Top Online Small Business Lines of Credit

Nathan Allen

Photo: Top Online Small Business Lines of Credit

Introduction to Lines of Credit

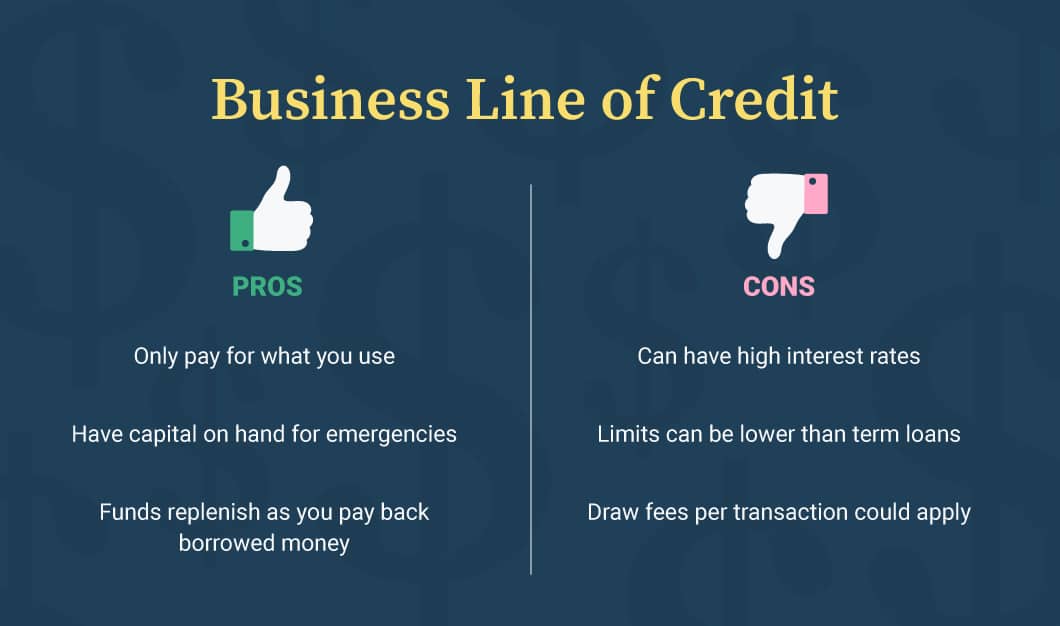

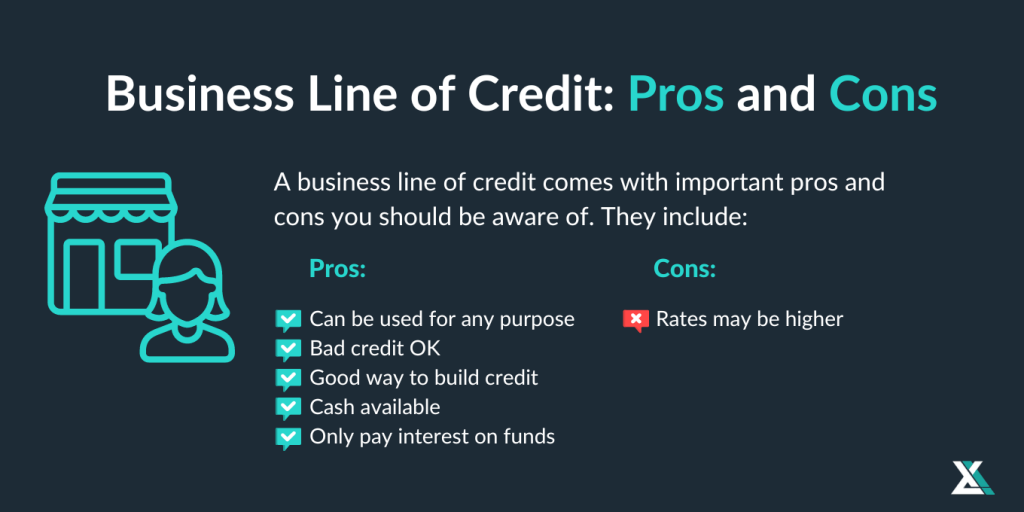

A line of credit is a flexible financing option that allows small businesses to access a predetermined amount of funds at their discretion. This credit arrangement is particularly beneficial for managing cash flow fluctuations, enabling businesses to respond swiftly to unforeseen expenses or investment opportunities. Unlike traditional loans, which provide a lump sum of money that must be repaid in fixed installments, a line of credit offers more versatility. Small business owners can withdraw funds as needed, only paying interest on the amount drawn, which can significantly ease financial strain.

The importance of a line of credit in cash flow management cannot be overstated. Small businesses often encounter seasonal sales fluctuations, delayed payments from clients, or unexpected expenses all of which can impact working capital. A line of credit serves as a financial safety net, allowing business owners to access funds when cash flow is tight without lengthy approval processes. This quick access to cash can empower businesses to seize opportunities for growth or address immediate operational needs without having to apply for a new loan each time funds are required.

Additionally, lines of credit can aid in building credit history for small businesses. By utilizing and repaying the drawn amount responsibly, business owners can enhance their credit score, which may facilitate securing larger loans or more favorable loan terms in the future. It is also worth noting that lines of credit come in secured and unsecured forms, with secured lines generally offering lower interest rates due to the collateral provided. Thus, understanding the nature of lines of credit and their specific benefits can significantly impact a small business’s financial health and growth trajectory.

Why Small Businesses Need a Line of Credit

Small businesses often encounter financial challenges that necessitate a reliable source of funding, making a line of credit an essential financial tool. One major reason for this need is to effectively manage cash flow, especially during slow seasons when revenue may dip. Many small businesses experience fluctuations in sales, and having access to a line of credit allows them to cover operational expenses, ensuring that they can meet payroll, pay suppliers, and maintain day-to-day operations without interruptions.

Moreover, unexpected expenses can arise at any time. Whether it is an urgent repair, an inventory shortage, or an unexpected increase in operational costs, having a line of credit provides small business owners with a safety net. This flexibility enables businesses to address unplanned costs promptly without resorting to high-interest loans or compromising their financial stability.

Lines of credit can also present opportunities for growth. For instance, a small business may have the chance to invest in a new marketing campaign, purchase additional inventory, or expand their services. Accessing a line of credit can facilitate these investments, empowering small businesses to seize opportunities they may not be able to afford otherwise. For example, a local bakery that secured a line of credit was able to launch a new product line during the holiday season, resulting in a significant increase in sales and customer engagement.

Statistics further emphasize the importance of lines of credit in small businesses. According to a survey conducted by the Small Business Administration, approximately 30% of small business owners reported using a line of credit for operational expenses. This statistic highlights the widespread recognition of lines of credit as a favorable financing option. Overall, a line of credit serves as a vital tool for small businesses, aiding in cash flow management, addressing unexpected costs, and fostering growth opportunities.

Types of Lines of Credit Available

Small businesses often require financial flexibility to manage their operational costs and growth initiatives. One of the best solutions available is a line of credit, which allows businesses access to funds as needed. Lines of credit can be generally categorized into three primary types: secured, unsecured, and revolving lines of credit.

Secured lines of credit are backed by collateral, such as real estate or equipment. This type of credit typically offers lower interest rates, making it an attractive option for businesses with sufficient assets. However, the downside is the risk of losing the collateral if the business defaults. For startups or businesses without significant assets, secured lines might not be a viable choice.

Unsecured lines of credit, on the other hand, do not require collateral. Instead, lenders assess the creditworthiness and business history of the applicant. Although this type of credit provides easier access to funds, it often comes with higher interest rates and lower credit limits compared to secured lines. Unsecured lines are particularly beneficial for businesses that may not have valuable assets to pledge but maintain a strong credit profile.

Business credit cards also fall under the category of lines of credit. They offer flexibility for everyday purchases and often include rewards programs. While their accessibility is advantageous, interest rates can be steep if balances are not paid in full each month. It is essential for businesses to evaluate their spending habits and payment capabilities before relying on credit cards as a primary financing option.

Revolving lines of credit allow businesses to borrow up to a predetermined limit and pay back only what they use, with financing becoming available again as payments are made. This type of credit is exceptionally beneficial for managing cash flow fluctuations. Each type of line of credit has distinct advantages and disadvantages thus, readability in choosing the best option will depend on the specific financial needs and risk tolerance of the business.

Understanding the Eligibility Criteria

Qualifying for a small business line of credit entails meeting specific eligibility criteria, which can vary depending on the lender. One of the most critical components is the credit score. Lenders typically prefer a personal credit score of 650 or higher. A strong credit score demonstrates financial responsibility and can significantly enhance your chances of approval. However, some lenders may cater to business owners with lower scores, albeit with higher interest rates.

Business History and Financial Documentation

Another aspect that lenders consider is the history of your business. Generally, they seek enterprises that have been operational for at least six months, although this requirement can vary. Additionally, lenders usually require financial documentation such as profit and loss statements, tax returns, and a bank statement. These documents help assess the financial health of your business and its ability to repay any borrowed amount.

Collateral Requirements

Collateral plays a crucial role in qualifying for a small business line of credit. Some lenders require collateral, which can be in the form of business assets, properties, or personal guarantees. This is especially common if you opt for larger credit limits. Offering collateral can improve your chances of securing credit by mitigating the risk for lenders, allowing them to ensure that they have recourse if you default on repayment.

Improving Chances of Approval

To increase your chances of being approved for a small business line of credit, consider taking proactive steps. Start by reviewing and improving your credit score if necessary. Paying off debts and correcting any inaccuracies on your credit report can make a significant difference. Furthermore, having a well-prepared business plan and organized financial records can showcase the potential success of your business, reassuring lenders of your creditworthiness. Finally, exploring multiple lenders can help you find the best terms and increase your chances of approval.

Choosing the Right Lender

When seeking a line of credit for your small business, selecting the right lender is crucial to ensuring financial stability and growth. One of the foremost considerations should be the interest rates offered by potential lenders. Interest rates can vary significantly between institutions, so it is advisable to compare multiple options. A lower interest rate can lead to substantial savings over time, especially if you anticipate using your line of credit frequently.

In addition to interest rates, the terms of the credit line are equally important. Different lenders may impose various conditions on how funds can be utilized, repayment schedules, and the duration of the credit line. Understanding these terms is essential to ensure they align with your business needs and cash flow management practices. Flexible repayment options can also provide additional relief in times of financial strain.

Another critical factor is customer service. Engaging with lenders who prioritize customer support can make a significant difference in your borrowing experience. Efficient communication and responsive service can help address any inquiries or issues promptly, ensuring that you have the necessary support during both application and repayment phases.

Furthermore, researching online reviews can provide valuable insights into a lender’s reputation. Exploring feedback from existing customers can reveal their experiences related to the application process, service quality, and responsiveness. Focus on lenders that consistently receive positive reviews, as this often signifies a trustworthy lender.

It is advisable to compile a shortlist of reputable lenders specializing in small business financing. Institutions that have established a solid presence in the market, such as traditional banks, credit unions, and online lenders with strong track records, should be prioritized. Investing time in thorough research can empower you to make an informed decision when selecting the right lender for your small business line of credit.

Managing Your Line of Credit Effectively

Managing a line of credit effectively is crucial for small business owners looking to leverage this financial resource for growth while minimizing risk. One of the key strategies is to monitor usage diligently. Keeping track of how much credit is accessed and for what purposes helps ensure that the funds are utilized optimally. Regularly reviewing your credit utilization ratio is advisable this ratio should ideally be kept below 30% of your total credit limit to maintain a healthy credit score.

Furthermore, timely repayments are essential. Scheduling repayments to coincide with cash flow patterns can help avoid any penalties and maintain good standing with your lender. Establishing a repayment plan that aligns with your revenue cycles allows you to ensure that you are not overextending your finances. Consistent, on-time payments not only solidify your reputation as a reliable borrower but also positively impact your credit score, aiding future credit applications.

It is equally important to be vigilant against common pitfalls such as overspending. When access to credit is readily available, there might be a tendency to use it frivolously. To counter this, setting a budget that clearly outlines your business spending and sticking to it can help in avoiding unnecessary debt. Additionally, having a clear purpose for each draw from your line of credit and differentiating essential expenses from optional ones lays a strong financial foundation.

Lastly, maintaining a healthy credit score hinges on these proactive measures. Regularly checking your credit report for inaccuracies, managing outstanding debts, and avoiding unnecessary credit inquiries are all practices that support long-term financial health. By understanding and implementing these strategies, you can manage your line of credit effectively, ensuring that it serves as a valuable tool for your small business’s financial success.

Common Misconceptions About Lines of Credit

Lines of credit, while a valuable financial tool for many small businesses, are often surrounded by a cloud of misconceptions. One prevalent myth is the belief that acquiring a line of credit leads to uncontrollable debt accumulation. In reality, a line of credit is designed for flexibility, allowing businesses to only draw what they need, when they need it. This feature can aid in managing cash flow without the necessity of borrowing large sums upfront, thus granting businesses greater control over their expenses and repayment strategies.

Another common misunderstanding is that once a line of credit is established, the entire credit limit must be utilized. This is not the case. Small business owners can withdraw any amount up to their approved credit line, and they are not obligated to use the full limit. This flexibility allows businesses to draw funds during short-term financial strains and pay them back as they become financially stable again. Using a line of credit responsibly involves only borrowing what is necessary and repaying it on time, which can enhance the business's credit score over time.

Furthermore, some entrepreneurs assume that lines of credit are exclusively for larger businesses. This perception is misleading, as many financial institutions now offer tailored lines of credit suitable for small businesses. Such credit options can provide vital support during growth phases or unexpected emergencies. Understanding these common misconceptions can empower small business owners to make informed financial decisions, utilize lines of credit effectively, and debunk the myths that can hinder their access to valuable funding resources. By fostering a clearer understanding of how lines of credit operate, business owners can leverage these financial tools to enhance their operations securely and responsibly.

Real-Life Success Stories

Many small businesses have successfully utilized lines of credit to navigate challenges and fuel their growth aspirations. For instance, consider the case of a local bakery that was struggling to meet demand during the holiday season. With limited cash flow and high customer interest, the owner decided to apply for a line of credit. This financial tool allowed her to purchase additional ingredients and hire temporary staff, ultimately leading to a significant increase in holiday sales. By the end of the season, the bakery not only covered its credit expenses but also retained a loyal customer base, positioning it for future success.

Another compelling example comes from a tech startup that faced unforeseen expenses while developing its software product. The founders opted for a line of credit to address immediate cash flow needs. They were able to cover operational costs without sacrificing their project timeline. This strategic use of credit helped them to launch their product successfully, gaining traction in a highly competitive market. Today, the startup has expanded its team and product offerings, attributing much of its initial growth to prudent financial decisions.

These examples highlight the flexibility and utility of lines of credit for small businesses. They offer access to necessary funding without the burden of long-term commitments. It is essential for entrepreneurs to carefully assess their financial needs and consider how a line of credit might be structured to support their specific goals. Small business owners can take inspiration from these success stories, understanding that with careful planning and smart financial choices, they too can navigate challenges and pursue growth opportunities effectively.

Frequently Asked Questions (FAQ)

When considering a small business line of credit, potential borrowers often have numerous questions regarding eligibility, impact on credit scores, and use cases. Understanding these factors can help facilitate informed decisions in securing necessary financial resources for your business.

One common question revolves around eligibility requirements for a small business line of credit. Generally, lenders assess various criteria, including the business's credit score, revenue, time in operation, and overall financial health. Typically, businesses with a credit score of 650 or higher are at an advantage, but some lenders may offer options for those with lower scores. Moreover, proving consistent revenue generation is crucial lenders often seek a minimum annual revenue threshold, which can vary based on the institution.

Another area of concern is the impact of applying for a line of credit on a business's credit score. Most lenders will perform a hard inquiry to assess creditworthiness, which may temporarily lower the credit score. However, responsibly managing the drawn funds and making timely repayments can positively influence the credit standing over time, enriching future borrowing potential.

Small business lines of credit can be used for various purposes, such as managing cash flow, purchasing inventory, or financing unexpected expenses. The flexibility of these lines allows businesses to draw funds as needed and only pay interest on the amounts utilized. This can be particularly beneficial during slow sales periods or when a quick infusion of cash is necessary to seize timely opportunities.

Finally, first-time applicants often seek advice on securing their first line of credit. Being well-prepared is key: applicants should gather necessary documentation, such as financial statements, tax returns, and a solid business plan demonstrating the intended use of the credit. This preparation can enhance the chances of approval and facilitate a smoother application process.

For You ✨

View All

February 16, 2025

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10