Streamlined Online Applications for Business Credit

Nathan Allen

Photo: Streamlined Online Applications for Business Credit

Introduction to Business Credit

Business credit refers to the financial reputation and borrowing capacity of a company as evaluated by lenders and credit agencies. It plays a critical role in determining a business's ability to secure financing, which is essential for operational sustainability and growth. Unlike personal credit, which applies to individuals and is influenced by personal financial behavior, business credit is distinctly tied to the business's financial activities and performance. Most importantly, business credit is assessed through various business credit reporting agencies that analyze financial data, payment history, and creditworthiness.

The distinction between business credit and personal credit is pivotal for entrepreneurs. While personal credit scores are primarily derived from individual credit card usage, loans, and personal debt, business credit scores consider elements such as business transactions, expense management, and relationships with suppliers and customers. Furthermore, maintaining separate business credit from personal credit helps protect personal assets since it establishes a corporate identity that can stand alone financially. This division can be crucial in minimizing risk and liability for business owners, especially during times of financial difficulty.

Good business credit is advantageous for numerous reasons, extending beyond mere access to financing. It enables businesses to negotiate favorable terms with suppliers, which may include lower costs or extended payment periods. Businesses with strong credit ratings are often viewed as low-risk by financial institutions, which can lead to better loan terms and interest rates. Additionally, a healthy credit profile can enhance a company's overall credibility, attracting potential clients and partners. Therefore, developing a solid business credit history is essential for companies of all sizes seeking to thrive in competitive marketplaces.

Why Streamline Your Business Credit Application Process?

The importance of streamlining the business credit application process cannot be overstated. A more efficient application process not only saves time but also significantly reduces stress for business owners navigating the often complex landscape of financing. By minimizing inefficiencies, businesses can enhance their approval rates for credit applications, allowing them faster access to the necessary funds required for growth and operational needs.

When the application process is simplified, it enables applicants to submit their requests with less hassle and in a more expedited manner. This results in quicker turnaround times and, consequently, faster funding. Therefore, businesses can avoid unnecessary delays that might hinder their operations or growth plans. Focusing on streamlined processes allows business owners to concentrate on what truly matters the day-to-day operations of their enterprise rather than getting bogged down in paperwork and lengthy procedures.

Moreover, a streamlined application process fosters a better overall experience for applicants. With clearer guidelines and reduced documentation requirements, potential borrowers can better understand what is expected from them and can more easily provide the necessary information. This level of clarity not only boosts confidence in the application process but also facilitates improved communication and transparency between lenders and borrowers.

Additionally, as businesses become more adept at navigating streamlined processes, they can forge more robust relationships with financial institutions. Establishing trust and open lines of communication can lead to better terms, more favorable rates, and an ongoing partnership that benefits both parties in the long run. The advantages of an efficient business credit application process extend beyond immediate funding they positively impact a business's operational capabilities and long-term success.

Key Features of Streamlined Online Applications

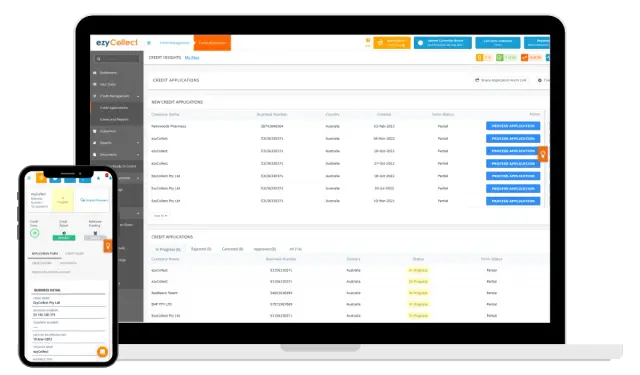

Streamlined online applications for business credit present a range of critical features that significantly enhance user experience and efficiency in obtaining financing. One of the primary aspects of these applications is their user-friendly interfaces. Designed with simplicity in mind, these interfaces enable applicants to navigate through the process intuitively. For example, many platforms use visual indicators to guide users through each section, minimizing confusion and reducing the likelihood of errors during data entry.

Automation of data entry is another pivotal feature. By allowing users to import financial data directly from accounting software, such as QuickBooks or Xero, applicants can save time and ensure accuracy. This automation reduces the manual workload, thus expediting the application process. Furthermore, the integration with accounting software allows the online platform to pre-fill necessary fields, making it easier for users to complete applications promptly.

Instant feedback mechanisms play a crucial role in improving the application experience. By providing real-time updates on application status, users remain informed throughout the process. For instance, some platforms offer immediate validation of submitted information if anything is missing or incorrect, users receive prompts to rectify these issues before finalizing their applications. This proactive approach minimizes delays and enhances customer satisfaction.

Mobile accessibility is another essential feature of modern online applications. With more business owners relying on mobile devices for everyday tasks, many platforms are optimized for smartphones and tablets. This ensures that users can apply for business credit conveniently, anytime and anywhere. Features such as touch-friendly navigation and quick-loading pages make the mobile experience seamless.

Each of these features contributes to a more effective and satisfying application process, enabling business owners to secure the credit they need with greater ease and efficiency than ever before.

Steps to Prepare for Your Business Credit Application

Applying for business credit online can be a streamlined process if you take the time to prepare adequately. The first step in this journey is gathering all necessary documents. Commonly required documentation includes your business financial statements, tax returns from the previous years, a business plan that outlines your objectives, and legal structure documents such as business licenses and permits. Ensure that you have all these documents readily accessible before beginning the application process, as this will significantly expedite your application.

Next, it is essential to understand your business credit score and credit reports prior to applying for credit. Your business credit score is pivotal since it reflects your financial reliability to potential lenders. Obtain your credit reports from major credit bureaus like Dun & Bradstreet or Experian and review them carefully for any inaccuracies. Addressing discrepancies can enhance your creditworthiness and increase your chances of a successful application.

After gaining insights into your credit score, it is wise to evaluate your credit needs. Consider how much funding you require and the intended purpose of the credit. Having a clear understanding of your borrowing needs not only helps in choosing the right loan amount but also enables you to identify suitable lenders that align with your business goals. Research various lending options, including traditional banks, credit unions, and alternative lenders, to determine which one best fits your financial scenario.

Lastly, selecting the right lender is crucial for a successful application. Look for lenders that specialize in business credit and offer flexible terms that meet your needs. Compare interest rates, fees, and customer reviews to ensure you make an informed decision. By taking these steps, you will be well-prepared to submit an effective online application for business credit, increasing the likelihood of receiving the financing necessary for your business growth.

Choosing the Right Lender for Online Applications

When seeking business credit through online applications, selecting the right lender becomes a crucial step in securing financing that meets your unique needs. Several factors should be taken into account to ensure a suitable match and successful borrowing experience.

One primary consideration is the interest rates offered by various lenders. Each lender may have different rates based on creditworthiness, loan amounts, and the specific type of financing. It is advisable to compare interest rates from multiple lenders to identify which options are the most cost-effective for your business. Furthermore, be vigilant about hidden fees, as they can significantly impact the overall cost of borrowing.

Additionally, evaluate the application processes of potential lenders. Some institutions provide a streamlined, user-friendly online application, while others may have complicated procedures that could lead to delays. A straightforward application process can save valuable time and reduce frustration. Approval times are also an important factor some lenders can provide a decision within hours, while others may take several days or even weeks. Knowing your time frame can help refine your options.

Customer service should not be overlooked when selecting a lender. A responsive and reliable support team can make a significant difference when addressing concerns or inquiries throughout the application process. Look for lenders that have positive reviews regarding their customer service experience. Reputation is another critical factor to consider examine both industry reviews and feedback from other business owners to gauge the reliability of potential lenders.

As you make comparisons between different lenders, it may help to create a checklist of these criteria, allowing for a side-by-side evaluation. By carefully considering interest rates, application processes, approval times, customer service, and lender reputation, you can make a more informed decision that aligns with your business credit needs.

Common Mistakes to Avoid in Online Business Credit Applications

Submitting an online business credit application can be a straightforward process, but several common mistakes can hinder your chances of approval. By understanding these pitfalls, business owners can better navigate the application process and secure the financing they need.

One significant error applicants often make is providing misinformation. This can range from inaccuracies in business revenue figures to incorrect legal business names. Such discrepancies can lead to mistrust from lenders, negatively impacting the approval process. It is vital to ensure that all information provided is accurate and consistent with company documents, such as tax returns and registration records.

A lack of supporting documentation can also be detrimental. Lenders typically require various documents to verify your business's financial stability and creditworthiness. Missing documents, such as bank statements, profit and loss statements, or business licenses, can result in delays or outright denial of the application. It is essential to compile all necessary materials beforehand and understand what specific documents are needed for the application.

Failing to read the application terms thoroughly is another frequent oversight. Some applicants overlook critical details, such as interest rates, repayment terms, or fees associated with the loan. Absorbing this information beforehand not only helps in making informed decisions but also prevents unintended consequences later on. Understanding the fine print of loan agreements can save businesses significant money and stress in the long term.

Lastly, poor communication with lenders can create barriers to successful applications. Engaging in proactive communication, clarifying questions early, and providing timely responses can foster a positive relationship with lenders. A lack of communication can lead to misunderstandings and missed opportunities. By avoiding these common mistakes, applicants can enhance their chances of securing business credit through online applications.

Enhancing Your Business Credit Score

Improving your business credit score is a crucial step to securing favorable financing options and establishing a solid financial reputation. One of the most effective strategies for enhancing your credit score is ensuring timely bill payments. Consistently paying your bills on or before their due dates demonstrates reliability to credit reporting agencies and contributes positively to your score.

Another essential aspect to consider is your credit utilization ratio. This ratio evaluates the amount of credit you are using relative to your available credit. It is advisable to maintain a low credit utilization ratio, ideally below 30%. This indicates to lenders that your business is not overly reliant on credit, enhancing your score while also easing the approval process for future lending.

Establishing trade lines with suppliers is also beneficial for your business credit score. By creating accounts with suppliers that report payment behavior to credit bureaus, you can effectively build a robust credit history. These trade lines can significantly impact your credit score, especially when they reflect timely payments and good standing.

Additionally, regular credit monitoring is vital for maintaining and enhancing your score. By routinely checking your business credit reports, you can identify inaccuracies or fraudulent activities that could negatively affect your credit score. Many credit monitoring services provide alerts for significant changes, allowing you to respond swiftly and rectify any issues.

Implementing these strategies not only bolsters your creditworthiness but also lays a strong foundation for future growth and expansion. A healthy business credit score opens the door to better loan terms, interest rates, and overall financial opportunities. Taking the initiative to improve your credit score will ultimately contribute to the stability and success of your business in the competitive marketplace.

Case Studies: Successful Credit Applications

Understanding the process of securing business credit can be significantly enhanced by examining real-life case studies of businesses that have successfully navigated streamlined online credit applications. By analyzing varied industries and the types of financing they secured, valuable insights can be gained regarding the benefits of this efficient process.

One notable example is a tech startup that needed immediate funding for product development and marketing. Utilizing a streamlined online application system, the company submitted their documents electronically, allowing for an expedited review process. Within 48 hours, they received approval for a significant line of credit, which they used to bring their innovative product to market swiftly. Their experience underscores how a simplified application process can lead to faster decision-making and operational efficiency, enabling businesses to seize growth opportunities promptly.

Another case study involves a small retail business that had previously struggled to secure financing through traditional means. Faced with cash flow challenges, they turned to a streamlined online platform specializing in business credit. After submitting a concise application and a few supporting documents, the owners were surprised to receive multiple offers from different lenders within days. This competition among lenders allowed them to negotiate better terms, ultimately securing a loan that provided the necessary capital for inventory expansion. This scenario illustrates how streamlined credit applications can create a more competitive environment for borrowers, particularly in industries where cash flow management is critical.

A further case is that of a construction company that successfully accessed working capital through an online credit application process. Traditionally known for lengthy waits when seeking loans, this firm appreciated the intuitive design of the online form and the quick retrieval of information required. They were able to complete their application in less than an hour, gaining access to funds within a week. Their experience highlights not only the efficiency of online processes but also the accessibility for businesses operating in demanding sectors.

These case studies reflect the transformative potential of streamlined online applications for business credit, offering practical lessons about accessibility, efficiency, and the advantages of leveraging technology in finance.

Conclusion and Call to Action

In this discussion about streamlined online applications for business credit, we have explored several key themes that underscore the importance of modernizing the credit acquisition process. As the business landscape continues to evolve, traditional methods of applying for credit have often proven to be cumbersome and time-consuming. The shift toward online applications not only enhances accessibility but also expedites the approval process, allowing businesses to focus on their growth and operational goals rather than getting bogged down by paperwork.

Moreover, the advantages of streamlined applications extend beyond convenience. By utilizing advanced technology and automated systems, lenders can offer quicker assessments, reducing the overall waiting time for applicants. This is particularly beneficial for startups and small businesses that often face challenges in securing the funding they require. Additionally, the ability to submit applications electronically allows business owners to keep detailed records and track their submissions, fostering better organization and transparency in financial dealings.

We encourage readers to consider their own experiences with business credit applications. Have you navigated the process recently? What challenges did you encounter, and did you find that online applications improved your experience? Your insights could prove invaluable to other business owners exploring similar paths. Furthermore, we invite you to engage with additional resources we've compiled on this topic, which can provide deeper information and guidance on this crucial aspect of business finance.

In summary, embracing streamlined online applications for business credit will not only facilitate easier access to funds but also empower business owners to make informed decisions quickly. We urge you to take action whether by applying for credit, sharing your thoughts in the comments below, or delving further into the resources available. Your participation is essential in fostering a community of informed business owners navigating the credit landscape.

For You ✨

View All

February 16, 2025

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10