An Overview of Senior Secured Loans for Investors

Nathan Allen

Photo: An Overview of Senior Secured Loans for Investors

Introduction to Senior Secured Loans

Senior secured loans represent a specific category of debt financing where loans are secured by collateral. Typically, this collateral might include assets such as real estate, machinery, or inventory. Investors favor these loans largely due to their positioning in the capital structure. In the event of a borrower default, senior secured loans generally afford investors a higher recovery rate compared to unsecured loans, which lack specific collateral backing.

One defining characteristic of senior secured loans is the priority of repayment in the event of bankruptcy. They take precedence over lower-ranking debts, allowing holders to recoup their investments more effectively. This structured hierarchy in repayment makes them an attractive option for investors seeking stability and security in their portfolios. Additionally, their floating interest rates can lead to favorable returns, particularly in a rising interest environment.

Unlike traditional loans or unsecured debt instruments, senior secured loans often involve private companies and leveraged borrowers. The lending process typically requires extensive due diligence, as investors must evaluate the quality of the underlying collateral and the borrower's financial health. While this level of scrutiny can be time-consuming, it ultimately helps in assessing risk and enhancing the potential returns.

Furthermore, senior secured loans often feature less price volatility than other investment types, making them a suitable choice for risk-averse investors. As a hybrid asset class, they combine elements of fixed income and equity, providing diverse opportunities for yield enhancement. Their unique risk-return profile appeals to institutional investors and private equity firms seeking to tap into the growth potential of various markets without exposing themselves to excessive risk.

The Mechanics of Senior Secured Loans

Senior secured loans are a pivotal element of the corporate lending landscape, characterized by their prioritization in repayment and backed by collateral. The structure of these loans is designed to provide lenders with a significant level of security. In essence, senior secured loans are debt instruments that are secured by specific assets of a borrower, which act as collateral against the borrowed amount. This collateralization plays a crucial role in the risk assessment process for lenders and enables investors to recover their capital more readily in the event of borrower insolvency.

From a legal standpoint, senior secured loans are governed by specific contractual agreements that delineate the rights of the lenders regarding the collateral. These agreements dictate the terms of repayment, the interest rates, and the priority of claims in the unfortunate scenario of bankruptcy. In this context, secured lenders typically have the first claim on the available assets, which positions them favorably compared to unsecured creditors. This priority ensures that, should a borrower face financial distress, senior secured lenders are more likely to recuperate their investments.

Additionally, financial institutions categorize senior secured loans as less risky compared to other forms of financing, mainly due to the backing of tangible or intangible assets. This perceived reduced risk translates into lower interest rates than those associated with unsecured loans. The mechanics of senior secured loans also encompass specific covenants that borrowers must adhere to, aimed at safeguarding the lender's investment and ensuring ongoing disclosure about the borrower's financial status. Consequently, these comprehensive frameworks surrounding senior secured loans foster a more stable lending environment, appealing to investors seeking security and reliable returns.

Benefits of Investing in Senior Secured Loans

Investing in senior secured loans presents several advantages, making this asset class particularly appealing to investors. One of the primary benefits is the attractive yield potential. Senior secured loans often provide higher interest rates compared to traditional fixed-income securities like Treasury bonds or corporate bonds. This increased yield is primarily due to the higher risk associated with lending to borrowers who may not qualify for standard bank loans. Given the current low-interest-rate environment in many economies, securing robust yields through these loans can significantly enhance an investor's overall return profile.

Another notable advantage is risk mitigation. Senior secured loans hold a priority claim over the assets of a borrower in the event of liquidation. This means that if a company faces financial distress and its assets are sold, senior secured lenders will be repaid before other creditors. This hierarchical structure reduces the potential losses associated with defaults, making senior secured loans a comparatively safer investment option during turbulent market conditions. The security of such loans becomes particularly valuable in an economic downturn, where the risks of defaults increase.

Moreover, investing in senior secured loans offers effective portfolio diversification. Incorporating this asset class can enhance the risk-return profile of an investor's portfolio. Senior secured loans tend to demonstrate low correlation with traditional equity markets, thus providing a buffer against market volatility. This characteristic allows investors to balance risk while benefiting from the income generated by the loans. Furthermore, as the economic landscape continues to shift, senior secured loans can serve as a viable option to withstand various financial climates, providing flexibility in investment strategy.

Risks Associated with Senior Secured Loans

Investing in senior secured loans can present certain risks that potential investors should be aware of to make informed decisions. One of the primary risks is default risk. This occurs when the borrowing entity fails to meet its debt obligations, resulting in a loss for the investor. Although senior secured loans are backed by collateral, the value of that collateral may not fully cover the amount owed, particularly during economic downturns when asset values can fluctuate. Proper due diligence and assessing the borrower's creditworthiness are essential steps in mitigating default risk.

Another significant risk involved in senior secured loans is interest rate risk. Changes in market interest rates can negatively affect the value of existing loans. For instance, if interest rates rise, new loans may offer higher returns, making existing loans less attractive unless they too are adjusted. This can lead to a decrease in the market value of the senior secured loans. Investors can manage interest rate risk by diversifying their portfolios with loans that have varied maturities and being cautious about the economic climate when entering new investments.

Market volatility also plays a crucial role in the performance of senior secured loans. Economic instability, changes in government policies, or unexpected global events can lead to a significant fluctuation in market conditions, impacting the demand for loans and their corresponding yields. Investors can reduce exposure to market volatility by investing in a diversified array of secured loans in varying sectors and regions. Additionally, using hedging strategies, such as interest rate swaps, could provide protection against adverse price movements in the securities market.

Market Trends and Performance Analysis

The market for senior secured loans has demonstrated notable resilience in recent years, characterized by a structured approach to offering debt security to both lenders and borrowers. In 2023, the trend has shifted towards a cautious yet optimistic outlook, as economic recovery bolsters investor confidence. Analysts have observed a steady demand for these loans, primarily driven by corporate refinancing activities, as companies seek to optimize their capital structures amidst fluctuating interest rates.

Performance metrics indicate that senior secured loans have continued to outperform other fixed-income instruments, offering attractive yields in a low-interest-rate environment. According to recent reports, the average yield on these loans has maintained a competitive edge, often surpassing traditional alternatives such as government bonds. This trend reflects investors' preference for stability and regular income, even as concerns about potential market volatilities loom.

Historical data suggests that the default rates on senior secured loans historically remain lower compared to unsecured debt, reinforcing their appeal during economic downturns. For instance, credit rating agencies have reported a decline in default rates over the past two years, with figures hovering around 2%, which is significantly lower than the previous decade's peaks. This performance is partly attributed to the rigorous underwriting standards implemented by lenders.

Looking ahead, forecasts indicate that as the interest rate cycle evolves, the senior secured loan market may continue to adapt. Factors such as rising inflation, potential shifts in monetary policy, and evolving investor sentiment will all play a critical role in shaping the future landscape. Market analysts suggest that savvy investors should keep a close watch on these dynamics as they unfold, preparing to recalibrate their strategies in response to ongoing trends.

Evaluating Senior Secured Loan Opportunities

Assessing senior secured loan opportunities requires a careful and methodical approach to ensure that investments are sound and align with the overall financial strategy. One of the most critical factors to consider is the credit quality of the borrower. Investors should examine the borrower's credit history, financial statements, and overall creditworthiness. A robust credit assessment helps in identifying the likelihood of repayment and the risks associated with default. Additionally, it is advisable to review any existing ratings from established credit agencies, as these can provide an objective evaluation of the borrower's financial health.

Another vital aspect to examine is the loan terms. This includes the interest rate, repayment schedule, and covenants attached to the loan. A favorable interest rate is essential as it directly impacts the return on investment. Investors should also scrutinize the repayment structure to understand cash flow implications and potential impacts on liquidity. Loan covenants may impose restrictions on borrower activities thus, it is essential to evaluate whether they protect investor interests adequately. These terms should be compared against industry benchmarks to ensure competitiveness.

Market conditions play a significant role in the evaluation of senior secured loans. Investors must be attentive to the broader economic environment, including interest rates, inflation, and market liquidity. A favorable market can enhance loan performance and reduce default probabilities, whereas a volatile environment may introduce additional risks. Monitoring market trends and economic indicators can provide insights into the viability of the investment.

Finally, engaging with experienced professionals or financial advisors can provide valuable perspectives and a broader market understanding. By being diligent in evaluating these factors, investors can enhance decision-making and identify viable senior secured loan opportunities that align with their investment objectives.

The Role of Institutional Investors in Senior Secured Loans

Institutional investors play a pivotal role in the senior secured loan market, significantly influencing both market dynamics and pricing structures. These entities, which include pension funds, insurance companies, and asset management firms, possess substantial capital and expertise, allowing them to engage in large-scale investment activities. Their participation is not only essential for liquidity but also impacts the risk-return profile associated with senior secured loans.

One of the key ways institutional investors shape the market is through their demand and investment strategies. As these investors increasingly allocate a portion of their portfolios to senior secured loans, they drive demand, which in turn affects pricing. The entry of institutional capital can lead to tighter spreads and better terms for borrowers, as the competition among lenders intensifies. This influx of capital can create a more stable lending environment, which is beneficial for the overall health of the market.

Moreover, institutional investors often have a long-term investment horizon, which contrasts with the shorter-term focus of some individual investors. This long-term perspective encourages the development of a robust secondary market for senior secured loans, enhancing the overall liquidity of these financial instruments. By participating in secondary markets, institutional investors facilitate price discovery and enable other market participants to buy and sell loans more efficiently.

The knowledge and analytical capabilities that institutional investors bring to the table also contribute to better credit assessment and risk management within the sector. Their sophisticated modeling and due diligence processes can help identify undervalued opportunities, thus setting a high standard for loan origination practices. As a result, individual investors stand to benefit from the trends and insights driven by institutional activity in the senior secured loan market.

In conclusion, the influence of institutional investors in the senior secured loan market is profound. Their participation not only shapes pricing and liquidity but also raises the overall standard of investment practices, ultimately benefiting individual investors involved in this complex financial landscape.

Regulatory Environment and Compliance

The regulatory environment surrounding senior secured loans is vital for investors to understand as it encompasses a multitude of laws and guidelines that govern lending practices, risk assessments, and investment strategies. A primary regulatory framework includes the Dodd-Frank Wall Street Reform and Consumer Protection Act, which established comprehensive rules to promote transparency and prevent risk-taking behavior by financial institutions. This legislation specifically addresses the reporting requirements and capital thresholds that lenders must adhere to, thereby impacting the availability and terms of senior secured loans.

In addition to Dodd-Frank, the Basel III Accord plays a crucial role, setting international standards aimed at enhancing financial stability through stricter capital requirements and liquidity mandates for banks. These regulations compel lenders to maintain higher capital reserves when underwriting senior secured loans, potentially affecting the overall supply of capital in the market. As a result, investors must stay informed about how these regulations shape lending practices and the subsequent risk profile of senior secured loans.

Another essential aspect of compliance is the adherence to anti-money laundering (AML) and know your customer (KYC) regulations. Investors who engage in the senior secured loan market must ensure that their activities align with these requirements to mitigate potential legal risks and reputational harm. Compliance with cybersecurity laws is also gaining importance as the industry evolves, highlighting the need for protection against data breaches that could compromise confidential loan information.

Developments in the regulatory landscape can lead to shifts in investor sentiment and market dynamics. For instance, any proposed changes in interest rates by the Federal Reserve can influence the lending environment and investment returns. Consequently, investors engaged in senior secured loans must continuously monitor regulatory updates and assess their implications, ensuring that their strategies remain sound and compliant.

Conclusion and Call to Action

Throughout this article, we have explored the intricacies of senior secured loans and their significance for investors seeking stability and higher returns. Senior secured loans represent a unique investment opportunity, offering a collateralized debt that is prioritized during liquidation, thus providing a layer of protection for lenders. The appeal of these loans lies in their potential for attractive yields, particularly in an ever-evolving market landscape where traditional fixed-income investments may not yield sufficient returns.

We have discussed how senior secured loans can complement an investment portfolio by enhancing diversification and providing income streams. Furthermore, the discussion emphasized the importance of understanding the borrower’s creditworthiness and the overall risk-reward dynamics of these loans. By carefully assessing factors such as the borrower's financial stability and market conditions, investors can make informed decisions that align with their financial goals.

In light of these insights, it is crucial for investors to remain proactive in their engagement with senior secured loans. Whether you are an experienced investor or new to this asset class, staying updated with market trends and research can significantly augment your investment strategies. Therefore, we encourage readers to delve deeper into the world of senior secured loans, seeking out relevant literature, attending investment webinars, or consulting with financial advisors specializing in structured finance.

We invite you to share your thoughts and experiences regarding senior secured loans in the comments below. Engaging with others can foster a robust community of investors and provide valuable perspectives. If you have any questions or need further information, do not hesitate to reach out. Your engagement is key to unlocking the full potential of this valuable investment opportunity.

For You ✨

View All

February 16, 2025

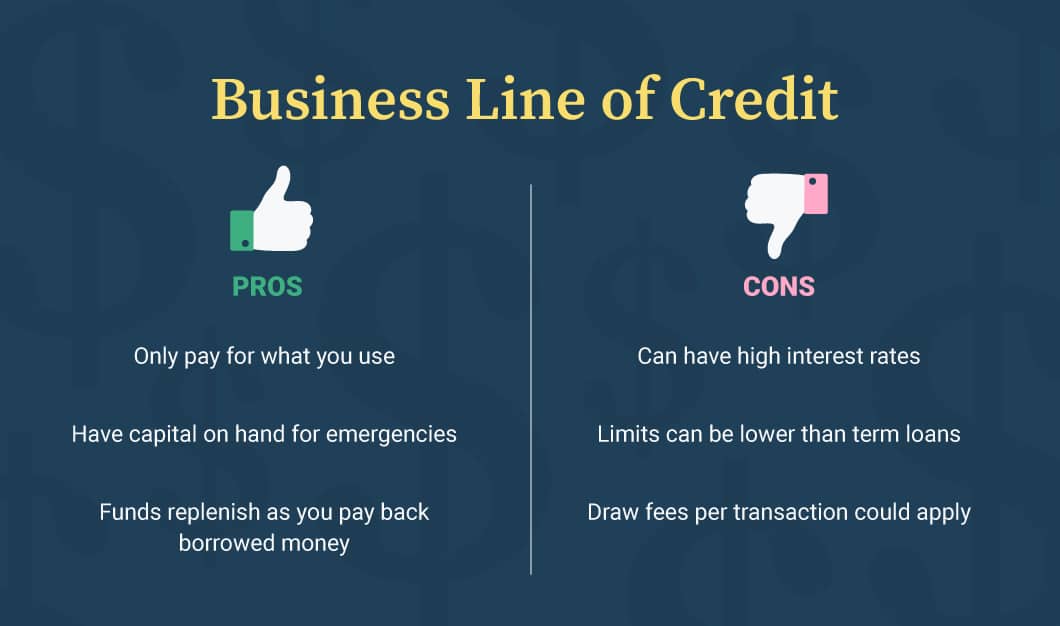

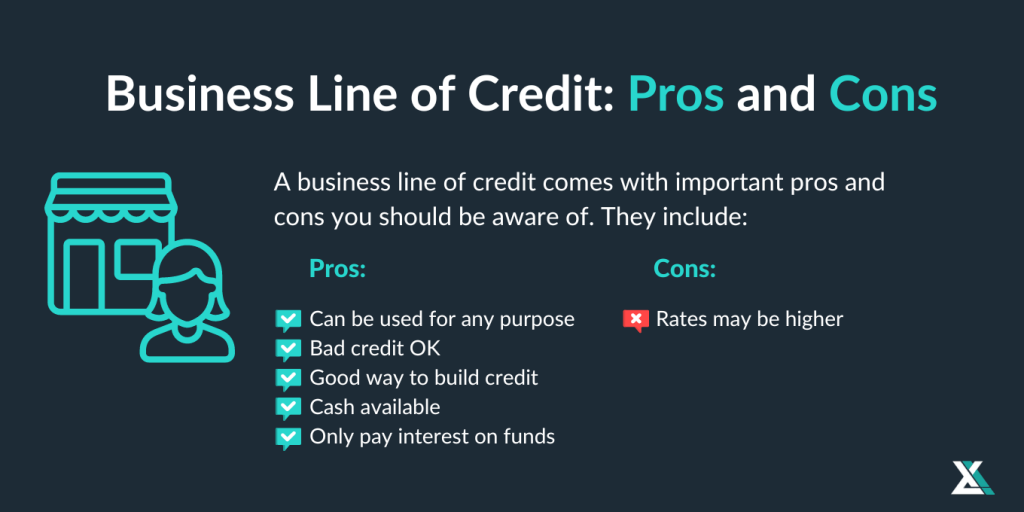

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10