Best Business Line of Credit Options in 2025

Nathan Allen

Photo: Best Business Line of Credit Options in 2025

Introduction to Business Lines of Credit

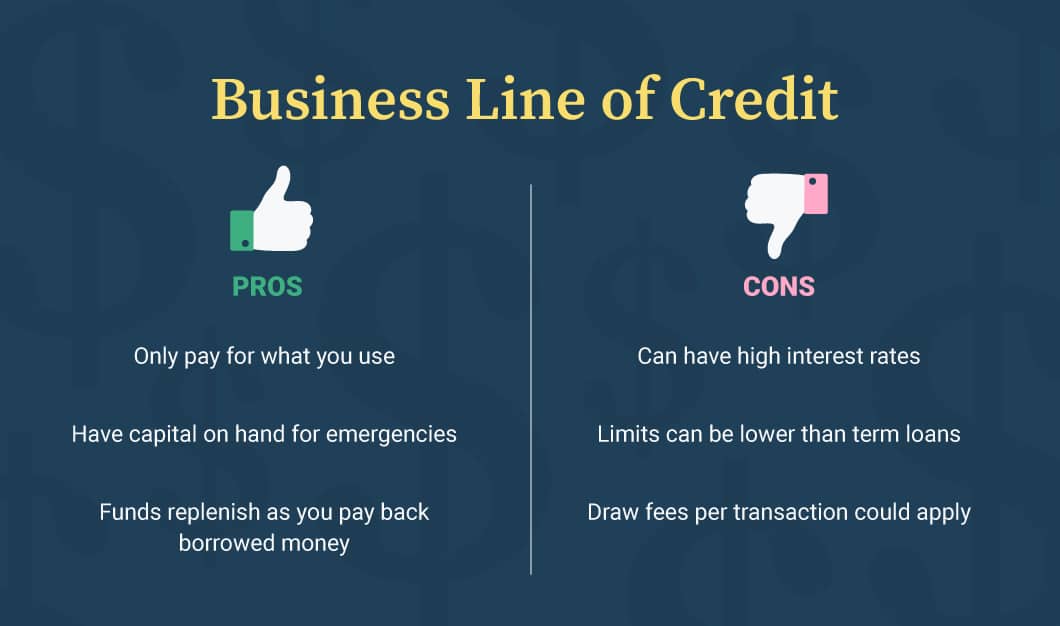

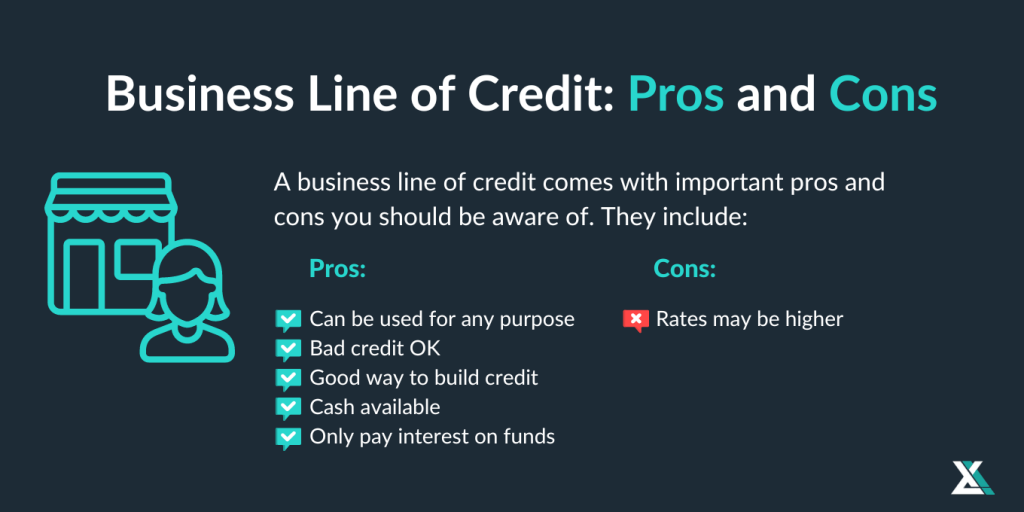

A business line of credit is a flexible financing option that allows businesses to access a predetermined amount of funds to meet their short-term financial needs. Unlike traditional loans, which provide a lump sum that must be repaid in fixed installments, a line of credit operates similarly to a credit card. Businesses can draw funds as needed, only paying interest on the amount utilized. This setup offers significant advantages for cash flow management, enabling companies to navigate unexpected expenses, manage seasonal fluctuations, or invest in opportunities without the burden of a lengthy application process.

The importance of a business line of credit for managing cash flow cannot be overstated. In an increasingly dynamic economic environment, many enterprises face the challenge of managing variable income and expenses. A line of credit serves as a financial safety net, allowing businesses to cover operational costs or seize new opportunities with agility. Furthermore, it can lead to improved credit ratings when used responsibly, as consistent repayment of borrowed amounts can reflect positively on the business's overall financial health.

<p 2025,="" a="" ability="" access="" adapt="" and="" as="" available="" business="" by="" can="" cash="" changes,="" changing="" climate,="" continue="" credit="" crucial="" demand="" demands="" economic="" effectively.Understanding the Different Types of Business Lines of Credit

Business lines of credit are essential financial instruments that provide companies with flexibility and cash flow management options. Within this domain, there exist various types of lines of credit, which can be broadly categorized into secured and unsecured lines, along with revolving credit lines. Each type caters to unique business needs and circumstances, making it important for business owners to understand their characteristics.

Secured lines of credit require the borrower to pledge an asset, such as real estate or inventory, as collateral for the loan. This collateralization typically enables lenders to offer lower interest rates compared to unsecured options, making this type appealing for businesses with substantial assets. However, one potential drawback is that failure to repay the loan could result in the loss of the pledged collateral. Secured lines can be an excellent choice for businesses looking to access larger credit limits or lower rates while having valuable assets to back the credit.

In contrast, unsecured lines of credit do not require collateral, which can be a significant advantage for businesses that lack sufficient assets. Instead, these lines are based on the borrower’s creditworthiness and revenue. While typically more costly in terms of interest rates and fees, unsecured lines of credit provide immediate access to funds without risking valuable assets. Such credit options can be especially beneficial for startups and small businesses that may not have substantial collateral yet require quick financing to manage operational costs.

Moreover, revolving credit lines offer ongoing access to funds up to a specified limit, allowing businesses to borrow, repay, and borrow again without reapplying for credit. This flexibility makes revolving lines ideal for managing short-term expenses, inventory purchases, or cash flow gaps. Businesses can strategically utilize this credit type to maintain liquidity while minimizing borrowing costs if managed responsibly. Understanding these options and their nuances empowers business owners to select the most suitable line of credit for their unique financial scenarios.

Key Factors to Consider When Choosing a Line of Credit

When selecting a business line of credit, it is essential for companies to evaluate several key factors that can significantly impact their financial health and operational flexibility. One of the foremost considerations is the interest rate associated with the line of credit. Interest rates can vary widely between lenders, and a lower rate can result in substantial savings over time. Consequently, it is prudent for business owners to compare offers from multiple financial institutions to find the most competitive rates available.

Another critical aspect to consider is the fees tied to the line of credit. Lenders often charge various fees, including annual fees, transaction fees, or maintenance fees. Understanding these costs is vital, as they can contribute to the overall expense of borrowing, potentially outweighing the benefits of a more favorable interest rate. A thorough examination of the fee structure will assist businesses in determining the true cost of accessing credit against their operational needs.

Repayment terms are also a significant factor in the decision-making process. Businesses should closely analyze the repayment schedule, including whether repayments are monthly, weekly, or based on usage. Flexible repayment options can provide added comfort during lean periods, allowing companies to align their cash flow cycles with repayment obligations. Furthermore, considering the lender's reputation is crucial businesses should seek lenders known for reliable customer service and ethical practices. Researching online reviews and seeking recommendations can provide insight into a lender's trustworthiness and operational efficiency.

Ultimately, balancing these factors interest rates, fees, repayment terms, and lender reputation against current business needs and future growth objectives will enable companies to make informed choices regarding lines of credit. Evaluating these criteria ensures that businesses select the most appropriate line of credit option to support their financial strategies moving forward.

Top Business Line of Credit Options for 2025

As businesses navigate the complexities of financing, understanding the top business lines of credit available in 2025 is crucial for making informed financial decisions. Different lenders present varying features, advantages, and user experiences that significantly impact a company's access to necessary funds. Here, we will explore some leading financial institutions that have distinguished themselves in the market.

One of the top contenders is Bank of America. Known for its comprehensive suite of financial products, its business line of credit offers up to $100,000 with a competitive interest rate starting at 8.5%. This flexible credit line can serve small to medium-sized enterprises looking to manage cash flow fluctuations or capitalize on business opportunities. Many users highlight the straightforward online application process and excellent customer service provided by the bank.

Another prominent option is Wells Fargo, which provides a line of credit with funding amounts ranging from $10,000 to $150,000. The appeal of Wells Fargo lies in its flexible repayment options and the ability to withdraw funds via checks or online transfers. User testimonials frequently underscore the convenience of having access to both short- and long-term borrowing options based on their evolving business needs.

Lastly, BlueVine has gained notable popularity for its online-based line of credit, offering up to $250,000. This facility is particularly appreciated for its rapid funding approvals, often within hours, making it ideal for businesses in need of immediate cash. Clients frequently commend BlueVine for its transparent fee structure and responsive support, thereby solidifying its position as a key player in the business lending arena.

In conclusion, choosing the best business line of credit in 2025 will depend on various factors, including funding amount, interest rates, and user experiences. The highlighted options stand out for their unique features, making them suitable for diverse business needs and lending preferences.

The Application Process: Step-by-Step Guide

Applying for a business line of credit can seem daunting however, by following a structured approach, entrepreneurs can enhance their chances of approval and secure necessary funding. The process typically begins with gathering essential documentation. Most financial institutions will require personal and business tax returns, bank statements, financial statements, and a clear business plan outlining intended use for the funds. Having all necessary paperwork ready can simplify the process and expedite approval times.

Once the documentation is prepared, the next step is to choose the right lender. It is crucial to research various lenders carefully, as they may differ significantly in terms of interest rates, fees, and repayment terms. Compare traditional banks, credit unions, and online lenders to find the one that best meets your business needs. Read reviews and consider recommendations to ensure reliability and quality customer service.

During the application, accuracy is vital. Ensure that all forms are completed thoroughly and clearly. Common pitfalls include submitting incomplete applications or providing inaccurate financial data. Such mistakes can delay the review process or even result in rejection. In real-life scenarios, small businesses that have been meticulous in their documentation and honest about their financial standing report higher success rates in securing funding.

Once you submit the application, be prepared to answer follow-up questions. Lenders may seek additional information or clarification, which emphasizes the importance of maintaining open communication. An entrepreneur’s responsiveness can positively influence the lender’s perception and may lead to a quicker approval.

In conclusion, taking a systematic approach to applying for a business line of credit preparing documentation, choosing the right lender, ensuring accuracy, and maintaining communication can significantly enhance the likelihood of approval. By considering these steps, businesses can successfully navigate the application process and access the funding they need to grow.

Managing Your Line of Credit Wisely

Effectively managing a business line of credit is essential for optimizing cash flow and promoting growth. One of the primary strategies involves consistent monitoring of credit usage. It is important to keep track of how much of the available credit is being utilized. Many financial institutions offer online dashboards that provide real-time updates on credit balance and utilization rates, which can be quite beneficial for business owners.

In addition to monitoring usage, staying informed about the prevailing interest rates is crucial. Interest rates can fluctuate based on economic conditions, and understanding these variations can help businesses make informed decisions regarding when to draw from their line of credit. By analyzing market trends and interest rate changes, business owners can strategically time their withdrawals, ensuring that they minimize financial costs.

Timely repayments are another critical factor in managing a line of credit wisely. Establishing a regular repayment schedule can help avoid late fees and penalties, while also maintaining a positive credit score. Businesses should consider automating payments or setting reminders to ensure they never miss a due date. This proactive approach fosters a strong relationship with lenders, which may lead to favorable terms or increased credit limits in the future.

Using a line of credit to foster business growth is a powerful strategy when implemented properly. It can facilitate immediate investments in equipment, inventory, or marketing campaigns that can result in increased revenue. However, business owners must ensure that they use credit appropriately and avoid financing non-essential expenses.

Lastly, various financial management tools available in the market can help businesses track and optimize their credit usage. These tools often include budgeting apps and accounting software that can provide insights into cash flow and spending patterns. By utilizing these resources, business owners can gain better control over their finances, leading to sustainable growth.

Common Mistakes to Avoid with Business Lines of Credit

Utilizing a business line of credit can be an effective way to finance operational needs or unexpected expenses, but several common mistakes can undermine its benefits. One primary pitfall is overspending. A business might be tempted to withdraw more than necessary simply because the funds are available. This tendency leads to increased debt levels and can create cash flow problems. To avoid this, companies should establish a budget that clearly delineates when and how much to draw from their credit line, aligning it with concrete financial needs.

Another significant mistake is neglecting repayment schedules. Failing to adhere to the terms set forth by the lending institution can lead to increased financial charges, negatively affect the business's credit score, and potentially result in the loss of access to credit in the future. It is crucial for businesses to keep track of their payment deadlines and amounts to ensure timely repayments. Implementing a calendar reminder or automating payments may assist in maintaining a disciplined repayment habit.

A misunderstanding of the terms associated with the line of credit is a further area of concern. Companies may enter into contracts with incorrect assumptions about interest rates, repayment periods, or draw limits. This lack of clarity can result in significant financial repercussions down the line. It is advisable for businesses to meticulously read all related documentation and seek clarification from lenders on aspects they do not fully understand before agreeing to the terms.

Avoiding these common mistakes can transform a business line of credit from a potential liability into a valuable financial tool that supports growth and stability. Implementing strategic budgeting, maintaining awareness of repayment deadlines, and ensuring a thorough understanding of credit terms are vital to successful utilization.

Future Trends in Business Financing

As we look towards 2025, the landscape of business financing, particularly the availability and use of lines of credit, is expected to undergo significant transformations. One major trend is the increased adoption of emerging technologies that enhance the efficiency of the lending process. Fintech companies are likely to play a pivotal role by introducing innovative solutions such as artificial intelligence (AI) and machine learning algorithms. These technologies can expedite the underwriting process, enabling lenders to assess creditworthiness in real-time based on a broader spectrum of data, thus making lines of credit more accessible to a diverse array of businesses.

Additionally, changing lender criteria will likely redefine how businesses apply for and secure financing. Traditional lending institutions may adapt their parameters to stay competitive, leading to a more flexible approach towards credit assessment. This shift will probably benefit small businesses and startups, which often struggle to meet the stringent requirements typically enforced by banks. Lenders may prioritize alternative data points, such as cash flow history and transactional data, which can provide a fuller picture of a business’s financial health.

Moreover, the economic environment will undeniably influence the availability and terms of business lines of credit. Factors such as inflation rates, interest rates, and overall economic stability will dictate lending practices. For example, as inflation continues to resonate within economies, interest rates may rise, making lines of credit more expensive. Business owners must stay informed about these economic trends, as they will directly affect their financing options and cost of borrowing. Understanding these dynamics will be essential for businesses seeking to navigate the complexities of financing in this evolving landscape.

FAQs About Business Lines of Credit

Business lines of credit are a popular financing option for many entrepreneurs, but they can also be a source of confusion. Below are some frequently asked questions that can help clarify this financial tool.

What is a business line of credit? A business line of credit provides businesses with access to funds that can be drawn upon as needed, up to a pre-approved limit. This flexibility allows business owners to manage cash flow, cover unexpected expenses, or take advantage of timely opportunities without the responsibility of a lump-sum loan.

Who is eligible for a business line of credit? Eligibility for a business line of credit varies by lender but typically requires a combination of factors such as the business’s revenue, time in operation, and creditworthiness. New business owners may find options limited, while established enterprises often enjoy wider access to credit. It’s advisable to check specific lender requirements before applying.

What are the typical credit limits? Business lines of credit can range significantly in terms of credit limits, often from a few thousand dollars to several million. Limitations depend on the lender, the financial health of the business, and the owner’s credit score. Understanding these factors is crucial for businesses seeking appropriate financing options.

What costs are involved? While access to a line of credit can be beneficial, potential borrowers should be aware of associated costs. These often include annual fees, interest rates on drawn amounts, and potential maintenance fees. Conducting thorough research and comparing offers from multiple lenders can help in identifying the most cost-effective option.

Will a business line of credit impact my credit score? Yes, opening a business line of credit can affect both personal and business credit scores. Responsible use and timely repayments usually have a positive impact, while missed payments can lead to a decline in credit health. Monitoring credit scores regularly can help business owners maintain favorable ratings.

Understanding these key aspects of business lines of credit can provide better insight and preparation for potential applicants. The right information can significantly enhance decision-making processes.

Conclusion and Call to Action

In the evolving landscape of business financing, selecting the appropriate business line of credit is paramount for maintaining financial health and stability. This article has explored various options available in 2025, highlighting the significance of assessing interest rates, repayment terms, and eligibility criteria. Each type of line of credit presents unique advantages, whether it be traditional bank offerings or more flexible online alternatives, catering to different business needs.

Understanding the dynamics of your business, such as cash flow patterns and liquidity requirements, is crucial in making an informed decision. The right business line of credit can serve as a financial safety net, ensuring you can navigate unexpected expenses, invest in growth opportunities, or manage seasonal fluctuations in revenue. By carefully evaluating your options and aligning them with your business goals, you can harness the benefits of a business line of credit effectively.

Furthermore, as the financial landscape continues to change, staying updated on the latest developments, terms, and products is essential. Business owners are encouraged to research further, utilize resources available, and consult financial experts to optimize their financing strategies. We invite you to share your thoughts and experiences with business lines of credit in the comments below. Have you found particular options more beneficial? Your insights may assist others in their journey toward selecting the most suitable financing solution. In addition, don’t hesitate to explore further resources provided in this article on business financing to deepen your understanding and improve your financial decision-making.

For You ✨

View All

February 16, 2025

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10