Effective Debt Consolidation for Secured Debts

Nathan Allen

Photo: Effective Debt Consolidation for Secured Debts

Understanding Secured Debts

Secured debts represent financial obligations that are backed by collateral, an asset that lenders can claim if the borrower defaults on the loan. Common examples of secured debts include mortgages and auto loans. In the case of a mortgage, the property itself serves as collateral if the homeowner fails to make the required payments, the lender has the right to foreclose on the property. Similarly, with an auto loan, the vehicle acts as collateral, and failure to meet payment obligations may result in repossession.

In contrast, unsecured debts are not tied to any specific asset. Credit cards and personal loans typically fall under this category. Since unsecured creditors do not have a claim to the borrower’s property, the financial consequences of defaulting differ significantly, usually resulting in damage to credit scores rather than asset seizure. Understanding this distinction is crucial for individuals considering their financial options, especially when it comes to debt consolidation.

The implications of failing to repay secured debts can be quite severe. Defaulting on a secured loan can lead to the loss of the collateral associated with the debt, which may leave the borrower in a more precarious financial position. This is particularly significant for assets like homes or vehicles, which can be vital for everyday life. The loss of such assets can also lead to further financial strain, such as the costs involved in finding alternative housing or transportation. As a result, many individuals seek debt consolidation as a strategy to manage their secured debts more effectively, allowing them to maintain their assets while working toward financial stability.

The Importance of Debt Consolidation

Debt consolidation serves a vital function in financial management, especially for individuals managing multiple secured debts. The process involves combining various debts into a single loan or payment structure, making it significantly easier to oversee outstanding financial obligations. One of the primary advantages of debt consolidation is the simplification of payments. By merging several loans or credit accounts, borrowers only need to keep track of one payment rather than juggling multiple due dates, which can often lead to missed payments and additional fees.

Beyond just simplifying payment schedules, debt consolidation can result in a reduction of interest rates. Many consumers find themselves burdened with high-interest loans, which can dramatically increase the total amount owed over time. By consolidating these debts, borrowers often find a lower overall interest rate, particularly when transitioning to a fixed-rate loan. This reduction in interest can result in significant savings, allowing individuals to allocate more funds towards principal repayment, thus reducing their overall debt burden more efficiently.

Statistics reflect the effectiveness of debt consolidation as a financial strategy. According to recent studies, individuals who engage in debt consolidation have been found to reduce their debt by an average of 30%, with many reporting improved credit scores within a year of consolidation. These numbers underscore the relevancy of this approach for those grappling with financial difficulties, particularly those managing secured debts such as mortgages or car loans. By taking steps towards consolidating their debts, borrowers can proactively regain control of their finances, paving the way for a more stable economic future.

Understanding the Mechanics of Debt Consolidation

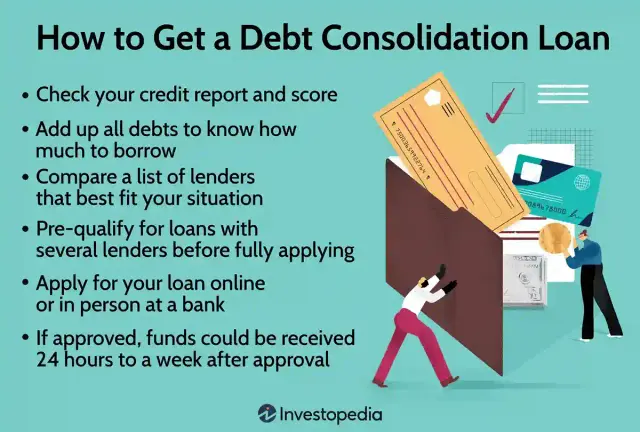

Debt consolidation serves as a strategic approach for managing and alleviating secured debts by amalgamating multiple obligations into a single, more manageable payment. The primary methods commonly employed include taking out a consolidation loan, executing a balance transfer, or adhering to a debt management plan. Each of these methods presents unique advantages and disadvantages that must be carefully evaluated before proceeding.

A consolidation loan involves securing a new loan, typically with a lower interest rate, to pay off existing secured debts. This process simplifies payments and potentially reduces financial strain, particularly if the new loan offers favorable terms. However, it may require collateral, leading to increased risk if repayments become unmanageable. It is essential to assess personal creditworthiness, as this can influence the loan's terms and interest rates.

Another viable option is a balance transfer, primarily applicable to credit card debts. This method entails transferring existing balances to a new credit card, often featuring an introductory zero-percent interest rate. This can offer considerable savings if the balance is managed prudently during the promotional period. Nonetheless, this option may carry substantial fees, and the risk of accumulating more debt can increase due to limited payment structures.

Alternatively, a debt management plan (DMP) involves working with a financial advisor or credit counseling service to negotiate lower interest rates and provide a structured repayment plan. While this approach can significantly ease the financial burden, it requires individuals to adhere to established guidelines, which may not suit everyone’s financial habits.

In conclusion, while each debt consolidation method presents distinct benefits and challenges, careful consideration of personal circumstances and financial goals is crucial to determine the optimal path forward.

Evaluating Your Financial Situation

Before considering debt consolidation for secured debts, it is vital to have a clear understanding of your financial situation. This initial assessment will inform your decision-making process and aid in selecting the most appropriate consolidation method. Start by calculating your total income: include all sources, such as salaries, bonuses, rental income, and any side businesses. This will provide a comprehensive overview of your financial resources.

Next, track your monthly expenses meticulously. Create a detailed list that covers both fixed expenses, like mortgage or rent, and variable expenses, such as groceries and entertainment. Understanding where your money is going will highlight potential areas for savings. Once you have detailed your income and expenses, you can subtract the total expenses from your income to determine your monthly cash flow. This figure will be crucial in deciding how much you can allocate toward debt repayment.

Additionally, it is important to evaluate the total amount of debt you currently carry. This should encompass not only the principal amounts owed but also any interest or additional fees which may apply. By aggregating this data, you will have a clearer perspective on the scale of the debt problem you face.

Your credit score plays a critical role in the debt consolidation process. A good credit score may provide access to better consolidation options, such as lower interest rates. Use various online tools or templates to assess your credit score, and consider obtaining your credit report to identify any discrepancies that could affect your average score. Addressing these issues before proceeding with consolidation is crucial.

Ultimately, compiling this information will furnish you with the necessary insights to move forward with greater confidence in your debt consolidation journey.

Choosing the Right Debt Consolidation Method

Debt consolidation presents a viable solution for individuals struggling with secured debts. As various methods exist, selecting the appropriate one is crucial to effectively managing financial obligations. Among the primary methods are personal loans, home equity loans, balance transfer credit cards, and debt management plans. Each option encompasses unique features such as interest rates, repayment terms, eligibility criteria, and anticipated outcomes, making it pertinent for borrowers to evaluate these elements carefully.

Personal loans typically feature fixed interest rates, allowing borrowers to predict their monthly payments accurately. These loans can consolidate multiple debts into a single payment, simplifying the repayment process. However, eligibility requirements may vary significantly, often contingent on one's credit score and income level.

Home equity loans utilize the borrower's home as collateral, providing lower interest rates compared to unsecured loans. This method offers the potential for larger amounts, thereby addressing substantial debts effectively. Nevertheless, the risk of losing one's home if unable to repay the loan is a serious consideration for prospective borrowers.

Balance transfer credit cards enable individuals to transfer existing debt to a new card, often with a promotional period featuring low or zero percent interest rates. While this option can lead to significant savings, it necessitates the discipline to pay off the transferred balance before the promotional rate expires.

Lastly, debt management plans involve working with credit counseling agencies to negotiate favorable terms directly with creditors. This method can provide structured repayment schedules however, it typically requires monthly contributions over an extended period, emphasizing the need for commitment from the individual.

When selecting the right debt consolidation method, individuals should consider their personal financial circumstances. Creating a checklist of essential questions can aid in determining the most suitable option, such as: What are my monthly expenses? Am I comfortable with the terms of securing a loan? What is my current credit score? Addressing these questions can guide individuals toward a more informed decision that aligns with their financial goals.

Creating a Debt Consolidation Plan

Developing a comprehensive debt consolidation plan is essential for individuals seeking to manage their secured debts effectively. The first step in this process involves setting realistic goals. It is crucial to evaluate the total amount of secured debt, the monthly payments, and interest rates associated with each obligation. Establishing clear, attainable objectives can greatly enhance motivation and accountability throughout the repayment journey. For example, rather than aiming to pay off all debts in six months, consider a timeline of one to three years, allowing for more manageable monthly contributions.

Creating a detailed budget is another critical component of a successful debt consolidation plan. Begin by compiling income sources, including salary, bonuses, or side jobs. After outlining the total monthly income, list all expenses such as housing, utilities, groceries, and other essential costs. This budgeting exercise reveals discretionary spending areas where adjustments can be made, thereby increasing funds available for debt repayment. Utilizing budgeting tools or apps can facilitate ongoing tracking and management of expenses, helping individuals stay on course.

Determining a repayment timeline is equally important. This timeline should be aligned with the overall debt goals and financial situation. For instance, if an individual consolidates several secured debts into a single loan with a lower interest rate, they may set a more aggressive repayment schedule. Incorporating milestones, such as paying off a certain percentage of the debt within the first year, can provide a sense of progress and motivate continued efforts.

To inspire readers further, examining real-life case studies of successful debt consolidation can offer valuable insights. Many individuals have effectively transformed their financial situations through well-structured plans, highlighting the importance of commitment and discipline. Real-world examples demonstrate that with the right approach, overcoming secured debts is not only achievable but can lead to enhanced financial stability.

Common Mistakes to Avoid in Debt Consolidation

When engaging in debt consolidation for secured debts, individuals often find themselves falling prey to a variety of common pitfalls that can hinder their financial improvements. Awareness of these mistakes is crucial for successfully navigating the consolidation process.

One of the most significant errors to watch out for is ignoring hidden fees associated with debt consolidation services. These fees can vary widely depending on the lender or service provider and may include origination fees, closing costs, or even penalties for early repayment. Before committing, it is essential to carefully examine the overall cost of consolidation, as these fees can substantially offset any potential savings achieved through lower interest rates.

Another common mistake involves failing to read the fine print of loan agreements. Many individuals are excited to obtain a new loan that promises lower monthly payments without thoroughly understanding the terms and conditions. This can lead to confusion regarding repayment schedules, interest rates, and potential changes to fees over time. Taking the time to read and comprehend the loan agreement is vital, as it provides insights into what to expect throughout the repayment period.

Additionally, potential changes in credit scores are often underestimated during the consolidation process. While consolidating debts may initially help improve credit utilization, individuals may not recognize how missed payments or an increased debt load can adversely affect their credit ratings. It is critical to maintain timely payments and monitor credit reports throughout the repayment process to ensure that one’s credit health remains intact.

By avoiding these common mistakes namely, overlooking hidden fees, neglecting to read fine print, and underestimating the impact on credit scores borrowers can make informed decisions that lead to more effective management of their secured debts.

Resources and Tools for Debt Consolidation

When navigating the complexities of consolidating secured debts, having the right resources and tools at your disposal can significantly enhance the process. Various budgeting apps, debt calculators, and lender-matching websites are critical components for an efficient debt consolidation strategy. These tools not only facilitate better financial planning but also help in monitoring progress throughout the repayment journey.

One of the most effective budgeting apps is Mint. This application allows users to track their expenditures, set budgets, and establish savings goals. It provides a consolidated view of all financial accounts, making it easier to grasp the overall financial picture. By using Mint, individuals can allocate funds toward debt repayment while managing day-to-day expenses, which is essential for successful consolidation.

Another useful resource is a debt calculator. Websites like National Debt Relief offer tools that enable users to enter their financial information and determine how long it will take to become debt-free under different consolidation scenarios. These calculators can offer insight into monthly payments required and the overall impact on one’s financial situation, facilitating more informed decisions.

For those seeking to connect with reputable lenders, platforms such as LendingTree or Credible can prove invaluable. These services help users compare various loan offers from multiple lenders, allowing them to identify the best interest rates and terms suited to their specific needs. Moreover, reading reviews and ratings of lenders can provide additional assurance before making a commitment.

Additionally, financial literacy websites such as NerdWallet provide comprehensive guides on debt consolidation, along with tips and tricks for managing secured debts effectively. Utilizing these resources can enhance understanding and empower individuals to take actionable steps towards financial stability through effective debt consolidation.

Conclusion

In conclusion, effective debt consolidation for secured debts can serve as a vital tool for individuals seeking to regain control of their financial situation. By understanding the various methods of consolidating debt, such as utilizing personal loans, home equity loans, or balance transfer credit cards, individuals can strategically manage their repayment obligations. Each option has its own unique features and implications thus, it is crucial to evaluate them based on one's financial situation, credit score, and long-term goals.

One of the primary benefits of debt consolidation is the potential for lower interest rates, which can lead to reduced monthly payments and overall financial relief. Effectively managing secured debts through this process can also enhance one's credit score over time, provided that payments are made consistently and on time. The simplicity of making a single monthly payment, rather than juggling multiple debts, can further alleviate stress and support a path to financial stability.

Additionally, it is important for individuals considering debt consolidation to be informed about the potential risks, such as leveraging assets or accruing further debt through additional borrowing. Financial education and awareness are essential components in harnessing the power of debt consolidation effectively. Centering on budgeting, spending habits, and financial planning will bolster one's ability to achieve financial independence.

We invite you to engage with us by sharing your thoughts and experiences related to debt consolidation in the comments below. Feel free to pose any questions you may have or share this article on your social media channels to help foster a supportive community. We also encourage you to explore additional resources linked within the post for further guidance on managing secured debts effectively. Your journey towards optimal financial health and peace of mind is our priority, and we are here to support you every step of the way.

For You ✨

View All

February 16, 2025

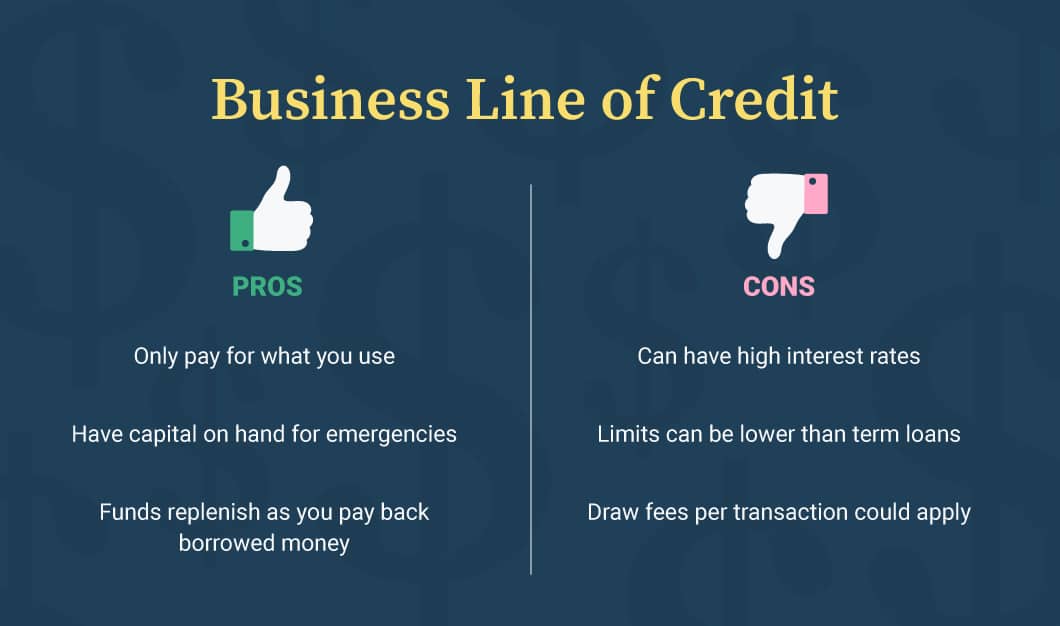

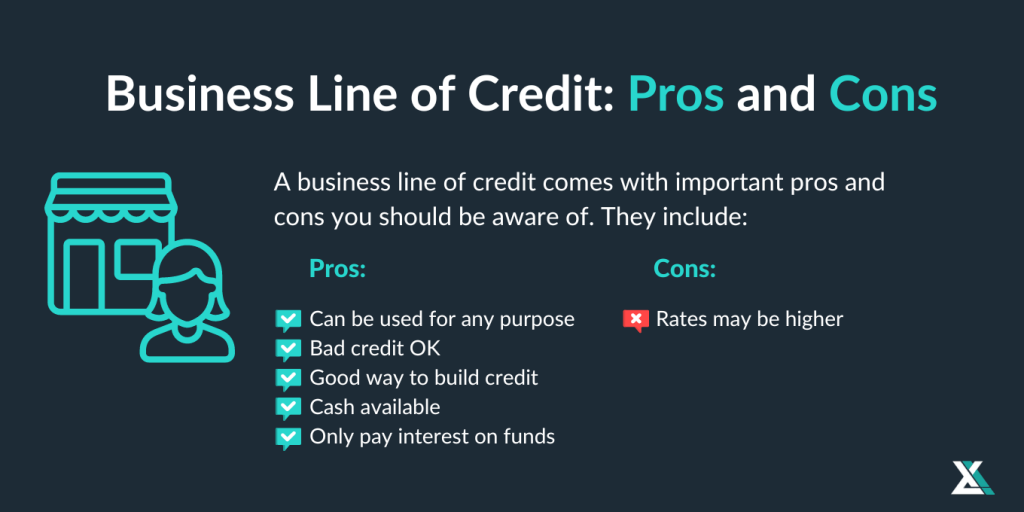

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10