Benefits of a Secured Debt Consolidation Loan

Nathan Allen

Photo: Benefits of a Secured Debt Consolidation Loan

Understanding Secured Debt Consolidation Loans

Secured debt consolidation loans represent a financial tool designed to assist individuals in managing multiple debts by combining them into a single loan. This type of loan requires collateral, which can include assets such as a home or vehicle, to back the borrowed amount. In essence, borrowers agree to pledge their collateral against the loan, thereby reducing the lender's risk. When an individual consolidates their debts using a secured loan, they often experience a lower interest rate than they may encounter with unsecured debt options.

The mechanics of secured debt consolidation involve taking out a new loan, often larger than the combined total of the existing debts, specifically to pay off these debts. This process simplifies finances, as individuals are left with a single monthly payment rather than juggling multiple payments with varying due dates. Common types of secured loans include home equity loans, where homeowners leverage the equity in their property, and secured personal loans which may use savings accounts or other assets as collateral.

Individuals facing high-interest credit card debts or multiple unsecured loans tend to benefit the most from secured debt consolidation loans. This is particularly advantageous for those who have substantial equity in their homes and are seeking a lower interest rate overall. By consolidating debt in this manner, borrowers not only streamline their financial obligations but can also potentially improve their credit scores over time by making consistent payments towards the secured debt.

In summary, secured debt consolidation loans serve a critical purpose in personal finance management, offering borrowers a strategic approach to reduce debt burdens and foster better control over financial health.

Advantages of Secured Debt Consolidation Loans

Secured debt consolidation loans offer several key advantages that make them an appealing option for borrowers aiming to manage their financial obligations more effectively. One of the primary benefits is the lower interest rates associated with these loans. Unlike unsecured loans, which typically come with higher interest costs due to the absence of collateral, secured loans allow lenders to offer more competitive rates. As a result, borrowers can save significantly on interest payments over the life of the loan, which can facilitate a quicker route to debt relief.

Another major advantage is the potential for improving one’s credit score. When a borrower consolidates multiple debts into a single secured loan, there is often a reduction in credit utilization rates and an improved payment history, as long as payments are made on time. Over time, these factors contribute positively to one’s credit profile. For example, if a borrower has high credit card balances and consolidates them into a secured loan with lower payments, they may refrain from maxing out credit lines, thus enhancing their creditworthiness.

Simplified monthly payments also form a crucial benefit of secured debt consolidation loans. Juggling multiple due dates and varying payment amounts can be overwhelming and confusing for borrowers. By consolidating debts, individuals can streamline their monthly obligations into one manageable payment, making budgeting easier and reducing the risk of missed payments, which can lead to late fees or additional interest accrual. For instance, replacing several credit card payments with a single secured loan payment allows borrowers to focus their financial efforts more effectively, fostering a sense of control over their financial future.

In conclusion, secured debt consolidation loans present distinct advantages such as lower interest rates, the potential for improving credit scores, and simplified payment structures, all of which can significantly enhance a borrower's financial management strategy.

Who Should Consider Secured Debt Consolidation?

Secured debt consolidation loans can be an effective financial solution for various individuals depending on their unique circumstances. Those who find themselves with significant debt burdens, often from multiple creditors, may particularly benefit from this type of financial strategy. When a person has accrued overwhelming balances across several accounts, the confusion and stress of managing multiple payments can be daunting. A secured debt consolidation loan simplifies this process, consolidating various debts into one manageable payment. This streamlining can prompt individuals to focus better on debt repayment and potentially improve their credit score over time.

Another demographic that should consider secured debt consolidation includes individuals who possess collateral assets, such as a home or a vehicle. By using these assets to secure a loan, borrowers often access lower interest rates compared to unsecured alternatives. This makes secured debt loans an attractive option for homeowners or individuals with significant equity in their property. For example, a homeowner with high credit card debt could leverage their home equity to pay off the credit cards, thereby reducing their overall interest costs and simplifying their payment structure.

Individuals struggling with poor credit histories may also find secured debt consolidation advantageous. Despite lower credit scores, the use of collateral to secure a loan can open avenues for acquiring financing options that might otherwise be unavailable. Implementation of this strategy often leads to a more manageable repayment process. An illustrative case involves a young professional overwhelmed by student loans and credit debt by utilizing their vehicle as collateral, they were able to secure a lower-interest consolidation loan that ultimately eased their financial burden. This showcases how various demographics can benefit significantly from secured debt consolidation tailored to their specific needs.

Risks Associated with Secured Debt Consolidation Loans

Secured debt consolidation loans can provide significant financial relief by combining multiple debts into one manageable payment. However, it is essential to recognize and understand the potential risks associated with this financing option. One of the primary concerns is the use of personal assets, such as a home or vehicle, as collateral. In cases where borrowers fail to meet their repayment obligations, they risk losing these valuable assets through foreclosure or repossession.

Borrowers should ensure they are keenly aware of their financial situation and ability to make consistent loan payments before proceeding with a secured debt consolidation loan. While these loans can lead to lower interest rates and more manageable payments, the stakes are considerably higher. If a borrower encounters unforeseen financial difficulties such as job loss or unexpected medical expenses the repercussions can be severe, leaving them facing the loss of their property.

Moreover, secured loans may not be a suitable choice for everyone. Individuals with unstable income or those who anticipate future financial challenges may find themselves in a precarious situation. It is prudent for prospective borrowers to explore alternative debt management strategies before committing to a secured loan. Options such as credit counseling or debt management plans can sometimes offer more flexible solutions without the risk of losing essential assets.

Furthermore, it is essential to conduct thorough research and comprehend the terms and conditions of any secured loan agreement. Understanding fees, penalties, and the impact on credit scores is vital for making an informed decision. Before proceeding with a secured debt consolidation loan, individuals should evaluate their financial health and seek professional advice if needed, ensuring that this option aligns with their long-term financial goals.

Steps to Obtain a Secured Debt Consolidation Loan

Obtaining a secured debt consolidation loan can be a strategic move for individuals seeking to manage multiple debts more effectively. The process begins with a thorough assessment of your financial situation. Take the time to evaluate your current debts, total outstanding balances, interest rates, and monthly payments. This will provide a clear picture of what you owe and help you determine how much you will need to borrow through the consolidation loan.

Once you have a solid understanding of your financial landscape, the next step is to research potential lenders. Not all lenders offer the same terms, and it is essential to find one that fits your needs. Start by exploring banks, credit unions, and online lending platforms. Reading reviews and checking the reputation of each lender can also be beneficial in identifying reliable lending sources.

After narrowing down potential lenders, it is time to compare loan options. Look for loans that have attractive interest rates and terms. Remember that secured debt consolidation loans leverage your collateral, which could make them more accessible. However, it’s crucial to read the fine print focus on factors such as fees, repayment periods, and whether the loans include any prepayment penalties.

Gathering the necessary documentation is a critical next step. Commonly required documents may include proof of income, credit reports, and details about existing debts, such as account statements. Having all required paperwork organized will facilitate a smoother application process.

Finally, familiarize yourself with the repayment terms offered by the lender. Understanding your payment schedule and any applicable interest charges will ensure that you remain compliant throughout the loan duration. By diligently following these steps, you can simplify your application for a secured debt consolidation loan and enhance your financial stability.

How Secured Debt Consolidation Can Impact Your Credit Score

Secured debt consolidation can significantly influence a borrower's credit score, primarily through the improvement of critical factors such as credit utilization ratios and payment history. When an individual consolidates multiple debts into a single secured loan, it often results in an immediate reduction of outstanding balances. This reduction can lead to a notable decrease in the credit utilization ratio, which is a vital component of credit scoring models. By lowering the percentage of available credit being utilized, borrowers may see an uptick in their credit scores.

Additionally, consolidating debts into a secured loan simplifies the payment process. Instead of managing multiple payments with different due dates and amounts, borrowers now have a single payment to focus on. This streamlined approach helps in fostering consistent payment habits, therefore reinforcing positive payment history, one of the most crucial determinants of credit scoring. Making timely payments on a secured debt consolidation loan can propagate a positive trend that ultimately reflects positively on a credit report.

However, it is essential to acknowledge that the impact of secured debt consolidation on credit scores is not solely determined by consolidating debts. Borrowers must also maintain responsible payment habits post-consolidation. Falling behind on a secured loan payment can have adverse effects, potentially reversing any gains made in credit score due to the consolidation effort. It is also important for borrowers to avoid accumulating more debt during this phase, as increased credit utilization from new debts can negate the advantages of the consolidation.

In conclusion, secured debt consolidation can potentially enhance a borrower's credit score through improved credit utilization ratios and established positive payment histories, provided they manage their payments diligently and avoid further debt accumulation.

Alternatives to Secured Debt Consolidation Loans

When exploring debt consolidation options, secured debt consolidation loans may not always be the best fit for everyone. Several alternatives provide varied structures, benefits, and drawbacks. Understanding these alternatives is crucial for making informed financial decisions.

One common alternative is unsecured personal loans. Unlike secured loans, which require collateral, unsecured personal loans rely solely on the borrower’s creditworthiness. This option can be beneficial for individuals who do not wish to risk their assets. However, the interest rates may be higher, particularly for borrowers with lower credit scores. It is essential to evaluate not only the rates but also the repayment terms to ensure the loan aligns with your financial goals.

Another viable choice is balance transfer credit cards. These cards allow borrowers to transfer existing high-interest debts onto a new card with a lower introductory rate, often as low as 0% for a limited period. While this can result in significant savings, it is important to read the fine print carefully, as rates may spike after the promotional period, potentially leading to increased debt if not managed properly. The success of this approach heavily depends on timely repayment and restraint from accumulating additional charges.

Additionally, credit counseling services offer a structured approach to managing debt. These services can provide valuable financial education, budgeting assistance, and negotiation with creditors for lower payments or interest rates. However, some may charge fees for their services, and individuals must be aware of potential scams in the industry.

Overall, each of these alternatives presents unique advantages and disadvantages. It is crucial for individuals to assess their personal financial situations, considering aspects such as credit history, current debts, and long-term goals before deciding on the most appropriate debt consolidation strategy.

Real-Life Success Stories of Secured Debt Consolidation

Secured debt consolidation loans have proven to be a lifeline for many individuals grappling with overwhelming debt. Consider the case of Sarah, a recent college graduate who found herself burdened with various student loans and credit card debt totaling over $40,000. Initially, she struggled to keep up with multiple payments, which only exacerbated her financial strain. After researching her options, Sarah opted for a secured debt consolidation loan, leveraging her car as collateral. This decision afforded her a lower interest rate and a single monthly payment, simplifying her financial obligations.

Within just a year, Sarah's financial landscape had transformed. She successfully paid off her high-interest debts, significantly reducing her monthly payment amount. The structured repayment plan provided her with the discipline needed to budget effectively. Sarah discovered that consolidating her debts not only enhanced her credit score but allowed her to save money in the long term. The relief of being able to allocate funds toward her savings goals and enjoy a more manageable financial situation has been life-changing.

Similarly, John, a small business owner, faced crippling debt due to unexpected business expenses that arose during a slow season. With his personal and business finances intertwined, John took the bold step of obtaining a secured debt consolidation loan against his home. This strategic move allowed him to consolidate $60,000 in debt into a lower-interest loan, which reduced his monthly payments significantly.

Having regained control over his finances, John was able to focus on revitalizing his business, implementing strategies that ultimately led to increased revenue. This success story highlights the potential of secured debt consolidation loans, illustrating how individuals can not only manage their debts effectively but also pave the way for financial recovery and stability.

FAQs About Secured Debt Consolidation Loans

Secured debt consolidation loans can be an effective financial solution for individuals looking to manage multiple debts. Here, we address some common questions regarding these loans to provide clearer insights into their workings.

What are the eligibility requirements for secured debt consolidation loans?

Eligibility for secured debt consolidation loans typically includes having a stable income, a decent credit score, and available collateral, which could be in the form of a home, vehicle, or other valuable assets. Lenders assess the borrower's financial stability and the value of the collateral before approving the loan. Meeting these criteria is essential for securing favorable loan terms and interest rates.

What is the usual duration of secured debt consolidation loans?

The duration of secured debt consolidation loans can vary significantly based on the lender and the amount borrowed. Generally, these loans can range from three to ten years. However, longer repayment terms may be available depending on the outstanding debts and the borrower's financial situation. It is important to consider the ramifications of a longer loan term, as it can lead to paying more interest over time.

Are there potential fees associated with secured debt consolidation loans?

When considering secured debt consolidation loans, borrowers should be aware of potential fees. These may include origination fees, appraisal fees for the collateral, and possible prepayment penalties. Reading the loan agreement carefully before signing is crucial, as it helps in understanding the total cost of borrowing.

What misunderstandings arise regarding collateral in secured debt consolidation loans?

A common misconception is that the collateral used for secured debt consolidation loans is not at risk. However, if the borrower fails to meet their repayment obligations, lenders have the right to seize the collateral. This underscores the importance of evaluating one's ability to repay the loan before committing to it.

These FAQs provide valuable information, enabling potential borrowers to make informed decisions about secured debt consolidation loans.

Conclusion: Making an Informed Decision on Secured Debt Consolidation Loans

In reviewing the benefits and risks of secured debt consolidation loans, it is essential to understand how these financial tools can effectively aid in managing your debts. Secured debt consolidation loans often provide lower interest rates compared to unsecured alternatives, making them an attractive option for individuals seeking to combine multiple debts into a single, more manageable payment. This can simplify finances, potentially reduce monthly payments, and help streamline budgeting. Furthermore, collateral backing these loans may assist borrowers in obtaining larger loan amounts, which can be used to pay off higher-interest debt more efficiently.

However, it is vital to consider the risks involved with secured debt consolidation loans. By offering collateral, borrowers face the potential loss of their assets, such as their home or car, in the event they default on the loan. Additionally, while consolidation may provide short-term relief, it does not address the underlying financial behaviors that may have led to the debt accumulation in the first place. Ensuring that you have a solid plan for managing expenses and avoiding future debt is critical when considering this financial strategy.

As you consider secured debt consolidation loans, it is essential to evaluate your financial situation carefully. Assess your income, expenses, and other debts to determine if this option aligns with your goals. Seeking professional advice can provide customized insights tailored to your circumstances, helping you make a well-informed decision. If you have experiences to share or questions regarding secured debt consolidation loans, feel free to leave a comment. Additionally, we encourage you to explore the resources provided in this article to further enhance your understanding of debt consolidation and its implications in your financial journey.

For You ✨

View All

February 16, 2025

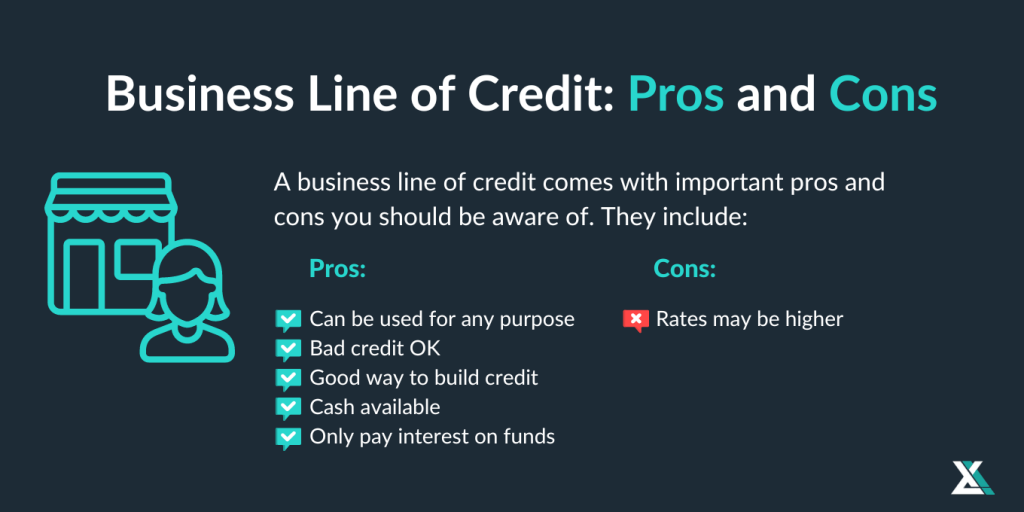

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10