Is a Secured Consolidation Loan Right for You?

Nathan Allen

Photo: Is a Secured Consolidation Loan Right for You?

Understanding Secured Consolidation Loans

A secured consolidation loan is a financial product designed to help borrowers consolidate multiple debts into a single loan while leveraging an asset as collateral. By securing the loan with an asset, such as a home or vehicle, borrowers may benefit from lower interest rates and potentially more favorable repayment terms compared to unsecured loans, which do not require collateral. The secured nature of these loans means that if the borrower defaults, the lender has the right to claim the asset to recover their losses.

The fundamental difference between secured and unsecured loans lies in the requirement of collateral. While a secured loan provides lenders with a safety net, it also places the borrower at risk failure to repay the loan can result in the loss of the asset. This aspect is crucial for individuals considering secured consolidation loans, as it necessitates a thorough evaluation of one's ability to meet the repayment obligations. Typically, secured loans may have larger borrowing limits, making them appealing for those seeking to consolidate high levels of debt.

Individuals often pursue secured consolidation loans for a variety of reasons. The primary motivation is to simplify their financial situation by combining various debts such as credit card balances, medical bills, or personal loans into a single commitment, borrowers can streamline their payments and manage their finances more effectively. Moreover, the potential for reduced interest rates can lead to lower monthly payments, contributing to improved cash flow. It is essential for borrowers to assess their financial standing, the value of the collateral, and current interest rates before committing to this type of loan.

Benefits of Secured Consolidation Loans

Secured consolidation loans offer numerous advantages that can significantly enhance an individual's financial situation. One of the most prominent benefits is the potential for lower interest rates compared to unsecured loans. By leveraging assets, such as a home or vehicle, borrowers can qualify for a secured loan with more favorable terms, making it an enticing option for those looking to reduce their overall debt burden. This lower rate can lead to considerable savings over the loan's lifespan, ultimately allowing individuals to allocate more funds toward other financial goals.

Additionally, secured consolidation loans often feature extended repayment terms. This flexibility can be particularly beneficial for borrowers struggling to manage multiple debt payments, as it allows them to spread out their payments over a longer period. Consequently, this may result in reduced monthly payment amounts, easing financial strain and improving monthly cash flow. As a result, individuals may find themselves in a better position to prioritize essential expenses, such as housing, utilities, and groceries, while still making headway on their consolidation loan.

Another significant advantage of secured consolidation loans is the ability to combine numerous debts into a single manageable payment. This not only simplifies the repayment process but also can help individuals maintain better financial organization. For instance, a borrower consolidating three high-interest credit cards and a personal loan into one secured loan can experience a more streamlined approach to debt management. Furthermore, when managed responsibly, secured consolidation loans can contribute positively to a person’s overall financial health. As individuals successfully repay their loans, their credit scores may improve, creating further opportunities for better financing options in the future.

Risks Associated with Secured Consolidation Loans

Secured consolidation loans can serve as a powerful debt management tool, yet they come with inherent risks that borrowers must carefully consider before proceeding. One of the primary dangers associated with these loans is the potential loss of collateral. Because secured loans are backed by an asset, such as a home or vehicle, failure to meet payment obligations can lead to foreclosure or repossession. This risk emphasizes the importance of a thorough review of one’s financial capabilities prior to committing to such a loan.

Additionally, while consolidation aims to simplify debt repayment, it can inadvertently lead to further financial complications if not managed wisely. Borrowers may find themselves in a cycle of debt if they fail to adjust their spending habits post-consolidation. The allure of having consolidated debts paid off can sometimes result in individuals accumulating new debts on top of the existing loan, ultimately worsening their financial situation. Therefore, it is crucial for borrowers to create and adhere to a budget that prioritizes debt repayment and prevents further borrowing.

Furthermore, the impact on one’s credit score cannot be overlooked. Although consolidating debts may initially boost credit scores by reducing overall credit utilization, the long-term effect can be detrimental if payments are missed or made late. Each missed payment can significantly harm a borrower's credit report and make future loans more expensive or difficult to obtain. Lenders often evaluate credit scores as part of their assessment for new credit, and a lowered score could lead to higher interest rates or denial of applications altogether.

In summary, while secured consolidation loans can offer potential benefits for managing debts, prospective borrowers must weigh these against the associated risks. Understanding and mitigating these risks is essential for ensuring long-term financial stability and success.

Assessing Your Financial Situation

Before considering a secured consolidation loan, it is essential to thoroughly assess your current financial situation. This evaluation serves as a foundation for understanding whether this type of loan aligns with your financial goals and capacity. Begin by analyzing your existing debt levels. Compile a comprehensive list of all outstanding debts, including loans, credit cards, and any other obligations. Calculate the total amount owed and assess the monthly payment requirements associated with each debt. This information will provide you with a clear picture of your current financial burdens.

Next, evaluate your credit score, as it plays a critical role in determining your eligibility for a secured consolidation loan. Obtain a copy of your credit report from a reliable source, and review it for accuracy. Understanding your credit score will help you grasp how lenders perceive your creditworthiness. A higher credit score may lead to better interest rates, ultimately reducing the cost of borrowing in the long term.

Moreover, consider your income stability. Assess your current employment situation and evaluate whether you have a reliable and steady source of income. A consistent income is crucial for meeting monthly repayment obligations associated with a secured consolidation loan. If your income fluctuates significantly, weigh the risks involved with committing to a loan that requires stable financial backing.

As you navigate this self-assessment process, reflect on the following questions: What are your immediate financial goals? Are you seeking to lower your monthly payments, or do you aim to pay off debt more quickly? How would a secured consolidation loan impact your overall financial health? Answering these questions will help you determine if pursuing a secured consolidation loan is the right choice for your unique situation.

Alternatives to Secured Consolidation Loans

When considering debt consolidation, secured consolidation loans are often viewed as a viable option, but several alternatives may better suit individual financial situations. Unsecured personal loans, for instance, allow borrowers to consolidate debt without offering collateral. These loans typically come with higher interest rates than secured loans, primarily due to the increased risk for lenders. However, they can be suitable for individuals who possess strong credit scores and prefer to avoid risking personal assets.

Another alternative is a debt management plan (DMP), which involves working with a credit counseling agency. Through a DMP, individuals can consolidate their debt payments into a single monthly amount, often at reduced interest rates. This option can be particularly beneficial for those who are struggling with unsecured debts, such as credit cards. While a DMP may require a commitment over several years, it contributes positively to financial education and budgeting skills, making it a robust choice for long-term financial health.

Balance transfer credit cards offer yet another alternative for potential debt consolidation. With these cards, individuals can transfer their existing high-interest debts onto a card that features a lower promotional interest rate, often even 0% for a limited time. This option can save borrowers money on interest while allowing them to manage their consolidated debt in a more flexible manner. However, it is essential to understand the terms and conditions, including any balance transfer fees, as well as the impact that high utilization may have on credit scores if one carries a large balance.

In exploring these alternatives to secured consolidation loans, it is crucial for borrowers to consider their unique financial situations, weighing the costs and potential impacts on credit scores. Each option presents distinct advantages and drawbacks, making it essential to conduct thorough research before committing to any debt consolidation strategy.

How to Choose the Right Lender

Selecting a lender for a secured consolidation loan is a critical process that can significantly impact your financial future. It is essential to conduct thorough research to identify a lender that meets your needs while offering favorable terms. Start by examining the interest rates that various lenders offer. Lower interest rates can save you a considerable amount over the life of the loan, so comparing multiple lenders is imperative. Pay attention to whether the rates are fixed or variable, as this can affect your payments in the long run.

Another factor to consider is the fees associated with the loan. Lenders may charge origination fees, closing costs, or prepayment penalties that can substantially increase the overall cost of borrowing. Strive to find a transparent lender that clearly outlines all fees involved. High fees can negate the benefits of a lower interest rate, so take a close look at the total financing costs associated with the consolidation loan.

Equally important is the quality of customer service. A lender should be responsive and available to assist you throughout the borrowing process. Research online reviews or ask for referrals to gauge other customers' experiences with different lenders. A lender’s trustworthiness is crucial ensure that they are reputable and have a history of ethical practices. The lender's compliance with regulations and industry standards can also serve as an indicator of their reliability.

Finally, it is paramount to read the fine print carefully and fully understand all loan terms before committing. This includes the repayment schedule, the implications of late payments, and the potential impact on your credit score. Clarity regarding the terms will help you avoid any unpleasant surprises down the line. By thoroughly evaluating these criteria, you can position yourself to make an informed decision regarding your secured consolidation loan.

Steps to Apply for a Secured Consolidation Loan

Applying for a secured consolidation loan can be a strategic financial decision for individuals seeking to streamline their debt obligations. The process necessitates thorough preparation, and understanding the steps involved is crucial for a successful outcome. Here, we outline a comprehensive guide to help you navigate the application process effectively.

Begin by assessing your financial situation and determining the total debt you intend to consolidate. This figure will help you establish the amount you will need from a secured consolidation loan. Next, gather essential documentation, which typically includes proof of income, a list of your existing debts, your credit report, and any other relevant financial statements. Having comprehensive documentation readily available can significantly enhance your credibility in the eyes of lenders.

The next step involves deciding on the type of collateral you will use to secure the loan. Common forms of collateral include real estate, vehicles, or other valuable assets. It is advisable to thoroughly evaluate the risks associated with using these assets, as failing to repay the loan could result in the loss of collateral. Make sure to identify and gather supporting documents that validate your ownership of the collateral, such as title deeds or bills of sale.

After organizing your documentation and collateral information, approach potential lenders. It is wise to compare offers from multiple financial institutions as terms, interest rates, and approval criteria can greatly vary. Being organized during this phase is key clearly outlining your financial needs and being prepared to discuss your financial history can enhance your chances of securing favorable terms. Finally, after thoroughly reviewing the loan terms and conditions, you are ready to submit your application. Pay close attention to the lender’s requirements throughout the approval process, and remain available for any further inquiries.

Managing Your Loan After Approval

Once your secured consolidation loan is approved, managing it effectively is crucial for ensuring financial stability and achieving long-term goals. The first step in this management process is creating a budget that incorporates your loan repayments. This budget should reflect your monthly income and expenses to clearly identify how much you can allocate toward the loan. By establishing a detailed plan, you can avoid late payments, which not only protect your credit score but also prevent additional fees from accruing.

In addition to budgeting, it is important to track your expenses carefully. Monitoring where your money goes can provide insights into areas where you might cut back, freeing up resources for loan repayments. Utilize budgeting apps or spreadsheets to categorize expenses, making it easier to visualize spending patterns. This practice encourages financial awareness and accountability, ensuring you stay on top of your fiscal responsibilities.

A fundamental principle of managing a secured consolidation loan is to avoid taking on new debts. While it may be tempting to finance new purchases or take out additional loans, doing so can compromise your ability to repay the consolidation loan in full and on time. Focus on living within your means, and redirect any available funds toward your loan payments or savings, fostering a healthier financial future.

Lastly, consider ways to leverage your secured consolidation loan to improve your overall financial health. If the loan has helped to reduce interest rates or monthly payments, the extra financial relief can be invested into savings accounts or emergency funds. Building a strong financial cushion not only supports loan repayment but also enhances overall financial security. By practicing disciplined financial habits and strategically managing the loan, you can progress toward securing a brighter future.

Frequently Asked Questions (FAQ)

Secured consolidation loans can be a beneficial financial tool for many individuals seeking to simplify their debts. However, there are commonly asked questions surrounding these types of loans that are important to address.

What is a secured consolidation loan?

A secured consolidation loan involves borrowing money to pay off multiple debts, using an asset as collateral. This often results in a lower interest rate compared to unsecured loans, making repayments more manageable.

Who is eligible for a secured consolidation loan?

Eligibility typically hinges on the value of the collateral offered, such as a home, vehicle, or other assets. Lenders will also consider the borrower's credit history and income level. Generally, individuals with a reliable source of income and sufficient equity in their assets have a higher chance of approval.

What loan amounts can one expect?

The loan amount for a secured consolidation loan largely depends on the value of the collateral provided. In most cases, lenders will allow borrowing up to a percentage of the asset's value, often ranging from 70% to 90%. The total amount available should be sufficient to cover existing debts.

What are the typical repayment terms?

Repayment terms for secured consolidation loans can vary widely. Borrowers typically find options ranging from 3 to 10 years, depending on the lender and amount borrowed. Shorter terms may lead to higher monthly payments but less overall interest paid over time.

How does a secured consolidation loan affect credit scores?

While taking out a new loan may initially affect your credit score, consolidating debts can lead to a positive long-term impact by reducing overall credit utilization and improving payment history. It is crucial to manage repayments responsibly to sustain credit health.

For You ✨

View All

February 16, 2025

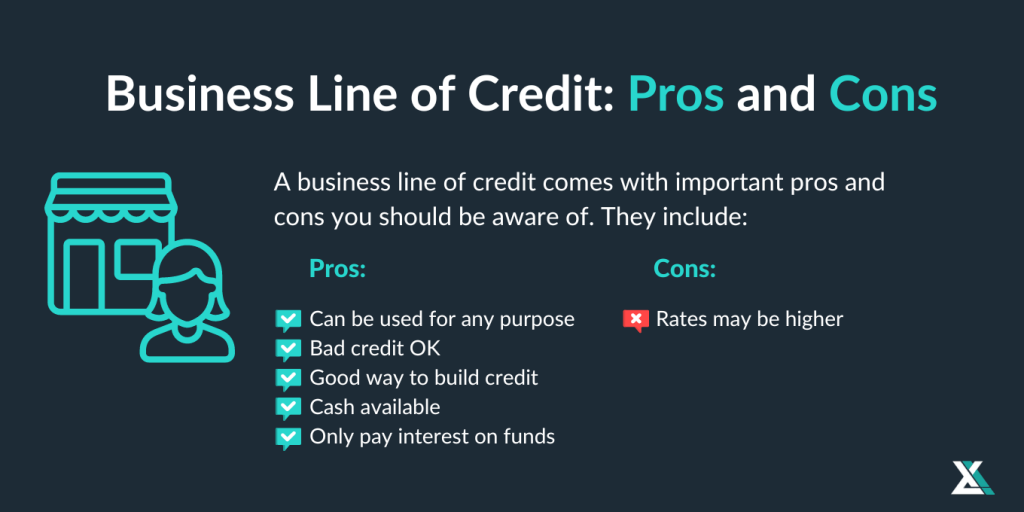

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10