Simplify Your Finances with Secured Debt Consolidation

Nathan Allen

Photo: Simplify Your Finances with Secured Debt Consolidation

Understanding Secured Debt Consolidation

Secured debt consolidation is a financial strategy that involves combining multiple secured debts into a single loan. Unlike unsecured debt, which does not require collateral, secured debts are tied to an asset, such as a home or vehicle. The primary benefit of this approach is the potential to lower overall monthly payments and reduce the interest rates on outstanding debts. By consolidating, individuals can streamline their finances, making it easier to manage their monthly obligations.

One of the most significant differences between secured and unsecured debt consolidation is the nature of the collateral. In secured debt consolidation, the borrower must provide an asset as security against the loan. This can lead to better terms, as lenders are more willing to offer lower interest rates when they have collateral to back their loans. However, it is crucial to recognize the risk involved if the borrower fails to meet the repayment requirements, they may lose the asset used as collateral.

For many individuals, secured debt consolidation can offer several advantages, such as lower interest rates, improved credit scores over time, and the convenience of managing a single monthly payment. For example, a homeowner struggling with credit card debt and personal loans might choose to consolidate those debts into a home equity loan. Doing so can provide relief by converting high-interest debts into a more manageable loan, potentially saving them thousands in interest payments.

However, secured debt consolidation does come with its drawbacks. The primary concern is the risk of losing the collateral. If borrowers are unable to meet their repayment obligations, they may face foreclosure or repossession of the asset. Additionally, while it offers a temporary solution, it is essential to address the underlying issues that led to the accumulation of debt in the first place to prevent recurrence.

The Benefits of Secured Debt Consolidation

Secured debt consolidation offers a range of advantages for individuals seeking to streamline their financial obligations. One of the most significant benefits is the potential for lower interest rates. By using collateral such as a home or vehicle borrowers can often secure loans at rates considerably lower than those associated with unsecured loans or credit cards. This difference can lead to substantial savings over time, particularly for those struggling with high-interest debts.

Additionally, secured debt consolidation can help reduce monthly payments. By consolidating multiple debts into one secured loan, borrowers may find their overall payment amounts decrease, making it easier to manage their finances on a monthly basis. This simplification can provide a sense of relief and focus, allowing individuals to allocate their resources more effectively across their living expenses and savings goals.

Another considerable advantage is the potential for a single, manageable payment. Juggling multiple debts can be overwhelming and stressful, often leading to missed payments and additional fees. However, with secured debt consolidation, managing one payment can streamline budgeting processes and reduce the mental burden associated with handling several creditors. This centralized approach not only simplifies financial management but may also improve overall financial discipline.

Statistical data supports these claims, with various studies indicating high success rates and customer satisfaction among individuals who have pursued secured debt consolidation. Surveys report that a significant percentage of borrowers experience improvement in their credit scores and overall financial health after consolidating their debts. Case studies reflect positive outcomes, showing that many individuals achieve notable reductions in both payment amounts and total debt burden when utilizing secured debt consolidation effectively.

How Secured Debt Consolidation Works

Secured debt consolidation is a systematic approach that allows individuals to combine multiple debts into a single, more manageable loan by using an asset as collateral. This process typically begins by assessing the amounts owed, interest rates, and the nature of existing debts. The primary objective is to reduce monthly payments and streamline financial obligations.

The initial step in secured debt consolidation involves evaluating eligibility criteria. Lenders generally require borrowers to have a stable income, a satisfactory credit history, and equity in a valuable asset, such as a home or a vehicle. These factors help ensure that borrowers can repay the consolidated loan. The asset’s value is crucial, as it affects the amount of funds a borrower can secure. Commonly accepted assets include real estate, savings accounts, and investment properties.

Once eligibility is confirmed, borrowers need to gather necessary documentation. Typical documents required include proof of income, tax returns, a list of debts, and documentation proving ownership of the secured asset. This documentation allows lenders to assess the borrower's financial situation accurately.

After compiling the necessary information, the borrower approaches a lender to discuss loan options. During this phase, the lender evaluates the borrower’s profile and the collateral. If approved, the consolidation loan replaces existing debts, merging them into a single loan with potentially lower interest rates. This offers numerous benefits, including simplified payments and the possibility of reducing overall debt.

As a result, secured debt consolidation typically leads to enhanced financial stability, helping individuals manage their financial commitments more effectively. Understanding the operational mechanics is essential for anyone considering this option, as it empowers them to make informed decisions about their financial future.

Assessing Your Financial Situation

Understanding your financial situation is a critical step before contemplating secured debt consolidation. A comprehensive self-assessment not only provides clarity but also empowers you to make informed decisions. Start by gathering all relevant financial documents, including loan statements, credit card bills, and income records. This foundational information will serve as the basis for your evaluation.

Begin by creating a list of all outstanding debts. This should include the total amount owed, interest rates, and monthly payment amounts. Organizing these details will facilitate a clearer picture of your financial obligations, allowing you to identify which debts are the most burdensome. It is also beneficial to categorize these debts into secured and unsecured forms secured debts typically involve collateral, while unsecured debts do not. Understanding these distinctions is key when considering debt consolidation options.

Next, assess your income sources and monthly expenses. Document official income details, including salaries, bonuses, and other revenue streams. Equally important is tracking your expenses to understand your spending patterns. Utilize budgeting tools or spreadsheets to list both fixed expenses, such as mortgage or rent payments, and variable costs, like grocery or entertainment expenses. This exercise can highlight areas where you can cut back and reallocate funds to debt repayment.

When evaluating your financial status, be cautious of potential pitfalls. Emotional spending and underestimating expenses can lead to a miscalculated assessment. Moreover, avoid making rushed decisions based on short-term relief without considering long-term implications. By approaching this self-assessment with diligence and accuracy, you will be better equipped to understand your financial landscape and the potential benefits of secured debt consolidation.

Choosing the Right Secured Debt Consolidation Option

Secured debt consolidation can be an effective solution for individuals seeking to streamline their financial commitments and potentially lower their interest rates. There are several types of secured debt consolidation loans available, each with unique features that cater to different financial circumstances. Understanding these options can help borrowers make informed decisions.

One common choice is the home equity loan. This type of loan allows homeowners to borrow against the equity built up in their property. It typically comes with competitive interest rates and fixed repayment terms, making it a favorable option for those looking to consolidate high-interest debts. However, because the loan is secured by the home, borrowers must carefully assess their ability to make regular payments to avoid the risk of foreclosure.

Another option is a secured personal loan, which is usually backed by an asset such as a vehicle or savings account. These loans can offer lower interest rates compared to unsecured options, providing significant savings over time. When selecting a secured personal loan, it's essential to consider the loan amount, repayment period, and potential fees, as these factors can influence financial health.

Additionally, lines of credit secured by personal assets, like home equity lines of credit (HELOCs), can provide flexible borrowing solutions. Unlike traditional loans, a HELOC allows borrowers to draw funds as needed, which is particularly beneficial for managing fluctuating expenses. However, this flexibility may lead to overspending if not monitored carefully.

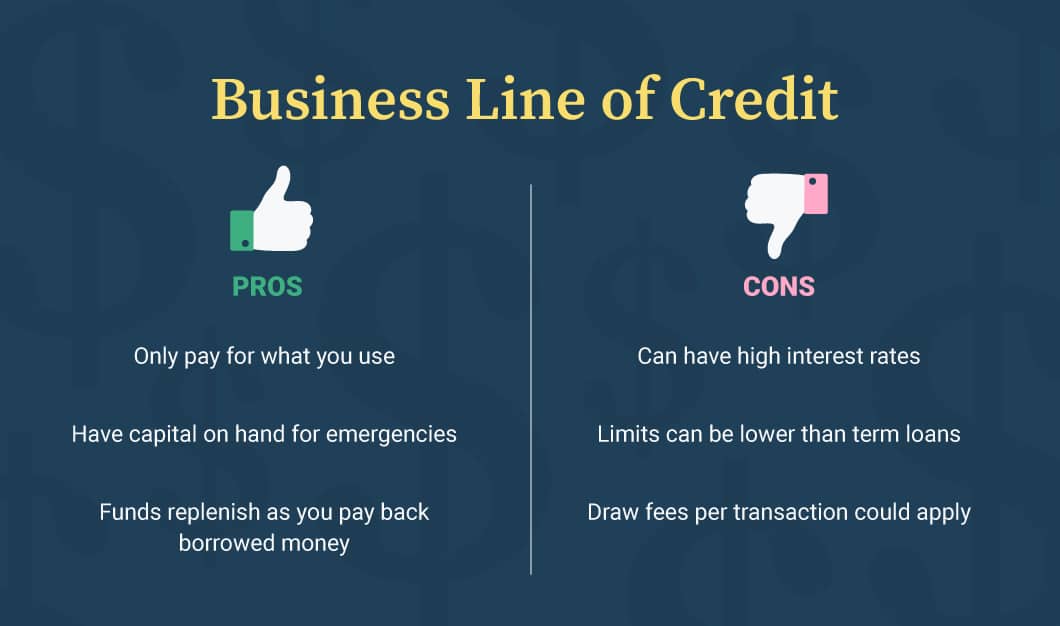

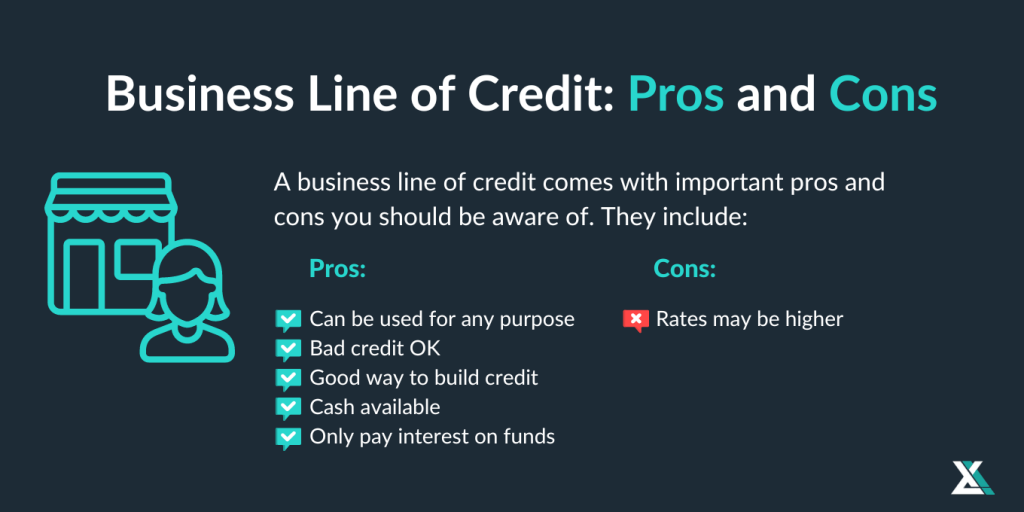

When choosing the best secured debt consolidation option, individuals should evaluate their current financial situation, interest rates, and repayment terms. Creating a comparison table can further illustrate the differences among these options, helping readers visualize their choices effectively. Understanding the pros and cons of each type will empower individuals to select the most suitable option for their specific needs.

Finding a Trustworthy Lender

When considering secured debt consolidation, the selection of a reputable lender is imperative. This process requires diligent research to ensure that the lender not only aligns with your financial goals but also operates with transparency and integrity. Start by utilizing online resources to read reviews and testimonials from previous clients. Websites that consolidate customer feedback can provide insights into the lender's reliability and service quality.

Next, verify the lender's credentials. Look for lenders that are licensed and regulated by appropriate governmental bodies. This step is vital as it helps safeguard you from potential fraud and predatory lending practices. In addition to credentials, be on the lookout for accreditations from recognized organizations, as this recognition often signifies that the lender adheres to ethical lending practices.

Understanding the terms and conditions presented by the lender is another essential aspect of your research. A trustworthy lender will offer clear and concise information regarding interest rates, payment schedules, and any fees associated with consolidation. Ensure that you take the time to read through the fine print, as this could reveal hidden costs that might not be immediately apparent.

When approaching potential lenders, prepare a list of questions that can provide you with critical information. Inquire about their experience with secured debt consolidation, the types of loans they specialize in, and their approach to customer service. You may also want to ask about the lender's process for evaluating your financial situation and how they tailor their services to meet diverse needs.

Ultimately, identifying a trustworthy lender requires thorough research and attentiveness to details. By taking these steps, you can successfully navigate the secured debt consolidation landscape and make informed decisions for your financial future.

Common Mistakes to Avoid

When navigating the process of secured debt consolidation, it is essential to remain vigilant and informed to avoid common pitfalls that can lead to increased financial stress. One of the most significant mistakes individuals often make is not reading the fine print of loan agreements. Many borrowers may overlook crucial details such as hidden fees, variable interest rates, or prepayment penalties that can alter the overall cost of the loan significantly. Thoroughly reviewing the terms of the consolidation loan can help prevent unexpected surprises that could jeopardize financial stability.

Another frequent misstep is misunderstanding the loan terms. Individuals may mistakenly assume that a consolidation loan will immediately improve their credit score or reduce monthly payments without fully grasping how interest rates and loan duration affect overall repayment amounts. It is imperative to conduct thorough research or consult a financial advisor to understand what the loan entails, ensuring that you have a clear picture of how it aligns with your financial goals.

Additionally, borrowing beyond one’s means constitutes a critical error in the debt consolidation process. While it may be tempting to consolidate not just existing debts but also take out extra funds for additional needs, doing so can lead to a cycle of debt that becomes difficult to escape. Individuals should carefully consider their current financial situation and only borrow what is necessary to consolidate existing debts rather than stretching their financial capabilities.

Lastly, failing to create a budget post-consolidation is a common oversight. A structured budget can help manage expenses effectively and ensure that new debts do not accumulate after consolidation. By taking these precautions and avoiding these common mistakes, individuals can navigate the secured debt consolidation process more effectively and tailor it to their financial situation.

Success Stories: Real-Life Examples

Secured debt consolidation has proven to be an effective financial strategy for numerous individuals seeking to regain control of their finances. One notable success story is that of Sarah and John, a couple who initially struggled with overwhelming credit card debt. After experiencing a layoff, they found themselves unable to keep up with high-interest payments, risking bankruptcy. By opting for secured debt consolidation, they were able to combine their outstanding balances into a single loan backed by their home equity. This significantly lowered their interest rate and allowed them to establish a manageable monthly payment plan. Within two years, they had paid off nearly 70% of their debts, allowing them to save for a future home purchase.

Another inspiring example is the story of Mark, a single father who faced financial turmoil after an unexpected medical crisis. With accumulating debt from medical bills and personal loans, Mark felt trapped and lost. He turned to secured debt consolidation as a potential solution. By leveraging his savings and utilizing a home equity loan, he consolidated his debts, reducing his financial burden substantially. This move not only lowered his interest rates but also enabled him to pay off his debts faster. A year later, Mark proudly reported being debt-free, having rebuilt his credit score, allowing him to plan for his children's future education.

Lastly, the Johnson family encountered financial distress after a prolonged job search left them with mounting student loans and credit card debt. They sought professional advice and decided to pursue secured debt consolidation to alleviate their financial strain. Securing a loan against their home enabled them to roll their exceptional debts into one lower-interest loan. The Johnsons were amazed at how quickly they could shift their financial reality. In less than three years, they regained stability, increased their savings, and became advocates for others to consider secured debt solutions. These stories demonstrate how secured debt consolidation can provide viable pathways to financial recovery when managed wisely.

FAQs about Secured Debt Consolidation

Secured debt consolidation is a financial strategy that many consumers consider, and it naturally raises various questions. One frequent inquiry is about how secured debt consolidation affects credit scores. When you consolidate debt using a secured loan, you can potentially improve your credit score over time. Payment history makes up a significant part of your credit score, so consistent, on-time payments can positively influence your score. However, be aware that initially, applying for a new loan may result in a hard inquiry on your credit report, which can cause a slight dip in your score.

Another common question pertains to the types of debt that can be consolidated. Generally, secured debt consolidation can include various debts such as credit card balances, personal loans, and medical bills. However, it is essential to clarify that not all debt types are eligible for consolidation. For instance, student loans may have specific repayment programs that function differently from conventional debt consolidation options.

Concerns about what happens if you default on a secured loan are also prevalent. Defaulting on a secured debt consolidation loan can lead to serious consequences. Since the loan is backed by collateral, such as a home or a vehicle, the lender has the right to seize the collateral to recover the outstanding loan amount. This risk underscores the importance of ensuring that you can meet the payment obligations before pursuing secured debt consolidation. Defaulting not only affects the asset at stake but also has long-lasting impacts on your credit score and overall financial health.

In conclusion, understanding these frequently asked questions can empower individuals in making informed decisions about secured debt consolidation. Gaining clarity on the implications for credit scores, the types of debt that can be consolidated, and the risks of defaulting can enhance your financial approach and lead to successful debt management.

Conclusion and Call to Action

Throughout this article, we have explored the various aspects of secured debt consolidation and its potential benefits for individuals seeking to simplify their financial situations. Secured debt consolidation refers to the process of combining multiple debts into a single loan backed by collateral, typically resulting in lower interest rates and more manageable monthly payments. This approach offers a strategic method for individuals to regain control over their financial lives, making it an advantageous option for those struggling with high-interest debts.

We discussed how secured debt consolidation can lead to significant savings over time through reduced interest costs. Additionally, the process can improve an individual's credit score by ensuring timely payments on the new consolidated loan, potentially leading to better financial opportunities in the future. Moreover, this method simplifies the repayment process, allowing borrowers to focus on a single monthly payment rather than juggling multiple debts. By understanding the implications and requirements of secured debt consolidation, individuals can make informed decisions tailored to their financial needs.

As we conclude, it is essential to emphasize the importance of evaluating all available options before committing to a debt consolidation plan. We encourage readers to explore their secured debt consolidation options and consider consulting with a financial advisor to gain personalized insights based on their unique circumstances. Sharing your experiences in the comments section can also foster a supportive community, allowing others to benefit from your journey. Take charge of your financial health today by considering secured debt consolidation as a viable solution for a brighter financial future.

For You ✨

View All

February 16, 2025

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10