Short-Term Business Lines of Credit Explained

Nathan Allen

Photo: Short-Term Business Lines of Credit Explained

Introduction to Short-Term Business Lines of Credit

Short-term business lines of credit are financial tools that provide businesses with flexible access to funds, allowing them to manage cash flow and meet immediate financial needs. Unlike traditional loans, which involve a lump sum disbursal, a business line of credit provides access to a predetermined amount of capital that can be drawn upon as necessary. This unique structure enables businesses to withdraw funds up to their credit limit, pay interest only on the amount used, and replenish the available credit as they repay their balances.

The primary purpose of short-term business lines of credit is to enhance liquidity within an organization. Liquidity refers to the ease with which assets can be converted into cash to meet short-term obligations. For small to medium-sized enterprises (SMEs), maintaining sufficient liquidity is critical to navigating unexpected expenses, seasonal fluctuations, and opportunities arising from market conditions. As such, having a robust cash flow management strategy is vital for business sustainability, and a short-term line of credit serves as an important financial safety net in this regard.

Access to short-term business lines of credit can prove invaluable for various operational needs. Businesses may utilize these lines for purposes such as purchasing inventory, managing payroll during cash flow crunches, or funding marketing initiatives. Additionally, they allow companies to capitalize on time-sensitive opportunities, such as securing bulk purchasing discounts or covering urgent repairs. The versatility offered by these credit facilities empowers entrepreneurs to effectively manage their financial landscape while promoting overall business growth and resilience.

How Short-Term Business Lines of Credit Work

Short-term business lines of credit are a flexible financial tool that allows businesses to access funds as needed, up to a predetermined limit. This type of credit operates on a revolving basis, similar to a credit card, which means that borrowers can withdraw funds, repay them, and then borrow again without having to reapply. When a business is approved for a line of credit, the lender sets a credit limit based on various factors including the business's creditworthiness, revenue, and time in operation.

Once the credit line is established, businesses can access funds for various purposes, such as managing cash flow, purchasing inventory, or taking advantage of time-sensitive opportunities. The amount of interest charged typically varies in accordance with the outstanding balance; thus, borrowers only pay interest on the funds they actually use. This can make short-term lines of credit more cost-effective compared to traditional loans, where interest accumulates on the entire loan amount from the outset.

Repayment terms for short-term business lines of credit are generally more stringent than those for long-term loans. Businesses may be required to make monthly payments that cover interest and a portion of the principal. The duration of these credit lines often ranges from a few months to a year, and lines can frequently be renewed if the business remains in good standing with the lender.

The application process for a short-term business line of credit can be relatively straightforward. Potential borrowers need to meet certain eligibility criteria, such as having a minimum credit score and demonstrating sufficient business revenue. Financial documents, including bank statements and tax returns, may be required to assess the financial health of the business. By understanding these mechanics, business owners can make informed decisions about utilizing short-term lines of credit to meet their financial needs.

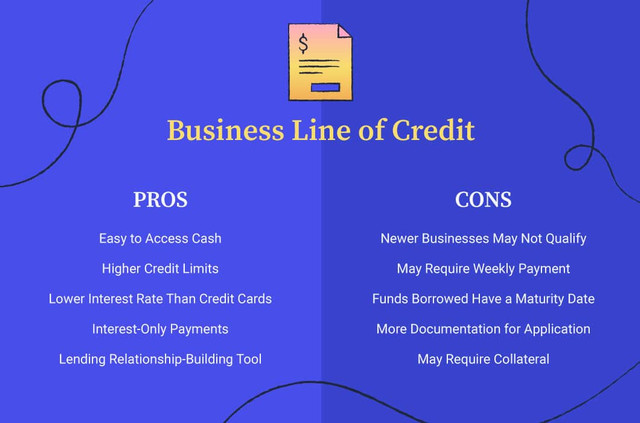

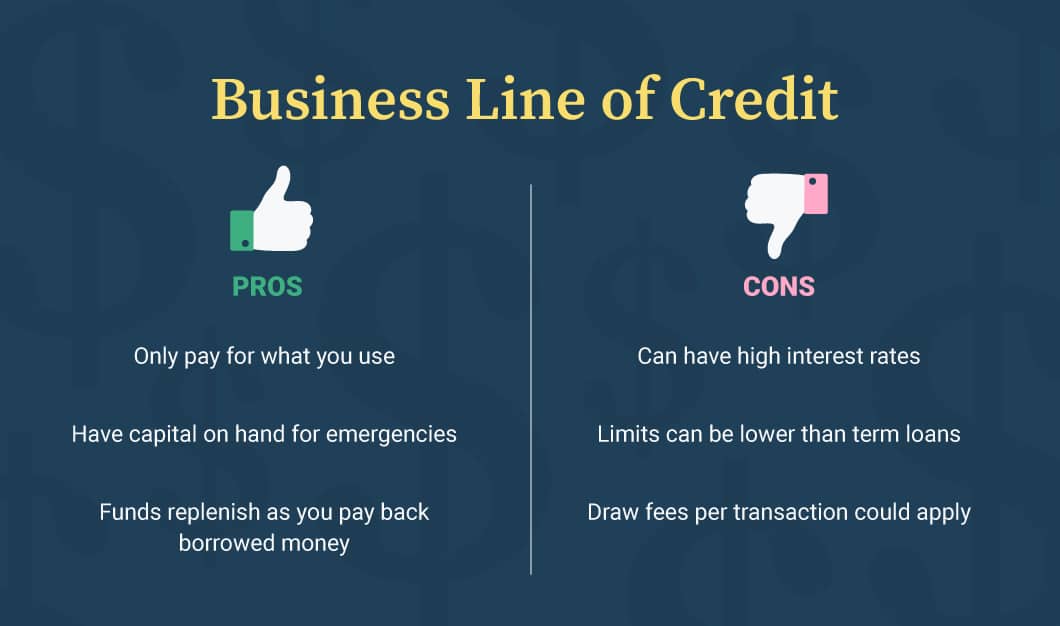

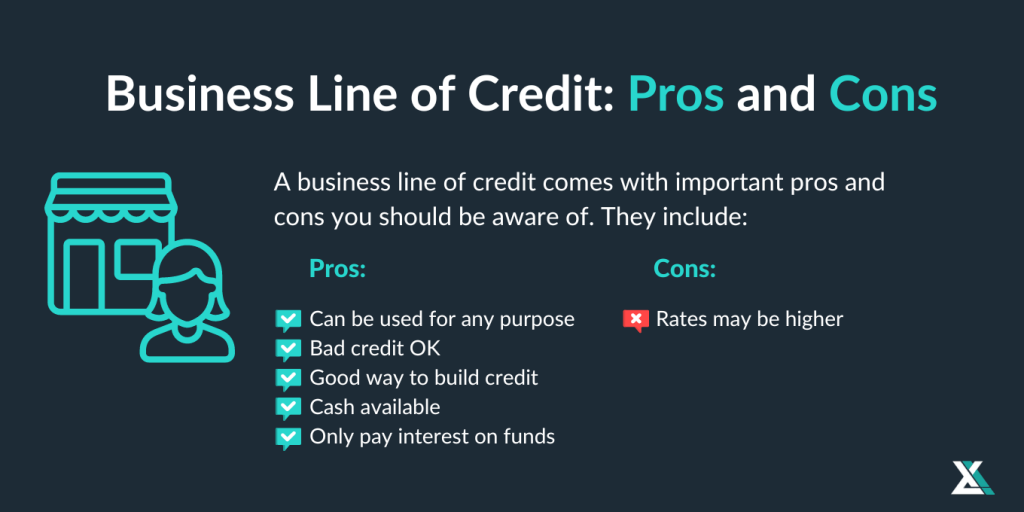

Advantages of Using Short-Term Business Lines of Credit

Short-term business lines of credit offer several significant advantages for enterprises seeking flexible financial solutions. One of the primary benefits is the inherent flexibility that these credit lines provide. Businesses can draw funds as needed, up to a predetermined limit, enabling them to manage their cash flow more effectively. This feature is particularly beneficial for seasonal businesses or those experiencing fluctuations in revenue, as it allows them to access funds precisely when required without the need for long-term commitments.

Another important advantage is the rapid access to funds that short-term lines of credit provide. Unlike traditional loans, which often involve lengthy approval processes, short-term credit can be accessed almost immediately. This immediacy can be crucial for businesses that need to seize time-sensitive opportunities or cover unexpected expenses. For example, if a company faces an urgent inventory shortage, they can quickly tap into their line of credit to replenish stock without enduring prolonged waiting periods typically associated with other types of financing.

Furthermore, utilizing a short-term business line of credit can enhance a company's ability to manage cash flow effectively. By having a readily available source of funds, businesses can ensure they have the necessary resources to meet operational costs, payroll, or unexpected bills. This can contribute to financial stability and alleviate the stress associated with cash shortages, allowing management to focus on strategic growth rather than day-to-day financial pressures.

Lastly, when compared to traditional loan options, short-term lines of credit can often be more favorable. They tend to have lower qualification requirements, making them accessible to a broader range of businesses. Additionally, with interest rates that may be more competitive than those of a conventional loan, they represent a viable alternative for companies aiming to optimize their financial strategies while maintaining flexibility and control over their resources.

Potential Drawbacks and Risks

While short-term business lines of credit can offer flexible financial solutions, they come with several potential drawbacks and risks that businesses should carefully consider before proceeding. One significant concern is the often high-interest rates associated with these lines of credit. Unlike traditional loans that may offer lower rates over extended repayment periods, short-term credit can carry steep interest rates which accumulate quickly, leading to the potential for a substantial financial burden if the borrowed amounts are not repaid promptly.

Additionally, reliance on short-term credit can lead to a cycle of debt. Businesses that frequently tap into these lines of credit may find themselves in a precarious position, depending on them for recurring operational expenses rather than employing sound financial practices that promote sustainable growth. This over-reliance can hinder the development of a robust cash flow management strategy, resulting in an unbalanced reliance on borrowed funds which may not be sustainable in the long run.

Furthermore, availing of multiple lines of credit or borrowing excessively can negatively impact a business’s credit score. Credit agencies evaluate a business’s credit utilization ratio, and if a significant portion of available credit is in use, it may signal financial instability to lenders. In some cases, this can restrict access to more favorable financing options in the future, complicating the financial landscape for the business.

In specific scenarios, a line of credit may not be the best fit for a business’s financial needs. For instance, businesses with unpredictable cash flows or fluctuating revenues might struggle to meet the repayment terms, making short-term credit a risky endeavor. Organizations should conduct thorough assessments of their financial positions and operational needs before committing to a short-term line of credit, ensuring that they have a comprehensive understanding of its associated risks and drawbacks.

Choosing the Right Lender for Your Business

When it comes to securing a short-term business line of credit, selecting the right lender is a critical step that can significantly influence your financial health. Different lenders offer varying terms, and understanding these differences can empower you to make informed choices that align with your business strategy. One of the first considerations should be the interest rates associated with the line of credit. Ideally, you will want to find a lender who offers competitive rates to minimize the cost of borrowing.

Beyond interest rates, it is essential to carefully examine any associated fees that may arise from the line of credit. Some lenders may impose origination fees, maintenance fees, or draw fees. These costs can add up and affect your overall financials. It is advisable to request a breakdown of all potential charges from prospective lenders to ensure transparency.

Repayment terms also warrant careful consideration. Different lenders offer various repayment schedules, which can impact your cash flow. Opt for a lender whose repayment structure can accommodate your business operations while allowing flexibility in case of unforeseen circumstances. Pay special attention to the expediency of the repayment process, as certain lenders may have more favorable terms than others.

Customer service is another element that should not be overlooked. A lender known for responsive and helpful customer service can be invaluable, especially during critical periods when access to funds may be required. Conducting thorough research on a lender’s reputation through online reviews or testimonials can provide insights into their reliability and support capabilities.

In summary, taking the time to conduct due diligence and comparing various lending options based on interest rates, fees, repayment terms, customer service, and overall reputation can significantly enhance your chances of selecting a suitable lender for your short-term business line of credit.

Strategies to Use Short-Term Business Lines of Credit Effectively

Short-term business lines of credit can serve as a vital financial tool for companies seeking to manage cash flow fluctuations while pursuing growth opportunities. To maximize the benefits of these credit lines, businesses need to adopt effective strategies that align with their financial goals.

One of the first steps is to develop a comprehensive budgeting plan for repayment. Structuring a repayment timeline allows businesses to understand how their cash flow will be impacted and ensures they can meet their obligations without incurring excessive fees. By forecasting expenses and anticipated revenue, companies can identify the optimal times for utilizing their credit, thus minimizing reliance on borrowed funds. Additionally, maintaining a healthy cash reserve can provide a buffer for any unforeseen expenses, reducing the stress associated with repayment deadlines.

Leveraging credit for growth opportunities is another essential strategy. Companies should evaluate their business model and identify key areas where short-term credit can facilitate expansion or operational improvements. For instance, purchasing inventory in bulk during seasonal sales or investing in marketing campaigns can create immediate growth. When implemented judiciously, this can enhance profitability and generate positive cash flow, making it easier to repay the borrowed amounts without straining finances.

Aligning the use of credit with long-term financial goals is crucial for sustainable success. Business owners should regularly assess their objectives and ensure that any use of credit is directly linked to achieving these goals. This may involve seeking professional financial advice or utilizing business planning tools to ensure decisions are data-driven and aimed at fostering growth rather than merely addressing short-term cash deficiencies.

By strategically managing a short-term business line of credit, organizations can not only navigate immediate cash flow challenges but also pursue opportunities that drive long-term success.

Alternatives to Short-Term Business Lines of Credit

While short-term business lines of credit can provide immediate financing solutions, numerous alternatives may suit businesses based on their specific needs and circumstances. Each alternative offers distinct advantages and disadvantages that can influence a business's financial strategy.

One notable option is traditional bank loans. These loans typically provide a lump sum of money that can be used for various purposes. They tend to offer lower interest rates compared to short-term lines of credit. However, the application process can be lengthy, and only qualifying businesses with strong credit scores may secure these loans.

Another commonly used alternative is credit cards. Business credit cards offer a convenient way to access funds, as they are readily available for purchases and enable users to build credit history. However, they often come with high-interest rates and may lead to debt if not managed carefully. Additionally, credit limits may be lower than those associated with short-term lines of credit.

Invoice financing is also an appealing alternative. This financing option allows businesses to borrow against their accounts receivable. By doing so, companies can access cash quickly without having to wait for customers to pay their invoices. The downside is that it can be more expensive than traditional loans due to fees associated with the financing process.

Lastly, crowdfunding can serve as a viable option for some businesses seeking financial support. Through crowdfunding platforms, businesses can raise funds from multiple individuals. This approach not only provides capital but also has the potential to create a customer base. However, success in crowdfunding relies heavily on effective marketing, and there is no guarantee that a target funding goal will be met.

In conclusion, while short-term business lines of credit may be beneficial, exploring these alternatives can help businesses find the most suitable financing solution for their unique circumstances.

Real-Life Case Studies: Success Stories

Numerous businesses have effectively leveraged short-term lines of credit to overcome financial hardships and capitalize on growth prospects. Consider the case of a small construction firm based in Texas. Encountering an unexpected spike in demand during a peak season, the business found itself in dire need of funds to procure additional materials and hire temporary labor. By utilizing a short-term line of credit, they successfully managed to expand their workforce and complete projects on time, thereby increasing customer satisfaction and generating repeat business. This strategic move not only preserved their cash flow but also strengthened their market position.

Another exemplary scenario involves a retail business that faced cash flow challenges due to delayed payments from clients. With the holiday shopping season approaching, maintaining adequate inventory levels was essential for maximizing sales. They opted for a short-term line of credit, which provided them with the immediate liquidity necessary to stock their stores. Consequently, they were able to meet customer demand during the critical holiday period, resulting in a significant boost in revenue. This timely financial decision reinforced their operational stability and allowed them to plan for future growth.

A third case to consider pertains to a startup in the tech sector. After developing a promising software solution, the startup needed funds to accelerate their marketing efforts and enhance product features. Relying on a short-term line of credit, they were able to invest in effective advertising campaigns and technical improvements. The influx of new customers not only validated their business model but also increased their valuation significantly during the next funding round. This success story illustrates how strategic borrowing can be a catalyst for rapid business growth.

These real-life examples demonstrate that short-term business lines of credit, when utilized wisely, can provide companies with essential capital to navigate financial challenges, seize opportunities, and bolster growth. Each story emphasizes the importance of timing and strategic decision-making in leveraging credit for business success.

Frequently Asked Questions about Short-Term Business Lines of Credit

Short-term business lines of credit are an essential financial tool for many entrepreneurs. The following addresses some frequently asked questions to clarify common concerns and provide insight into this type of financing.

How can I improve my eligibility for a short-term business line of credit? Eligibility for a short-term business line of credit typically hinges on several factors including credit score, business revenue, and time in business. To enhance your chances of approval, maintain a good credit score by paying debts on time and reducing outstanding balances. Regularly reviewing your business's financial statements can also be beneficial; showing consistent revenue may improve your profile. Additionally, having a business plan that demonstrates how you intend to use the funds can further strengthen your application.

What happens in case of non-repayment? Non-repayment can lead to severe consequences for borrowers. Failure to repay a business line of credit may result in penalties, increased interest rates, or a lower credit score, complicating future borrowing opportunities. In more serious cases, lenders may initiate collections tactics to recover the owed funds. It is crucial to communicate with the lender if financial difficulties arise, as they may offer alternative repayment plans or solutions to avoid such situations.

What is the difference between secured and unsecured lines of credit? The primary distinction between secured and unsecured lines of credit lies in the collateral requirement. Secured lines of credit require borrowers to pledge valuable assets, such as real estate or inventory, as collateral. This can lead to lower interest rates due to reduced risk for lenders. Conversely, unsecured lines do not require collateral, making them more accessible but generally accompanied by higher interest rates and stricter qualification criteria. Understanding the nuances of these types can help business owners make informed decisions tailored to their financial situations.

For You ✨

View All

February 16, 2025

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10