How to Apply for a Business Line of Credit

Nathan Allen

Photo: How to Apply for a Business Line of Credit

Introduction to Business Lines of Credit

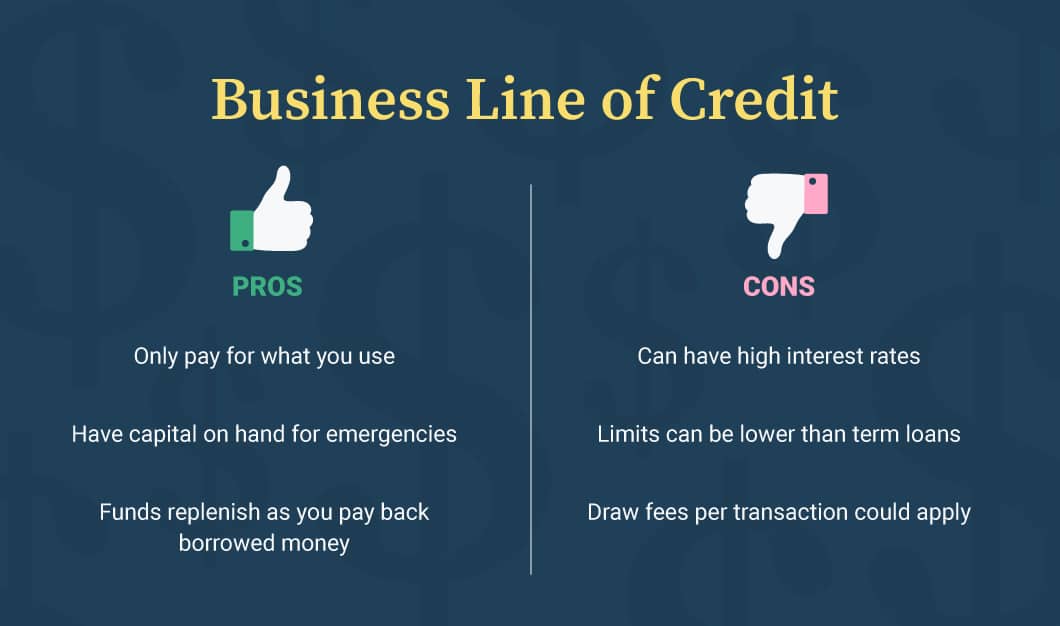

A business line of credit is a financial tool that provides companies with access to funds up to a predetermined limit. Unlike traditional loans, which offer a lump sum that must be repaid over a fixed term, a business line of credit allows owners to withdraw funds as needed. This flexibility makes it an attractive option for managing cash flow, covering unexpected expenses, or financing opportunities as they arise.

The primary purpose of a business line of credit is to provide liquidity to businesses. This financial instrument can help companies navigate seasonal fluctuations in revenue, invest in inventory, or respond to urgent operating costs without the need for applying for a new loan or waiting for approval. By having the ability to tap into an available credit line, businesses can maintain operational stability and seize growth opportunities promptly.

One of the significant advantages of a business line of credit is that interest is only paid on the amount drawn rather than the entire credit limit. This feature makes it a cost-effective alternative for businesses that may not need large amounts of capital immediately but want to have resources available for when the need arises. Moreover, the repayment terms can often be more favorable than those associated with standard loans, allowing for greater financial flexibility.

Understanding the application process for a business line of credit is crucial for business owners who want to leverage this financial resource effectively. By gaining insight into the criteria that lenders evaluate when assessing applications, entrepreneurs can better prepare their businesses for success. Recognizing the benefits and flexibility of a line of credit is the first step in ensuring that businesses have the financial tools necessary to adapt and thrive in a competitive landscape.

Understanding the Types of Business Lines of Credit

Business lines of credit are essential financial tools that provide companies with flexibility in accessing funds when needed. These lines can be categorized into several types, primarily focusing on secured versus unsecured credit, as well as revolving versus non-revolving credit options. Each type serves specific business needs and financial situations.

Secured lines of credit require borrowers to pledge collateral, such as commercial property or inventory. This collateral reduces the lender's risk, often resulting in lower interest rates and more favorable terms. For example, a small business that owns manufacturing equipment may use this asset to secure a line of credit, enabling them to access funds for operational costs or unexpected expenses. Conversely, unsecured lines of credit do not require collateral. While they provide quick access to funds, they typically come with higher interest rates and may require a stronger credit profile. A tech startup might choose an unsecured option to fund initial growth without placing any assets at risk.

Additionally, lines of credit can be classified as revolving or non-revolving. Revolving lines of credit allow businesses to withdraw, repay, and borrow again as needed, similar to a credit card. This can be particularly beneficial for managing cash flow fluctuations, where companies may face seasonal challenges. For instance, a retail business can use a revolving line to stock up on inventory before a busy season and pay it back once sales increase. In contrast, non-revolving lines of credit provide a fixed amount that must be repaid, with no option for borrowing again once the funds are depleted. This may be more suitable for a specific project with a clear budget and timeline, such as a restaurant launching a new menu or undergoing renovations.

By understanding these distinctions, business owners can make informed decisions about which type of credit aligns with their operational needs and financial strategies.

Eligibility Criteria for Business Lines of Credit

When seeking a business line of credit, it is essential to understand the eligibility criteria that lenders typically evaluate. These factors not only provide insight into a business’s financial health but also assist in making informed decisions during the application process.

First and foremost, one of the most critical components is the business credit score. Lenders often utilize this score to assess the creditworthiness of the organization. A strong credit score, usually above 680, can significantly improve the chances of approval and favorable terms. In contrast, a lower score may result in higher interest rates or rejection altogether. Business owners should regularly review their credit reports and work on improving any discrepancies before applying.

Another key factor is the annual revenue of the business. Lenders want to ensure that a company generates sufficient income to support its repayment obligations. Typically, a minimum revenue threshold will be set, which may vary among lending institutions. Declaring accurate and realistic revenue figures can enhance the likelihood of receiving a line of credit.

The time the business has been operational also plays a pivotal role in eligibility assessments. Lenders usually prefer businesses that have been established for at least one to two years. This duration provides enough historical data to evaluate the company’s stability and growth potential. Startups may face more stringent requirements and may consider alternative funding options.

Lastly, financial documentation is a vital requirement. Lenders generally demand detailed financial statements, tax returns, and bank statements to gauge the business's financial situation. Having these documents prepared in advance not only expedites the application process but also instills confidence in the lender regarding the borrower’s financial management.

In summary, understanding these eligibility criteria is essential for business owners looking to apply for a line of credit. By ensuring that they meet the necessary requirements, they can improve their chances of securing the funding needed for business growth.

Preparing Required Documentation

Preparing the necessary documentation is a crucial step in applying for a business line of credit. Properly organized documents will not only streamline the application process but also enhance your credibility with lenders. Key documentation often includes personal and business tax returns, financial statements, a business plan, and cash flow projections.

Personal and business tax returns are essential for lenders to review your financial history. Typically, you will need to provide at least two years of tax returns for both personal and business filings. This information helps lenders assess your ability to manage debt and provides insights into your overall financial health.

Financial statements, including balance sheets and income statements, are critical in illustrating your business's current financial status. These documents should be prepared to reflect your business's performance over the previous 12 months. If your business is new, pro forma financial statements may suffice, indicating projected revenues and expenses based on market research.

A well-crafted business plan is another critical component. It should clearly outline your business model, target market, and growth strategies. Lenders often look for a comprehensive analysis of your business environment and strategic approach, which will enhance the perceived viability of your business. This plan should also encompass details about how you plan to use the line of credit, thus demonstrating your forward-thinking approach.

Lastly, cash flow projections are paramount in assessing your business's ability to repay the credit. Providing projections for the next 12 months can showcase your understanding of cash flow dynamics and your preparedness for managing repayments. It's advisable to present these documents in a clear and professional format, ideally compiled in a binder or a digital folder, making it easy for lenders to review.

The Application Process Explained

Applying for a business line of credit involves several critical steps, each designed to help you obtain the necessary funds while ensuring the lender has a clear understanding of your business's financial health. The initial step is to choose a suitable lender. This can include traditional banks, credit unions, or alternative lending institutions. Researching various lenders' requirements, interest rates, and repayment terms is imperative, as this will influence the overall cost of borrowing and your business's financial flexibility.

Once you have selected a lender, the next step is to gather the required documentation. Typically, lenders will require financial statements, tax returns, and a solid business plan that outlines how the funds will be utilized. Preparing these documents in advance can help streamline the application process and demonstrate your organization and readiness to access credit.

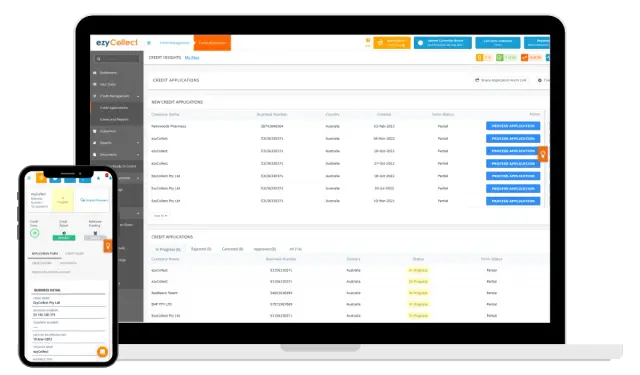

With your documents ready, you can proceed to submit your application. This is often done online, where you will fill out a detailed form containing personal and business information. Ensuring that all information is accurate and complete will reduce the likelihood of delays or application rejection. After submitting your application, the waiting period begins. During this evaluation period, the lender will conduct a thorough review of your financial reports and credit history. Be prepared to answer follow-up questions or provide additional documentation at this stage.

Throughout this process, avoid common pitfalls such as neglecting to understand the terms of the line of credit or applying for multiple lines with different lenders simultaneously, which may negatively affect your credit score. Transparency in your financial practices and a well-prepared business plan not only facilitate smooth processing but also improve your chances of approval. By following these steps diligently, you can navigate the application process with greater confidence.

Building a Strong Business Credit Profile

Establishing a robust business credit profile is essential for any entrepreneur seeking to secure a business line of credit. A strong credit profile not only enhances your creditworthiness but also increases your chances of obtaining favorable financing terms. Lenders evaluate various factors within your business credit profile, including your payment history, credit utilization, and overall financial stability, making it crucial to focus on these elements consistently.

One of the most effective strategies for bolstering your business credit score is to make timely payments on all invoices and bills. Late payments can have a significant adverse effect on your credit score, which may hinder your ability to access financing options in the future. Set up reminders or automate payments where possible to ensure you never miss a due date. Furthermore, managing existing debts wisely is essential keeping your credit card balances low relative to their limits can positively impact your credit utilization ratio, which is a key metric lenders assess.

Additionally, it is advisable to regularly review your credit reports for inaccuracies or discrepancies. Errors can lead to unwarranted credit score reductions and tarnish your business's credibility. If you find any inaccuracies, promptly report them to the credit reporting agency to ensure that your profile accurately reflects your financial history.

Seeking credit responsibly is another vital aspect of building a strong business credit profile. While it may be tempting to apply for multiple lines of credit simultaneously, doing so can signal risk to lenders. Instead, focus on establishing a modest number of credit accounts, using them responsibly, and maintaining a healthy payment history. Over time, these practices will contribute to a solid credit score, enhancing your eligibility and terms when applying for a business line of credit.

Comparing Lenders: Finding the Right Fit

When seeking a business line of credit, it is essential to explore various lenders to identify the most suitable option for your financial needs. Not all lenders offer the same terms and conditions, making thorough research and comparison crucial for making an informed decision. One of the first factors to evaluate is the interest rate associated with the line of credit. Different lenders may have differing annual percentage rates (APRs), which directly impact the cost of borrowing. It is advisable to compare not only the rates but also the mechanisms for rate adjustments, as variable rates can lead to fluctuating repayment amounts.

Another critical consideration is the repayment terms. Lenders may provide varied repayment periods, grace periods, and conditions for repayment, which can affect your business's cash flow management. Understanding whether you face short-term demands or can accommodate a longer term will help streamline your selection process. Furthermore, be aware of any additional fees, such as origination fees, maintenance fees, or prepayment penalties, which may not be evident at first glance but can accumulate significantly over time.

Customer service is another pivotal factor in choosing a lender. Establishing a line of credit often involves ongoing interactions with the lender, making accessible and responsive support a necessity. Look for lenders with strong reputations in customer service, which can often be gauged by online reviews and ratings. Engage with potential lenders by asking pertinent questions, such as how they handle customer inquiries, their availability for assistance, and their processes in case of payment difficulties. Customer feedback can provide valuable insights into what you can expect from the lender throughout your credit journey.

By approaching the selection of a business line of credit systematically and thoroughly, you can find a lender that not only meets your financial needs but also aligns with your business values and management style.

Managing Your Business Line of Credit Wisely

Once a business has successfully obtained a line of credit, the focus shifts to management strategies that maximize its benefits while minimizing potential pitfalls. Effective management of a business line of credit is essential for ensuring long-term financial health. It is crucial to adopt practices that avoid excessive debt while fostering growth opportunities.

One of the primary strategies for managing a business line of credit is to minimize interest costs through timely repayments. Interest can accumulate quickly, especially if the drawn amounts are significant. Therefore, it is advisable to pay off the drawn balance as soon as possible. This is particularly pertinent when the business's cash flow allows for such payments. Businesses should monitor their cash flow closely to identify optimal times for repayment, thereby reducing interest liabilities.

Timing is another important aspect to consider. Instead of using the credit line immediately, a business should evaluate its current financial position and determine whether it truly requires the funds. Utilizing a line of credit as soon as it is available might lead to unnecessary borrowing. It can be more prudent to draw on the credit only when there is a clear need, such as unexpected expenses or investment opportunities that can yield future benefits.

Moreover, businesses should consider using their credit line strategically to facilitate growth. This can involve financing short-term projects, capitalizing on bulk buying opportunities, or investing in marketing campaigns. By positioning the line of credit as a resource for strategic initiatives, rather than a fallback option during tough times, businesses can reinforce their financial stability and support long-term growth.

In summary, managing a business line of credit wisely necessitates careful consideration of repayment practices, timing of draws, and strategic utilisation for growth. By adhering to these principles, businesses can harness the full potential of their credit lines, ensuring that they serve as instruments conducive to long-term success.

Frequently Asked Questions (FAQ)

When navigating the world of business finance, particularly business lines of credit, several questions often arise. Understanding these queries can empower business owners to make informed decisions.

One common concern is what to do if your application for a business line of credit is declined. If faced with rejection, it’s paramount to assess the reasons behind it. Lenders typically consider factors such as credit score, revenue, and overall financial health. By obtaining your credit report, you can identify areas that may need improvement, and subsequently work towards enhancing your credit profile. Furthermore, you may want to consider applying for a secured line of credit, which involves offering collateral to reduce risk for the lender.

Another frequent query pertains to utilizing a line of credit during seasonal fluctuations. A business line of credit serves as a flexible financial resource that can be particularly advantageous during periods of inconsistent cash flow. For instance, if your business experiences a seasonal downturn, you can draw on the line of credit to cover essential expenses, ensuring operational continuity. Conversely, during peak seasons, you can repay the borrowed amount, thus maintaining a healthy credit utilization rate and fostering a positive relationship with your lender.

Lastly, many entrepreneurs ask about the differences between a business line of credit and a traditional loan. While both provide monetary support, they function differently. A traditional loan offers a lump sum amount that is repaid over time with fixed payments, whereas a line of credit provides access to funds up to a predetermined limit, allowing businesses to withdraw only what they need, when they need it. This flexibility can be particularly beneficial for managing cash flow and meeting unexpected expenses.

For You ✨

View All

February 15, 2025

Streamlined Online Applications for Business CreditExplore efficient online application processes for business lines of credit. Get funded faster with our expert tips!

Nathan Allen

February 14, 2025

Simplify Your Finances with Secured Debt ConsolidationLearn how secured debt consolidation can streamline your payments and reduce interest rates. Take control today!

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 16, 2025

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 21, 2025

Secured Loans Against Your House: What to KnowUnderstand the implications of securing a loan against your house. Make informed decisions to leverage your home equity.

Nathan Allen

February 16, 2025

Best Secured Loans for Debt Consolidation in 2025Find the top secured loans for consolidating debt this year. Compare options to choose the best fit for your needs.

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10