Leveraging Accounts Receivable for Secured Credit

Nathan Allen

Photo: Leveraging Accounts Receivable for Secured Credit

Introduction to Accounts Receivable and Secured Credit

Accounts receivable (AR) is a term that refers to the outstanding invoices or amounts owed by customers to a business for goods or services delivered but not yet paid for. In essence, it represents a claim for payment that a company expects to receive, essentially acting as an integral part of a company’s working capital. Businesses rely on AR as a source of cash inflow, contributing significantly to their operational liquidity.

Secured credit is a financial arrangement where a borrower secures a loan or credit against an asset, which, in the event of default, can be seized by the lender to recover the owed amount. This type of credit is often regarded as less risky for lenders, given that they have a tangible asset backing the loan. The relation between accounts receivable and secured credit becomes particularly crucial when businesses seek financing options to enhance their operations or tackle short-term cash flow challenges. Utilizing AR as collateral allows companies to leverage their receivables to access working capital more efficiently.

The connection between accounts receivable and secured credit highlights an essential aspect of business finance: the importance of creditworthiness. A company's ability to collect its receivables reflects its financial health and influences its appeal to lenders. Those with a strong track record of managing receivables are often able to negotiate better loan terms due to their perceived reliability. Understanding how to effectively manage accounts receivable can significantly impact a business's ability to secure favorable credit options.

In the following sections, we will explore various strategies businesses can employ to leverage accounts receivable to facilitate secured credit, ultimately illuminating the potential financial pathways available through sound AR management.

How Accounts Receivable Impact Your Business's Credit Rating

Accounts receivable (AR) serve as a critical component of a business's financial health and play a significant role in shaping its credit rating. A company's ability to efficiently manage its AR can directly influence its overall credit profile, creating implications for securing favorable credit terms, obtaining loans, and establishing business partnerships. Timely collection of accounts receivable is essential when invoices are collected promptly, it enhances cash flow, signaling to credit agencies that the business is financially stable and capable of meeting its obligations.

Credit agencies evaluate various factors related to accounts receivable when determining credit scores. One key factor is the aging of receivables outstanding invoices that remain unpaid for extended periods can negatively impact credit ratings. Businesses that consistently struggle to collect on their accounts face increased scrutiny from creditors and lenders, potentially resulting in higher interest rates or unfavorable lending terms. In fact, studies indicate that companies with ineffective AR management often experience credit score reductions, which can impair their access to capital.

Another important aspect is the turnover ratio of accounts receivable. This ratio measures how quickly a company can convert its receivables into cash. A higher turnover ratio typically reflects sound management practices, indicating that the company is effective in collecting payments. According to industry statistics, businesses that maintain a turnover ratio of 10 or more enjoy better credit ratings compared to those with lower ratios. Moreover, lenders frequently view a robust accounts receivable system as an asset that mitigates risk, enhancing the company’s bargaining power when negotiating loan terms.

In conclusion, accounts receivable significantly influence a business’s credit rating. By actively managing AR, companies can improve their financial standing and secure better credit opportunities, ultimately contributing to long-term growth and sustainability.

Transforming Accounts Receivable into Collateral for Secured Loans

Utilizing accounts receivable (AR) as collateral for secured loans can significantly enhance a business's access to capital. This transformation involves various legal and financial steps to ensure that AR is recognized as a viable asset. First, businesses must assess the quality and reliability of their receivables. This includes evaluating the creditworthiness of customers and the age of outstanding invoices, as lenders typically prefer receivables that are less than 30 days overdue.

Next, it is essential to establish a legal framework through which the receivables will be used as collateral. This typically requires entering into a security agreement with the lender, specifying the terms under which the AR will be pledged. Such agreements often outline the lender's rights, including what happens in the event of default. It is advisable for businesses to consult legal experts in this area to ensure compliance with relevant laws and to protect their interests.

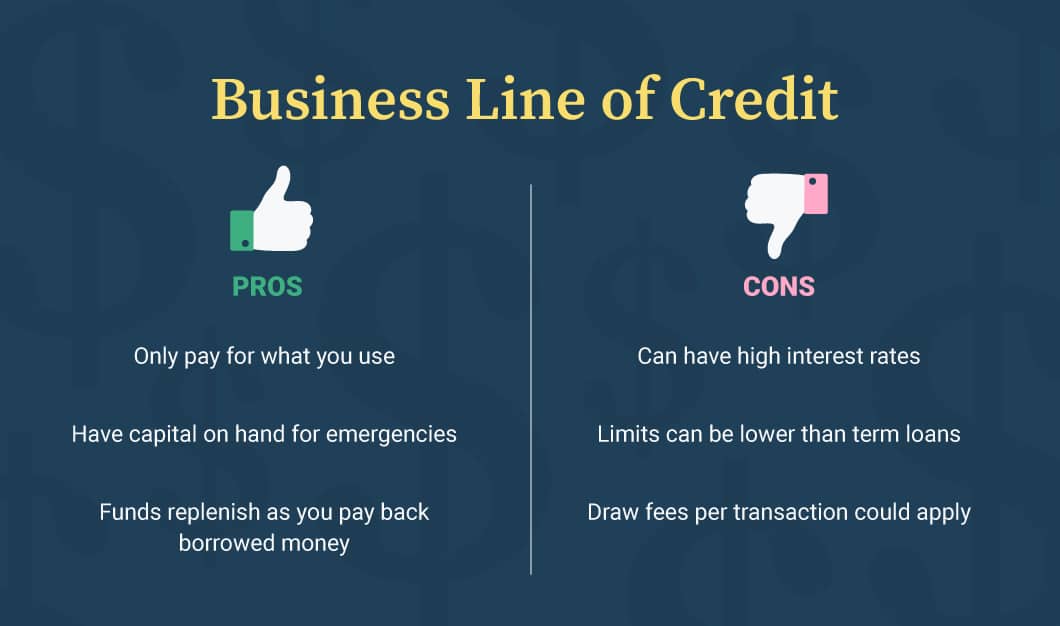

Various types of loans allow businesses to leverage accounts receivable for funding. For instance, factoring involves selling receivables to a third party at a discount in exchange for immediate cash. Alternatively, businesses can opt for a receivables-based line of credit, where lenders provide loans based on the value of outstanding invoices. Both options can provide quick access to funds, although they come with distinct costs and implications for cash flow.

Despite the benefits, using accounts receivable as collateral carries certain risks. Market fluctuations and changes in customer payment behavior can impact the value of receivables, potentially leading to unforeseen circumstances in which the expected loan amounts do not materialize. However, numerous businesses have successfully leveraged their AR for credit, illustrating its effectiveness. Companies that implement good credit management and maintain healthy customer relationships are often able to make this strategy work to their advantage, securing the necessary funds to maintain and grow their operations.

Choosing the Right Lenders for AR-Backed Financing

When considering accounts receivable (AR)-backed financing, the selection of an appropriate lender is paramount. Various financial institutions offer AR-backed loans, including banks, credit unions, and specialized lenders. Each type of lender has unique guidelines, processes, and expertise that can influence the terms and efficiency of your financing experience. Therefore, it is essential to conduct thorough research before making a decision.

One of the first steps in choosing the right lender involves understanding the criteria they utilize for evaluating accounts receivable. Generally, lenders assess the quality of the AR portfolio, including factors such as the aging of receivables, the creditworthiness of customers, and the concentration risk associated with large clients. A lender might be more inclined to provide financing for businesses with well-managed and diversified accounts receivable, demonstrating stability in cash flow. Potential borrowers should compile documentation that portrays the health of their AR, which can improve their chances of receiving favorable terms.

Key questions are crucial when engaging with prospective lenders. Inquire about their experience with AR-backed financing, as this will help gauge their familiarity with your specific industry. Additionally, ask about the lender's funding speed, fees, and repayment terms. It is vital to clarify the lender's expectations regarding your accounts receivable management, especially concerning collection practices and reporting requirements. Lastly, evaluate the lender's support services and willingness to establish a long-term relationship, as ongoing communication can enhance the financing process.

Conclusively, selecting the right lender for AR-backed financing involves careful evaluation and informed decision-making. By understanding the types of lenders available, scrutinizing their evaluation criteria, and asking pertinent questions, businesses can secure a financing solution that aligns with their financial objectives.

Evaluating Your Accounts Receivable: Metrics and KPIs to Consider

When considering leveraging accounts receivable for secured credit, it is essential to evaluate pertinent metrics and Key Performance Indicators (KPIs). These elements provide insights into a company's financial health and creditworthiness, helping businesses make informed decisions regarding their credit strategy.

One of the most critical metrics to assess is Days Sales Outstanding (DSO). DSO measures the average number of days it takes for a company to collect payment after a sale has been made. A lower DSO indicates quicker payment collection, reflecting positively on the efficiency of the accounts receivable process. By regularly calculating DSO, businesses can benchmark their performance against industry standards and implement strategies to improve it, such as optimizing invoicing processes or enhancing customer communication.

Another vital KPI is the aging of receivables, which categorizes outstanding invoices based on how long they have been overdue. This analysis helps identify problematic accounts that may pose a credit risk. Companies can prioritize collections on these overdue receivables and consider adjusting credit limits for high-risk customers. Regular reviews of the aging report can be instrumental in reducing the overall accounts receivable balance and improving liquidity.

Additionally, turnover ratios, particularly the accounts receivable turnover ratio, gauge how effectively a company collects its debts. This ratio compares net credit sales to average accounts receivable during a specific period, indicating how efficiently a business utilizes its receivables. A higher turnover ratio is typically favorable, suggesting effective credit and collection policies. Companies can enhance this metric by refining their credit policies, providing discounts for early payments, or implementing a more rigorous collections process.

In conclusion, monitoring these metrics and KPIs not only helps businesses improve their accounts receivable management but also strengthens their position when seeking secured credit. Accurate data and consistent measurement practices will ultimately lead to a more efficient financial operation and increased creditworthiness.

Best Practices for Managing Accounts Receivable Effectively

Effective management of accounts receivable (AR) is crucial for any business aiming to enhance cash flow and secure credit. Implementing efficient invoicing procedures is one of the foundational steps in this process. Ensuring that invoices are accurate, clear, and sent promptly can facilitate faster payments from customers. It is advisable to establish a standardized invoicing system that delineates payment terms, itemizes services or products provided, and includes payment instructions. This clarity helps prevent misunderstandings that can lead to delays in payment.

In addition to effective invoicing, setting appropriate customer payment terms is essential. Organizations should consider the nature of the business relationship, industry standards, and the financial health of the customer when determining these terms. Offering flexible payment options or discounts for early payments can incentivize timely remittance. Conversely, it is vital to assess the risk of extending credit to new customers or clients meticulously, thereby minimizing potential losses in accounts receivable.

Another key aspect of AR management is implementing follow-up strategies for overdue invoices. Regularly monitoring accounts receivable aging reports allows businesses to identify overdue payments quickly. Engaging in consistent communication with customers regarding outstanding invoices can reinforce payment expectations. A gentle reminder, followed by a stronger follow-up if necessary, can often prompt customers to settle their debts without jeopardizing the business relationship.

Lastly, integrating technology solutions can significantly improve accounts receivable processes. Utilizing AR management software enables businesses to automate invoicing, track payments, and send reminders efficiently. These tools can provide valuable insights into customer payment behaviors and overall AR health, allowing organizations to make data-driven decisions. By adhering to these best practices, businesses can optimize accounts receivable management, thereby strengthening their financial position and improving their capability to secure necessary credit.

Understanding the Risks Involved in AR Financing

Accounts receivable (AR) financing is an appealing option for businesses seeking to secure credit however, like any financial strategy, it is accompanied by inherent risks. One of the primary risks in AR financing is the potential for clients to default on their payments. When businesses rely on their receivables as collateral for loans, the collectability of those receivables directly impacts their ability to repay the borrowed funds. A scenario where a significant customer faces financial difficulties could lead to delays or even uncollectibility, placing the borrowing entity in a precarious financial position.

Another risk arises from the quality of the receivables themselves. If a business has a high proportion of receivables from clients with low credit ratings or a history of late payments, this poses a substantial risk to acquiring financing. Lenders typically assess the creditworthiness of customers whose invoices comprise the collateral, making the establishment of sound credit management practices crucial. To mitigate this risk, businesses should perform diligent credit checks and maintain a balance of receivables among diverse clients to minimize dependency on any single entity.

Moreover, additional risks pertain to changes in market conditions and economic downturns. During such periods, clients may experience cash flow pressures, resulting in extended payment cycles or defaults. Businesses can counter this by enhancing their accounts receivable practices, such as implementing rigorous collections processes and maintaining flexible terms that promote timely payments. Establishing clear communication with customers regarding payment expectations can also foster better relationships, leading to improved collection rates.

In conclusion, while accounts receivable financing offers numerous advantages, businesses must be cognizant of the associated risks. By understanding these challenges and proactively addressing them, organizations can make informed decisions regarding AR-backed financing while safeguarding their financial stability.

Case Studies: Successful Utilization of Accounts Receivable for Secured Credit

Numerous companies across different industries have successfully leveraged their accounts receivable to secure credit, showcasing innovative strategies and revealing valuable insights. For instance, a mid-sized manufacturing company, facing cash flow issues due to delayed customer payments, decided to utilize its accounts receivable for secured financing. By partnering with a factoring company, they sold a portion of their outstanding invoices, which provided immediate cash flow. This allowed them to fulfill supplier obligations and take advantage of bulk purchasing discounts. Ultimately, this strategy increased their profitability and stabilized their operational flow.

Another compelling case involves a retail firm that experienced seasonal fluctuations impacting its cash reserves. Recognizing the potential of their accounts receivable, they opted for an asset-based lending approach. By using their receivables as collateral, they secured a line of credit that provided sufficient liquidity to manage inventory purchases during peak seasons. This strategic move not only alleviated cash constraints but also enhanced their competitive positioning in the market.

A further example can be drawn from a technology startup that faced rapid growth. They recognized that their accounts receivable could be leveraged for securing credit. However, they encountered challenges when their customers' credit histories were less than stellar, complicating the financing process. The startup overcame this by establishing clear communication with lenders and providing detailed financial documentation that highlighted their growth trajectory and revenue predictability. As a result, they successfully secured a loan, which enabled them to invest in research and development, leading to innovation and business expansion.

These case studies illustrate that leveraging accounts receivable for secured credit is not only viable but can also provide significant benefits when implemented with careful planning and execution. The strategies employed by these companies can serve as valuable blueprints for businesses looking to optimize their financial operations.

Frequently Asked Questions (FAQ) About Leveraging Accounts Receivable

When businesses consider leveraging their accounts receivable (AR) for secured credit, they often have numerous questions. One common question is, "How much of my accounts receivable can I use for collateral?" Generally, lenders evaluate the quality and the aging of the receivables. Most financial institutions will typically lend up to 80-90% of the total value of the accounts receivable, depending on factors such as the diversity of the receivables and the creditworthiness of the customers involved. Therefore, the more reliable and diverse the customer base, the higher the percentage you may be able to secure as funding.

Another frequent inquiry pertains to interest rates associated with AR-backed loans. The interest rates can vary significantly depending on a myriad of factors, including your business's credit score, the total value of the receivables, and the lender's own policies. However, it is common to see rates ranging from 6% to 15%. Businesses must also consider additional fees or costs related to the financing option they choose, as these can influence the total financial obligation.

Additionally, businesses often wonder about the duration of payment terms. Typically, AR financing can have terms ranging from a few months to several years, based on the specific arrangement with the lender. It is vital for businesses to understand these terms fully to manage their cash flow effectively and avoid any potential pitfalls associated with short-term financing.

Another area of concern might be the impact of leveraging accounts receivable on customer relationships. Proper communication and transparency with customers can mitigate any concerns, allowing for a smooth process that doesn't disrupt the existing business model. Overall, being well-informed about leveraging accounts receivable is essential for any business looking to expand its financing options.

For You ✨

View All

February 16, 2025

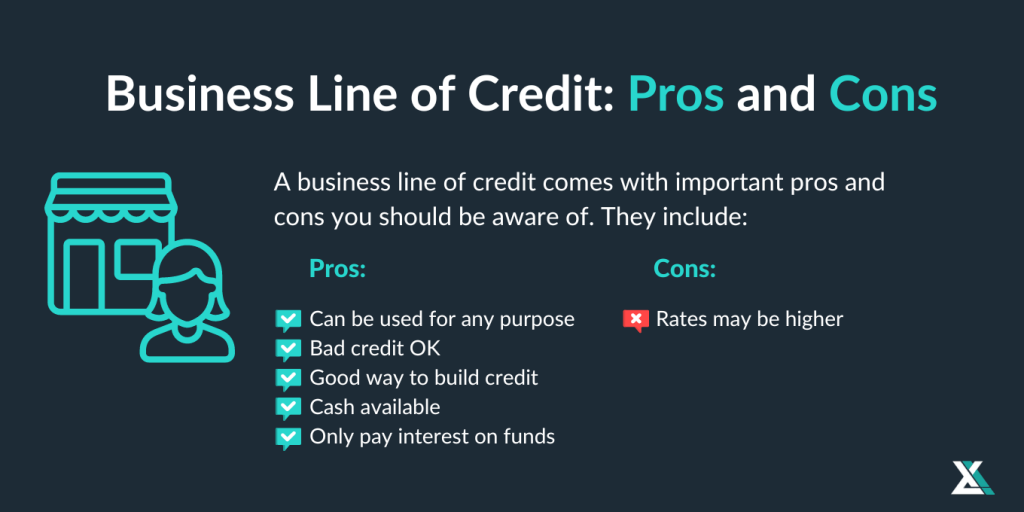

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10