Secured Loans Against Your House: What to Know

Nathan Allen

Photo: Secured Loans Against Your House: What to Know

Introduction to Secured Loans

Secured loans are a common financial product that allows individuals to borrow money by leveraging an asset as collateral. In contrast to unsecured loans, which do not require any collateral and are granted based primarily on the borrower's creditworthiness, secured loans involve pledging an asset often real estate such as a house. This key difference significantly affects the terms, interest rates, and overall risk associated with the loan.

When a homeowner applies for a secured loan, they essentially agree that if they fail to repay the loan according to the terms, the lender has the right to take ownership of the collateral. This arrangement tends to lower the level of risk for lenders, often resulting in lower interest rates compared to unsecured alternatives. Such loans can offer substantial borrowing power, as lenders may be willing to lend a higher amount against valuable property. This can be particularly beneficial for homeowners looking to finance major expenses like home renovations, education costs, or debt consolidation.

Common scenarios in which homeowners might consider secured loans include the need for significant financial assistance to improve property value, cover unexpected medical bills, or consolidate existing debts into a single, manageable payment. The equity built up in a home representing the difference between the property's market value and what the owner owes on the mortgage often provides a robust source for secured loans. Homeowners must consider their financial capabilities carefully, acknowledging that while these loans can offer necessary funds, the risks associated with borrowing against one's property can lead to losing the family home if repayment is not managed prudently.

Understanding Secured Loans Against Your House

Secured loans against your house, commonly known as home equity loans or second mortgages, allow homeowners to borrow money by leveraging the equity they have in their property. When a homeowner takes out a secured loan, their house serves as collateral, which can significantly influence loan terms, including the amount available to borrow and the interest rate. Typically, lenders assess the loan-to-value (LTV) ratio, which is the ratio of the loan amount to the appraised value of the property. Generally, a lower LTV ratio may enable borrowers to access better interest rates and terms because it signifies a lower risk to the lender.

Interest rates associated with secured loans tend to be lower than those for unsecured loans due to the reduced risk involved for lenders. This means that borrowers can potentially lower their overall interest costs. Repayment terms for secured loans can vary widely, often ranging from five to thirty years. It is essential for borrowers to understand that these loans come with a fixed or variable interest rate structure, influencing monthly payments and overall financial planning.

However, taking out a secured loan against your house carries inherent risks. One major risk is the potential loss of the home if the borrower fails to meet repayment obligations, as the lender has the right to repossess the property. Moreover, fluctuations in the housing market can affect the property's value and the amount of available equity, potentially leaving borrowers in a precarious financial situation. Before proceeding with a secured loan, it is crucial for individuals to thoroughly evaluate their financial stability, consider alternative financing options, and fully understand the terms of the loan.

Types of Secured Loans for Homeowners

Secured loans are a popular choice for homeowners seeking financial assistance, as they leverage the value of the property to obtain funding. Among the different options available, three common types stand out: home equity loans, home equity lines of credit (HELOCs), and traditional mortgages.

Home equity loans allow homeowners to borrow a lump sum based on the equity they have built in their properties. This type of secured loan often features fixed interest rates and a fixed repayment schedule, making budgeting straightforward. The key advantage is that homeowners receive the funds all at once, making it a suitable option for significant expenses such as home renovations or debt consolidation. However, a potential drawback is that the borrower must commit to a fixed amount of debt, which may not be ideal for those whose financial needs fluctuate.

On the other hand, home equity lines of credit (HELOCs) provide a revolving credit option, similar to a credit card. This type of secured loan allows homeowners to borrow up to a predetermined credit limit, making it versatile for various needs, such as unexpected expenses or ongoing projects. The borrower only pays interest on the amount drawn, which can be financially beneficial. However, the variable interest rates associated with HELOCs can lead to unpredictable monthly payments over time, creating potential challenges for financial planning.

Lastly, traditional mortgages represent another form of secured loans available to homeowners. These loans are primarily used to finance the purchase of a home but can also be refinanced to access equity. With fixed and adjustable-rate options, traditional mortgages offer flexibility. One downside is that securing a mortgage typically involves a thorough credit evaluation and checking, along with closing costs, which can be burdensome for some borrowers.

Understanding the characteristics and implications of each type of secured loan is crucial for homeowners to make informed financial decisions that align with their particular goals and circumstances.

The Application Process: Step-By-Step Guide

Applying for a secured loan against your house can be a strategic financial decision, requiring a clear understanding of the application process. Following these steps will help streamline your application and increase your chances of approval.

First, it is essential to assess your financial situation and determine the amount of borrowing you require. This involves reviewing your current debts, income, and expenses. Understanding how much equity you have in your home will also guide your borrowing capacity, as lenders typically allow you to borrow a percentage of your home’s value. Once you have a clear idea of your needs, gather the necessary documentation.

Documents usually required for the application include proof of identity, proof of income (such as pay stubs or tax returns), credit history, and details about your existing debts. Additionally, you should prepare information about your home, including its value and any mortgages or liens on the property. A clean and organized set of documents can present you positively to lenders.

Next, be prepared for a credit check. Lenders will assess your credit history, considering factors such as your credit score and past repayment behaviors. A higher credit score will likely enhance your chances of securing favorable loan terms. If your score is not ideal, consider improving it before applying by reducing outstanding debts or correcting any inaccuracies in your credit report.

Finally, when presenting yourself to lenders, aim for transparency and clarity. Clearly articulate the purpose of the loan and your repayment strategy. Be ready to answer any queries regarding your financial situation. Maintaining open communication and demonstrating financial responsibility can prove beneficial throughout the application process. By following this comprehensive guide, you can navigate the secured loan application process with confidence.

Factors to Consider Before Taking a Secured Loan

Secured loans against your house can present both opportunities and risks, making it essential for homeowners to carefully weigh various factors before proceeding. One of the primary considerations is an individual’s financial situation. Borrowers should thoroughly assess their income, expenses, and overall financial stability. An evaluation of current debts and financial obligations will provide clarity on what repayment capabilities exist, helping to avoid potential future difficulties.

Another critical factor is the impact these loans may have on credit scores. Secured loans typically involve borrowing a significant amount, and failing to make regular payments can adversely affect creditworthiness. It is prudent for individuals to review their current credit profiles, understanding how a secured loan might change their risk assessment in the eyes of lenders. Maintaining a good credit score is vital for securing favorable borrowing terms in the future.

Future financial planning also plays a crucial role in the decision-making process. Homeowners should consider their long-term financial goals and how a secured loan fits into this strategy. Will the loan help address immediate needs while still allowing for future investments? It's essential to think about not only the short-term benefits but also the long-term implications of adding another financial commitment.

Lastly, understanding the terms associated with the secured loan is imperative. This includes the interest rate, loan duration, and any fees that may be charged. Homeowners should read the fine print carefully to comprehend any potential penalties or costs that could arise. An informed decision is best made when the intricacies of the loan are fully transparent and understood.

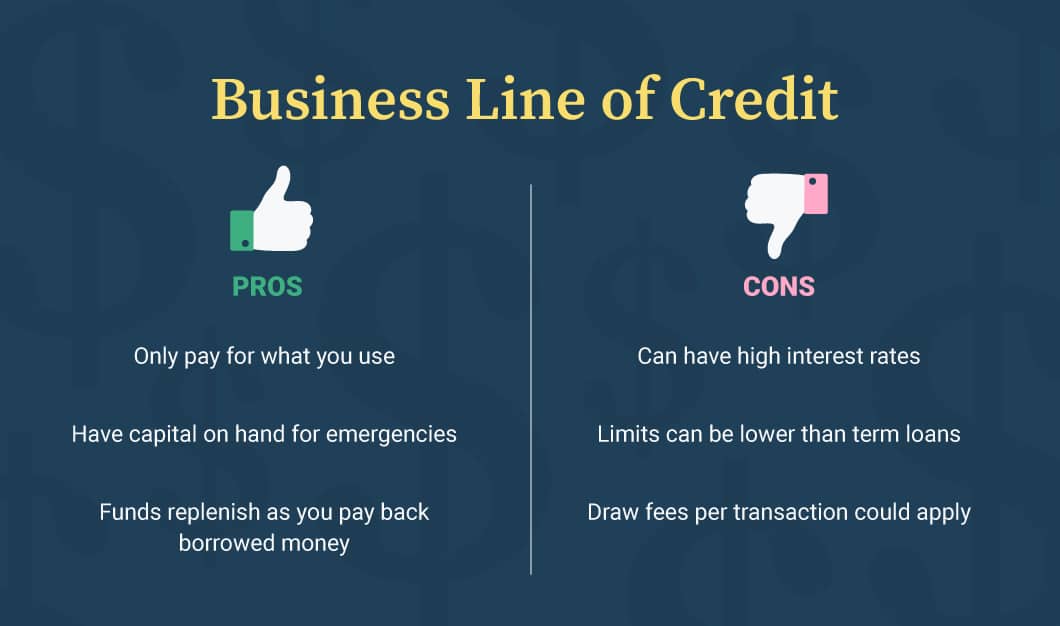

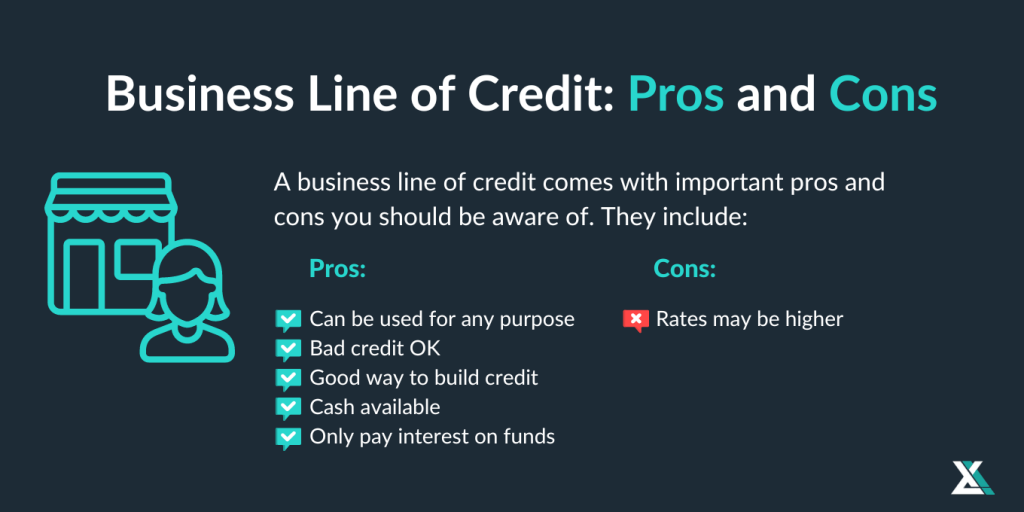

Pros and Cons of Secured Loans

Secured loans, also known as home equity loans, present a range of advantages and disadvantages that potential borrowers should carefully consider before committing. One of the primary benefits of secured loans is the lower interest rates compared to unsecured loans. Since these loans are backed by the borrower's home, lenders often view them as less risky, resulting in more favorable terms for consumers. Additionally, borrowers typically have access to a larger amount of money when using a secured loan. This can be particularly advantageous for those seeking significant financing for home improvements, education, or debt consolidation.

Another advantage lies in the flexibility of repayment terms. Secured loans may allow for extended repayment periods, making monthly payments more manageable. Furthermore, the interest paid on these loans may be tax-deductible, depending on the borrower's situation, offering yet another financial incentive. This can enhance the overall appeal for individuals who are looking to leverage their home equity to access funds.

However, it is crucial not to overlook the potential downsides of secured loans. One of the most significant risks is the possibility of foreclosure. If borrowers fail to keep up with repayments, lenders can take possession of the property, which poses a severe threat to homeownership. This risk necessitates a thorough evaluation of one’s financial stability before proceeding with a secured loan.

Moreover, the long-term financial implications of secured loans should not be underestimated. Borrowers may find themselves in a cycle of debt, especially if they utilize the funds for expenses that do not enhance their financial situation. Therefore, while secured loans can provide access to necessary funds at lower interest rates, they also carry risks that require careful consideration and responsible borrowing practices.

Practical Tips for Managing a Secured Loan

Secured loans, particularly those secured against your house, require careful management to ensure financial stability and maintain your property. One of the first steps in managing a secured loan is establishing a robust budgeting strategy. This involves tracking your income, expenses, and loan payments to get a clear picture of your financial situation. A well-prepared budget can help you allocate funds efficiently, enabling you to stay on top of your repayments. Utilizing budgeting apps or templates can further aid in this process, providing reminders for payment dates and highlighting any potential shortfalls.

Maintaining open and honest communication with your lender is also crucial when managing a secured loan. If you encounter any difficulties in making payments, it is advisable to reach out to your lender promptly. Most lenders are willing to work with borrowers facing temporary hardships and may offer alternatives such as repayment plans or loan modifications. For instance, a homeowner who faced unexpected medical expenses found it beneficial to communicate their situation to the lender, resulting in a short-term adjustment that allowed them to stay afloat without risking foreclosure.

Additionally, being proactive about refinancing can lead to significant savings and better loan terms. Monitoring the current interest rates can help determine if refinancing is a wise choice. If rates drop or your credit rating improves, it might be beneficial to renegotiate your loan terms to secure a lower interest rate. This adjustment could reduce monthly payments or overall loan costs. Consider examining your specific financial situation to determine whether refinancing aligns with your long-term financial goals.

By employing these strategies, individuals can effectively manage their secured loans, fostering a more secure financial future.

Common Myths About Secured Loans

Secured loans against property, such as mortgages or home equity loans, often carry several misconceptions that may deter potential borrowers from considering them. One prevalent myth is that secured loans are only available to those with pristine credit scores. While a good credit history can enhance the chances of approval and favorable terms, many lenders offer secured loans to individuals with less-than-perfect credit, especially when collateral like real estate is provided. This access can open doors for many who otherwise might struggle with unsecured loan options.

Another common belief revolves around the notion that secured loans pose a significant risk to homeownership. Though it's true that defaulting on a secured loan may lead to the loss of the property used as collateral, this outcome is not as imminent or inevitable as often suggested. Responsible borrowing and repayment, as well as understanding the terms of the loan, can mitigate such risks. It is crucial for borrowers to create a realistic repayment plan that aligns with their financial capabilities, ensuring that they do not jeopardize their home.

Additionally, there is a misconception that secured loans are inflexible, locking borrowers into a rigid payment structure. In reality, many lenders offer a variety of repayment options and terms. Borrowers may choose between fixed rates that provide stability or variable rates that could potentially lower payments over time. Moreover, some secured loans allow for early repayment without exorbitant penalties, giving borrowers the freedom to manage their debt according to changing financial situations.

By dispelling these myths about secured loans, potential borrowers can make informed decisions tailored to their needs. It is essential to consider all aspects of secured lending, including the true benefits and risks associated with these financial products.

Frequently Asked Questions (FAQs)

Secured loans against your house can raise numerous questions among potential borrowers. Understanding these loans can significantly impact your decision-making process. Here are some frequently asked questions to help clarify common concerns.

What is a secured loan? A secured loan is a type of borrowing that is backed by collateral, such as your house. In the case of secured loans against your house, the property serves as security for the loan. This means that if you default on payments, the lender has the right to claim the property to recover the owed amount.

How much can I borrow? The amount you can borrow with a secured loan largely depends on the equity you have in your house. Lenders typically allow you to borrow up to a certain percentage of your property's value, usually ranging from 70% to 90%. However, other factors such as your income, credit history, and the lender's policies will also influence the loan amount.

What are the benefits of secured loans against my house? One of the primary benefits is that they generally offer lower interest rates compared to unsecured loans, as the lender has collateral to mitigate their risk. Additionally, secured loans often provide larger borrowing amounts, making them suitable for significant expenses such as home renovations or consolidating debts.

What happens if I can't repay the loan? If you fail to repay the secured loan, the lender has the legal right to initiate foreclosure proceedings to recover the amount owed by selling your property. This risk underscores the importance of thoroughly evaluating your financial situation before committing to such a loan.

With these insights, potential borrowers can make informed decisions regarding secured loans against their house, understanding the implications and benefits of this financing option.

Conclusion and Call to Action

In conclusion, understanding secured loans against your house is crucial for making informed financial decisions. Throughout this article, we have explored what secured loans entail, their advantages and inherent risks, and the factors to consider before borrowing against home equity. Secured loans can provide necessary funds for substantial expenses, such as home renovations or debt consolidation, by leveraging the equity built in one’s home. However, it is essential to recognize the potential implications of defaulting on such loans, which may lead to the loss of your property.

Moreover, we discussed the significance of assessing your financial circumstances and the importance of comprehensive research into various lenders, loan offerings, and interest rates. Each individual's situation is unique, so tailoring your approach to secured loans based on personal financial stability and future plans will significantly mitigate potential risks. Secured loans can be a powerful financial tool when used responsibly, and they pose challenges that must be acknowledged and managed adequately.

We invite our readers to actively engage with this topic. If you have previously taken out a secured loan against your house, consider sharing your experiences in the comments section below. Your insights could be valuable to others weighing their options. Additionally, if you find yourself with questions or require tailored advice, we encourage you to reach out. Understanding the nuances of secured loans will empower you to navigate the financial landscape more effectively, ensuring that you can make choices that align with your goals and circumstances.

For You ✨

View All

February 16, 2025

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10