to respond swiftly to opportunities or crises, ultimately supporting growth and sustainability over time. Understanding how a business line of credit differs from traditional loans and recognizing its benefits can empower small business owners to make informed financial decisions crucial for their success.

Understanding the Importance of E-A-T in Securing Financing

In the realm of financing, particularly when it comes to securing a business line of credit, the principles of E-A-T Expertise, Authoritativeness, and Trustworthiness play a critical role. These guidelines, while originally formulated by Google to evaluate the quality of content online, have transcended their digital roots to influence real-world financing decisions made by lenders. By embodying these principles, small businesses can significantly enhance their credibility with potential creditors.

Expertise is essential as it indicates a business's ability to operate effectively within its industry. Lenders are more likely to extend credit to businesses that demonstrate a solid understanding of their market, proven track records, and skilled management teams. For instance, showcasing industry-specific knowledge through professional certifications, relevant experience, and continual education can serve as powerful indicators of a business's expertise. This not only instills confidence in lenders but also showcases a commitment to the industry that can positively impact financing opportunities.

Authoritativeness further establishes a business’s position within its sector. This can be achieved through various means, such as receiving industry awards, being featured in reputable publications, or accumulating positive reviews and testimonials from satisfied customers and partners. When a business is recognized as an authority in its field, it signals to lenders that the business is credible and reliable, thus improving its chances of securing financing.

Trustworthiness is the final piece of the E-A-T puzzle. A business's ability to demonstrate transparency in its operations, maintain open communication with stakeholders, and uphold ethical standards can establish a strong foundation of trust. This is particularly pertinent when evaluating financial histories, where a clean record without defaults or inconsistencies can serve as a testament to a business’s reliability. By investing in E-A-T, small businesses can enhance their appeal to lenders and improve their chances of obtaining necessary financing.

Preparing Your Business for a Line of Credit Application

Before seeking a line of credit, it is crucial for small businesses to engage in thorough preparation. This process not only enhances the chances of approval but also secures a favorable lending arrangement. First and foremost, organizing financial statements is essential. Businesses should compile clear and accurate financial documents, including balance sheets, income statements, and cash flow statements. These documents should ideally reflect the business's performance over the past few years to give lenders a comprehensive overview of its financial health.

In addition to financial statements, understanding and monitoring credit scores cannot be overlooked. Lenders often use credit scores as a determining factor in their decision-making process. A business should review its credit history and rectify any discrepancies that may exist. Furthermore, understanding the components that influence credit scores such as payment history, debt levels, and credit utilization can be advantageous. This knowledge provides insight into potential areas for improvement, thus positioning the business more favorably in the eyes of lenders.

Another significant component of preparation is the development of a comprehensive business plan. This plan should articulate the business’s strategic goals, target market, and overall vision. A well-crafted business plan not only illustrates how a line of credit will be utilized but also demonstrates the business's capability for growth and profitability. This is paramount, as lenders seek confidence in a borrower’s potential to repay the borrowed amount. Practical tips for enhancing this plan include performing market analysis, outlining specific financial projections, and detailing risk management strategies.

By diligently preparing financial statements, understanding credit scores, and creating a robust business plan, small businesses can significantly improve their attractiveness to potential lenders. Such proactive measures not only facilitate the application process but also pave the way for successful financial management in the future.

The Different Types of Business Lines of Credit

Understanding the different types of business lines of credit is essential for small business owners aiming to secure adequate funding for their operations. The main types of business lines of credit fall into two categories: secured and unsecured lines. Secured lines require the borrower to pledge collateral, such as inventory or real estate, which can enhance the chances of approval and may result in lower interest rates. However, this also means that the borrower risks losing their assets if they fail to repay the loan. On the other hand, unsecured lines of credit do not require collateral but generally come with higher interest rates and stricter credit requirements, making them more difficult to obtain for some businesses.

In addition to secured and unsecured lines, lines of credit can also be categorized as revolving and non-revolving. A revolving line of credit allows businesses to borrow, repay, and borrow again, making it a flexible option for managing cash flow. This type of credit is beneficial for businesses that face seasonal fluctuations in revenue or require ongoing access to funds. Conversely, non-revolving lines of credit are offered for a fixed amount and must be paid back in full before the borrower can access additional funds. While they may provide a beneficial lump-sum amount for a specific project or need, they do not offer the same flexibility as their revolving counterparts.

Each type of business line of credit carries its own advantages and disadvantages, and understanding these is crucial for small business owners. By assessing their funding needs, risk tolerance, and business objectives, entrepreneurs can make informed decisions that will best suit their financial situations. Whether it’s maintaining cash flow or financing specific projects, selecting the appropriate type of credit plays a significant role in the overall financial strategy of a small business.

How to Choose the Right Lender for Your Business Line of Credit

Choosing the right lender for your business line of credit is a pivotal step for any small business owner. Selecting a lender who understands your particular needs can significantly impact your financial flexibility. To begin, it is essential to evaluate interest rates offered by various lenders. Typically, these rates can vary drastically from one lender to another, making it crucial to compare them thoroughly. A lower interest rate can save your business considerable money over time.

In addition to interest rates, repayment terms are another critical factor. It's advisable to look for lenders who provide flexible repayment options. This could mean longer repayment periods or options that allow for more manageable monthly payments. Not only do favorable repayment terms aid in cash flow management, but they can also alleviate financial pressure during slower business periods.

Moreover, it is vital to consider any fees associated with the line of credit. Many lenders may charge fees for accessing funds, late payments, or maintenance fees. A clear understanding of these fees can help you avoid unexpected costs that could hinder your business's financial health. Ensure that you ask potential lenders for a detailed breakdown of any charges, so you are fully informed before agreeing to their terms.

The reputation of lenders also plays an important role in the selection process. Researching customer reviews and testimonials can provide insight into the lender’s reliability and customer service. Engaging in discussions with fellow small business owners can be equally insightful as personal experiences often reveal crucial information about lenders’ practices.

In summary, evaluating interest rates, repayment terms, fees, and lender reputation will equip you with the necessary insights to choose the right lender for your business line of credit. Take your time during this process, as the right lender can make a substantial difference in the financial landscape of your business.

The Application Process: Step-by-Step Guide

Securing a business line of credit requires a thorough application process that typically unfolds in several key steps. Understanding these steps can greatly enhance a small business's chances of obtaining the financing it needs. The first stage involves gathering all the required documentation to present a comprehensive financial picture to lenders. Essential documents often include business financial statements, tax returns, cash flow projections, and legal business documentation such as licenses and registration. Ensuring all documents are organized and readily available can streamline the application process.

Next, the business owner must fill out the application form accurately. The information requested will vary by lender but generally involves details regarding the business history, revenue, and purpose of the credit line. It is crucial to be transparent and precise when providing this information. Any discrepancies or inaccuracies could lead to delays or even rejection of the application. Additionally, maintaining a good credit score is vital, as lenders often assess personal and business credit history during the evaluation process.

Once the application is completed and submitted, businesses can expect a review period where the lender evaluates the financial health of the business. This phase could involve further communication between the business owner and the lender, primarily for additional documentation or clarification. Understanding the timelines for approval is important they can vary from a few days to several weeks depending on the lender's evaluation procedures.

Throughout the application process, several common pitfalls should be avoided. Small businesses often overlook the importance of having a well-defined business plan or underestimate the significance of their credit score. Any negative marks on credit can severely impact eligibility. Furthermore, not fully understanding loan terms and conditions can lead to unfavorable borrowing experiences.

Maintaining Your Line of Credit: Best Practices

Once you have secured a business line of credit, maintaining it effectively is crucial for your financial health. One fundamental practice involves making on-time payments. Timely payments not only help you avoid late fees but also contribute positively to your credit profile. Consistent on-time payments demonstrate reliability to lenders and can lead to improved credit scores. A high credit score influences your eligibility for better rates and terms in future credit dealings.

Utilizing your line of credit responsibly is another vital practice. This means using the credit only when necessary and in amounts that you can comfortably repay. Overextending your borrowing can lead to a cycle of debt, making it challenging to manage repayments. Aim to keep your credit utilization ratio low ideally below 30% of your total available credit. This approach not only helps in maintaining a favorable credit score but also ensures you have sufficient funds available for emergencies or unforeseen expenses.

Furthermore, developing a strategic plan for renewing or increasing your credit limit can provide additional security and flexibility. Regularly assess your business’s financial health and growth projections to determine when an increase might be necessary. When approaching your lender about an increase, be prepared to present an updated business plan, demonstrate how effective you have been in managing your existing credit, and highlight your business's performance over the loan term. This professional dialogue can strengthen your case for an increased line of credit.

By adhering to these best practices making timely payments, using credit judiciously, and proactively engaging with lenders for potential increases you can maintain a robust line of credit that supports your business growth and financial stability.

Tax Implications and Considerations

When a small business secures a line of credit, there are significant tax implications that owners should be aware of, particularly concerning interest payments and how these relate to financial reporting. One primary advantage of utilizing a business line of credit is the potential deductibility of interest expenses. Generally, interest paid on funds borrowed for business purposes can be deducted from taxable income, thereby reducing the overall tax burden for the business owner. This provision signifies that, while the line of credit incurs a cost, it may simultaneously provide tax relief, enhancing cash flow management and allowing for more efficient use of funds.

It is essential for business owners to maintain accurate records of interest payments as these figures will be required for tax reporting. Furthermore, when engaging with a line of credit, it is important to discern how these financial transactions are reflected in the company's books. Generally, receiving funds from a line of credit does not constitute taxable income. Instead, the proceeds are recognized as liabilities, and the focus should remain on the management of interest expenses. Failure to account for these aspects properly can result in inaccurate financial information, leading to potential complications during an audit or financial review.

Moreover, while drawing on a line of credit may offer immediate liquidity, businesses need to evaluate the long-term financial impact and any considerations that arise from their drawdown behavior. The decision to use a line of credit should align with the overall financial strategy. Business owners should consult a tax professional to ensure compliance with relevant tax laws and regulations. Understanding these tax implications can empower small business owners to make informed decisions that favor their financial health while optimizing tax benefits.

Conclusion and Call to Action

As we have explored throughout this guide, securing a business line of credit is essential for small businesses seeking financial flexibility and growth potential. A line of credit provides an accessible funding source enabling businesses to manage cash flow fluctuations, invest in opportunities, and cover unforeseen expenses. By understanding the application process and requirements, business owners can position themselves to obtain the financing they need to thrive.

Small business owners must recognize the importance of maintaining a strong credit profile and preparing necessary documentation well in advance. Factors such as credit score, annual revenue, and the length of business operations can significantly impact the credibility of an application. It is advisable to compare various lenders and their offered terms, as this can lead to beneficial financing options tailored to specific business needs.

Importantly, careful management of a business line of credit can enhance overall creditworthiness, making it easier to secure future funding. It is beneficial to use the credit responsibly, ensuring timely repayments and mindful borrowing. As sales tactics evolve and markets fluctuate, a business line of credit offers the agility required to navigate various challenges effectively.

We encourage all small business owners who have yet to explore this crucial financial tool to take actionable steps towards obtaining a line of credit. Begin by assessing your current financial situation and creating a strategy for approaching potential lenders. Additionally, we invite you to share your experiences or thoughts on this topic in the comments section below. Sharing this article with fellow business owners can foster a community of knowledge, helping others understand the importance of securing a business line of credit for future growth and success.

Frequently Asked Questions (FAQ)

Business lines of credit are essential financial tools for small businesses understanding their intricacies is key. Many prospective borrowers often have questions about eligibility requirements, credit score improvement strategies, and actions to take following a denied application.

One common query is regarding the eligibility requirements for obtaining a business line of credit. Typically, lenders evaluate factors such as the business’s credit history, annual revenue, and time in operation. Most lenders prefer businesses that have been established for at least six months to a year and generate consistent revenue. It is also essential to maintain a good credit score, as this is a significant determinant in securing favorable terms. A score of 700 or above is generally considered desirable, although some lenders might cater to businesses with lower scores.

Another frequently asked question pertains to improving credit scores. Small business owners can enhance their credit ratings by ensuring timely payments to vendors and creditors, reducing outstanding debts, and keeping credit utilization low. Regularly reviewing their credit reports for inaccuracies can also help in maintaining or boosting scores. Taking proactive steps, such as obtaining secured credit cards or working with credit-building services, can be beneficial for those looking to establish or repair their credit status.

In instances where a business line of credit application is denied, it's crucial to understand the reasons behind the decision. Business owners should request feedback from the lender, which may highlight areas needing improvement. Given this information, one can address the shortcomings, perhaps by resolving any credit issues and reapplying after a certain period. Additionally, exploring alternative lenders who may have different criteria could provide other financing options.

For You ✨

View All

February 16, 2025

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10