Long-Term Business Lines of Credit: Pros and Cons

Nathan Allen

Photo: Long-Term Business Lines of Credit: Pros and Cons

Introduction to Long-Term Business Lines of Credit

Long-term business lines of credit represent a crucial financial resource for companies seeking flexibility and control over their capital needs. Unlike traditional loans that provide a lump sum of cash, a line of credit allows businesses to borrow funds up to a predetermined limit, utilizing only what they require at any given moment. This feature makes long-term lines of credit particularly appealing for managing fluctuating cash flow, as funds can be drawn and repaid as necessary.

In essence, a long-term business line of credit serves as a safety net, empowering businesses to address immediate financial demands without committing to high-interest payments characteristic of short-term loans. This flexibility is beneficial for startups aiming to establish themselves in the market, as well as for established enterprises looking to sustain operations amidst economic shifts or capital requirements for expansion. By securing a line of credit, businesses can ensure they have adequate liquidity to cover day-to-day expenses, seize growth opportunities, or respond to contingencies.

Compared to other financing options, such as term loans or equity financing, long-term business lines of credit provide a distinct advantage by allowing businesses to manage their repayment schedules more effectively. Interest is typically charged only on the drawn amount, which can lead to lower overall borrowing costs. Moreover, these lines of credit often come with no collateral requirements, depending on the lending institution and the creditworthiness of the business. Such attributes not only underscore their popularity among diverse businesses but also highlight the vital role they play in supporting long-term financial strategies and operational resilience.

What is a Long-Term Business Line of Credit?

A long-term business line of credit is a flexible financial tool that provides businesses with access to a predetermined amount of funds over an extended period, generally ranging from one to five years. The structure of this type of credit allows business owners to draw funds as needed, without the obligation to utilize the entire credit limit. This characteristic distinguishes it from traditional loans, where a lump sum is disbursed at the outset, leading to immediate repayment obligations.

The application process for securing a long-term business line of credit typically involves several steps. Initially, the business must submit an application that outlines its financial health, including credit history, income statements, and cash flow projections. Lenders will also evaluate the business's creditworthiness based on the owner's credit score and other financial metrics. Once approved, businesses can access funds as needed, which is particularly beneficial for managing expenses that fluctuate over time or for funding short-term projects.

In terms of typical terms associated with long-term lines of credit, interest rates may vary based on the lender and the specific creditworthiness of the business. Often, rates can be competitive compared to traditional loans, although they may be subject to variable interest terms, fluctuating with market rates. It is crucial for business owners to compare these terms, as long-term lines of credit can offer different benefits than short-term options. For instance, while short-term lines are ideal for immediate cash flow needs, long-term business lines of credit provide sustained access to capital, which can support strategic growth initiatives over time.

Understanding the distinctions between long-term and short-term lines of credit, as well as traditional loans, equips business owners to make informed financial decisions that align with their operational needs and growth objectives.

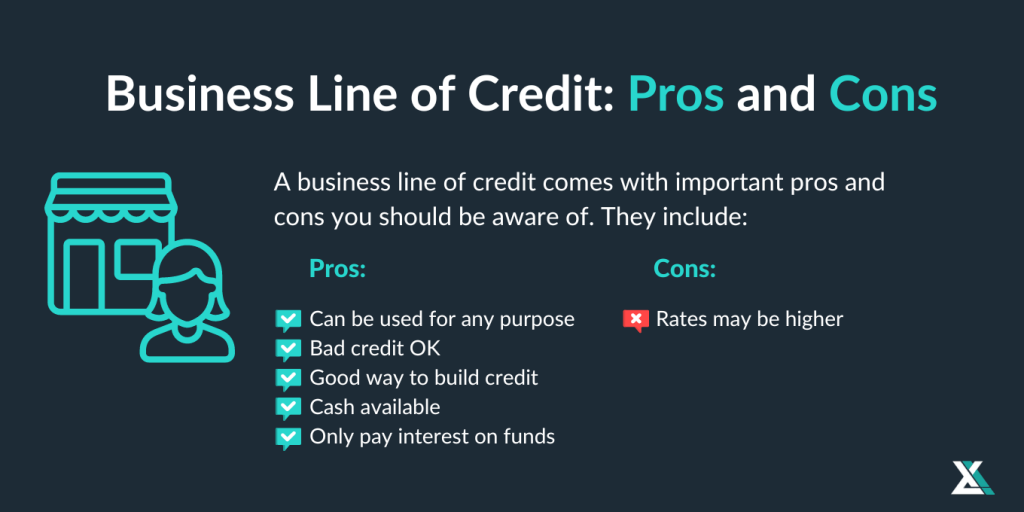

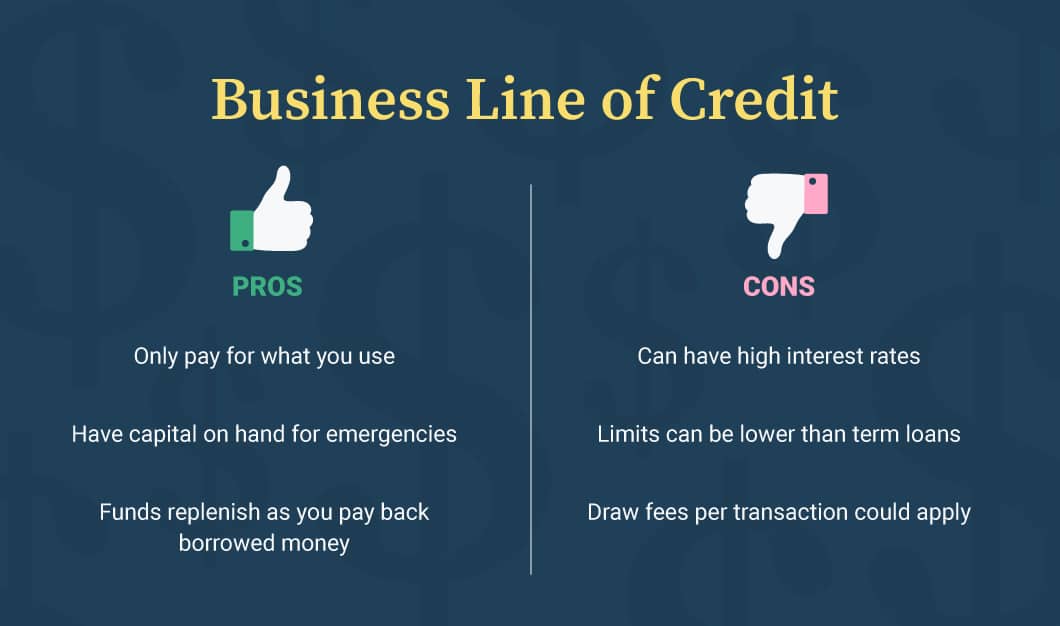

Advantages of Long-Term Business Lines of Credit

Long-term business lines of credit offer a significant advantage in flexibility, allowing businesses to draw money as needed, rather than receiving a lump sum loan. This feature enables entrepreneurs to access funds for unexpected expenses, seasonal fluctuations, or strategic investments without the burden of applying for a new loan each time. For instance, a retail business might utilize its line of credit during peak holiday seasons to stock up on inventory, ensuring they meet customer demand without experiencing cash flow shortages.

Another benefit associated with long-term lines of credit is the potential for lower interest rates compared to standard loans. Financial institutions often see these lines as lower risk due to their revolving nature, which can translate into more favorable borrowing costs. When a company can secure a line of credit at a competitive interest rate, it can execute plans more efficiently. For example, a small business with an established track record may find lenders willing to offer better rates, which can lead to significant savings over time.

Additionally, the accessibility of these credit lines is noteworthy. Businesses can draw upon their line of credit quickly and easily, with minimal paperwork involved in the process. This ease of access means that when a business faces urgent financial needs such as an unexpected equipment repair or the opportunity for a time-sensitive investment owners can act promptly without excessive delays. The nature of long-term business lines of credit facilitates improved cash flow management, allowing companies to bridge gaps by funding day-to-day operations while waiting for accounts receivable to come in.

Real-life examples and recent statistics reveal that many organizations leverage these financial tools to foster growth. According to research conducted by the Small Business Administration, approximately 60% of small businesses utilizing lines of credit reported improved cash flow management, which further enables them to invest in new opportunities and enhance their operational efficiency.

Disadvantages of Long-Term Business Lines of Credit

While long-term business lines of credit can offer significant advantages, they also come with several disadvantages that potential borrowers should carefully consider. One of the primary concerns is the potential for increasing debt levels. When businesses have access to a credit line, there may be a tendency to rely heavily on borrowed funds, leading to a situation where the overall debt burden escalates. For instance, a small business may initially use the credit line for expansion but could accumulate a large amount of debt if the revenues generated do not match expectations, ultimately affecting its financial stability.

Another disadvantage is the impact of variable interest rates. Long-term lines of credit often feature interest rates that can fluctuate based on market conditions or the lender's discretion. This variability can make budgeting and financial planning challenging for businesses, as payments could rise unexpectedly. For example, if a company borrows $100,000 at a variable interest rate of 5%, and rates increase to 7%, the monthly payments could significantly affect cash flow, particularly for companies with tight margins.

Additionally, borrowers may face potential fees associated with establishing and maintaining a line of credit. These fees can include annual fees, transaction fees, or withdrawal fees, which may not be immediately apparent at the outset. For businesses, these expenses can add up, thus diminishing the advantages of having access to credit. A construction company, for example, may find itself paying hundreds in fees over time, reducing the amount of working capital available for projects.

Lastly, the presence of a credit line can lead to underspending. With easy access to funds, some businesses may become less inclined to pursue alternative financing strategies or invest in areas that could yield higher returns. Instead, they may opt to rely solely on their credit line, which could limit their growth potential.

When to Consider a Long-Term Business Line of Credit

A long-term business line of credit can be a valuable financial tool in various scenarios. One situation where it is particularly beneficial is during seasonal fluctuations in revenue. Many businesses experience peak periods that require additional cash flow to manage increased inventory, staffing, or marketing efforts. In these instances, having access to a long-term credit line ensures that companies can meet their operational costs effectively without the pressure of high-interest rates associated with short-term loans.

Unexpected repairs can also necessitate the use of a long-term business line of credit. Whether it is a critical piece of equipment breakdown or an essential infrastructure issue, such repairs can lead to significant unplanned expenses. By securing a line of credit, businesses can address these urgent needs promptly, minimizing downtime and maintaining productivity without jeopardizing their finances.

Expansion opportunities present another compelling reason to consider this type of credit. When a business intends to grow its operations be it through hiring new staff, launching new products, or entering new markets the financial backing provided by a long-term line of credit can facilitate these initiatives. It allows businesses to invest in growth while spreading the cost over a more extended period, thus aligning cash flow with business expansion activities.

Practical guidelines for assessing the suitability of a long-term business line of credit include a thorough analysis of the company's financial health, examining cash flow patterns, and evaluating projected expenses. Businesses should also consider their ability to service the credit line comfortably without impacting their operational stability. By assessing these factors, companies can make informed decisions that reflect their unique financial needs and growth objectives.

Tips for Applying for a Long-Term Business Line of Credit

Applying for a long-term business line of credit can be a strategic move for businesses looking to ensure financial stability and flexibility. To enhance your chances of approval and secure favorable terms, consider the following actionable tips.

Firstly, assess your credit score. Lenders typically view creditworthiness as a key indicator of your reliability in repaying debts. A higher credit score can lead to better interest rates and terms. Before applying, obtain your credit report from major credit bureaus and review it for any inaccuracies. Addressing any discrepancies and ensuring your score reflects your true creditworthiness may give you an edge in negotiations with lenders.

Secondly, gather all necessary documentation. Lenders will often require specific documents to assess your business's financial health. This may include financial statements, tax returns, a business plan, and cash flow projections. Ensuring that these documents are accurate and well-prepared can significantly expedite the approval process and demonstrate your commitment to financial responsibility.

Moreover, choosing the right lender is crucial. Research various lending institutions, including traditional banks, credit unions, and alternative lenders. Evaluate their offerings, interest rates, and fees, as well as their track record with small businesses. Establish relationships and communication with potential lenders this may provide insights into their approval criteria and help tailor your application to meet their specific requirements.

Additionally, consider the timing of your application. Timing can influence the likelihood of approval and the terms offered. For instance, applying after a strong revenue quarter may present a more favorable picture of your business's financial health. Lastly, be prepared to explain how you intend to use the line of credit, as this clarity can instill confidence in lenders regarding your financial strategy.

Key Factors to Assess Before Making a Decision

When considering a long-term line of credit, businesses must evaluate several critical factors to ensure alignment with their financial strategy and goals. One of the foremost aspects is the overall financial health of the business. Analyzing current cash flow, profitability, and expense management can provide insights into whether the business can sustain ongoing payments over an extended period. It is essential to maintain a positive cash flow to ensure that debt obligations can be met without jeopardizing operations.

Current debt load is another critical factor. Companies should conduct a thorough assessment of their existing liabilities, including short-term and long-term debts. A high debt-to-equity ratio could pose risks, potentially leading lenders to view the business as a high-risk investment. Businesses with excessive debt might struggle to take on additional credit, making it necessary to create a manageable debt repayment plan before considering further borrowing.

Market conditions also play a significant role in the decision-making process. Economic fluctuations, industry trends, and competitive pressures can all influence the feasibility of maintaining a long-term line of credit. For instance, a firm operating in a declining market may find it challenging to manage financing without sacrificing strategic goals. Conversely, a flourishing market might present opportunities for leveraging credit more effectively. Understanding these dynamics can help businesses forecast potential risks and rewards associated with obtaining credit.

Ultimately, aligning a long-term line of credit with the business's goals is essential. Companies must define their objectives, whether for expansion, operational financing, or managing seasonal fluctuations. Clear strategic goals will assist in determining how much credit is required and the most suitable credit structure, ensuring that borrowing supports the long-term vision of the business.

Conclusion

When evaluating long-term business lines of credit, it is essential to consider various factors that could significantly impact your business's financial health and operational strategy. Throughout this discussion, we have highlighted the primary advantages, such as the flexibility and accessibility of funds that enable businesses to manage cash flow and pursue growth opportunities. Furthermore, a long-term line of credit can serve as a financial safety net, ensuring that your business has the necessary resources to weather unforeseen circumstances.

On the other hand, it is equally important to recognize the potential drawbacks. These may include higher overall costs due to interest rates and fees, as well as the risk of accumulating debt if not managed prudently. Therefore, assessing your business's unique financial situation is paramount before deciding to pursue this form of funding. Determining your cash flow needs, financial stability, and the ability to repay the borrowed amounts will directly influence your ability to successfully navigate the terms of a long-term business line of credit.

Ultimately, the decision to pursue a long-term line of credit should reflect a balance between your business needs and the potential risks involved. It is advisable to consult with financial advisors or industry experts who can provide tailored insights based on your specific circumstances. Engaging in discussions with peers or seeking additional advice can also provide different perspectives on managing funding challenges.

We encourage our readers to weigh the pros and cons carefully. Your thoughts on long-term business lines of credit are valuable please feel free to share your experiences or seek further advice in the comments section below. Your engagement will not only enrich the conversation but also assist others in making informed decisions regarding their financial choices.

Frequently Asked Questions (FAQ) about Long-Term Business Lines of Credit

Long-term business lines of credit offer flexibility and access to funds for various business needs, but prospective borrowers often have questions. Here, we address some frequently asked questions to demystify this financial product.

1. What is the application process like for long-term business lines of credit?

The application process typically involves several steps. First, businesses must gather documentation such as financial statements, tax returns, and business plans. Next, lenders will evaluate the business's financial health, creditworthiness, and operational history. This assessment can lead to varying timelines depending on the lender's requirements, which can range from a few days to several weeks. Establishing a strong relationship with the lender and ensuring that all necessary documentation is readily available may expedite this process.

2. How does a long-term line of credit impact my credit score?

When a business applies for a long-term line of credit, lenders will perform a credit inquiry. This hard inquiry might slightly lower the business's credit score. However, if the line of credit is used responsibly, such as by maintaining low balances and making timely payments, it can actually enhance credit scores over time. A positive payment history demonstrates to future lenders that the business is capable of managing credit responsibly.

3. What are the alternatives to long-term business lines of credit?

Alternatives to long-term business lines of credit include traditional term loans, equipment financing, or invoice financing. Each option has its own advantages and drawbacks. For instance, term loans provide a lump sum that must be repaid in fixed installments, while invoice financing allows businesses to borrow against contractual accounts receivable. Depending on a business's needs, one of these alternatives may be more suitable than a line of credit.

By understanding these key aspects of long-term business lines of credit and addressing common concerns, businesses can make more informed financial decisions.

For You ✨

View All

February 16, 2025

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10