Exploring Business Line of Credit Options

Nathan Allen

Photo: Exploring Business Line of Credit Options

Understanding Business Lines of Credit

A business line of credit is a flexible financing option that allows enterprises to access funds as needed, up to a predefined limit. Unlike a traditional loan, where a lump sum is provided and repaid over a fixed term, a line of credit allows businesses to withdraw funds, repay them, and borrow again, creating an ongoing source of capital. This structure effectively supports businesses in managing cash flow fluctuations and addressing unforeseen expenses, making it particularly beneficial for small and medium-sized enterprises (SMEs).

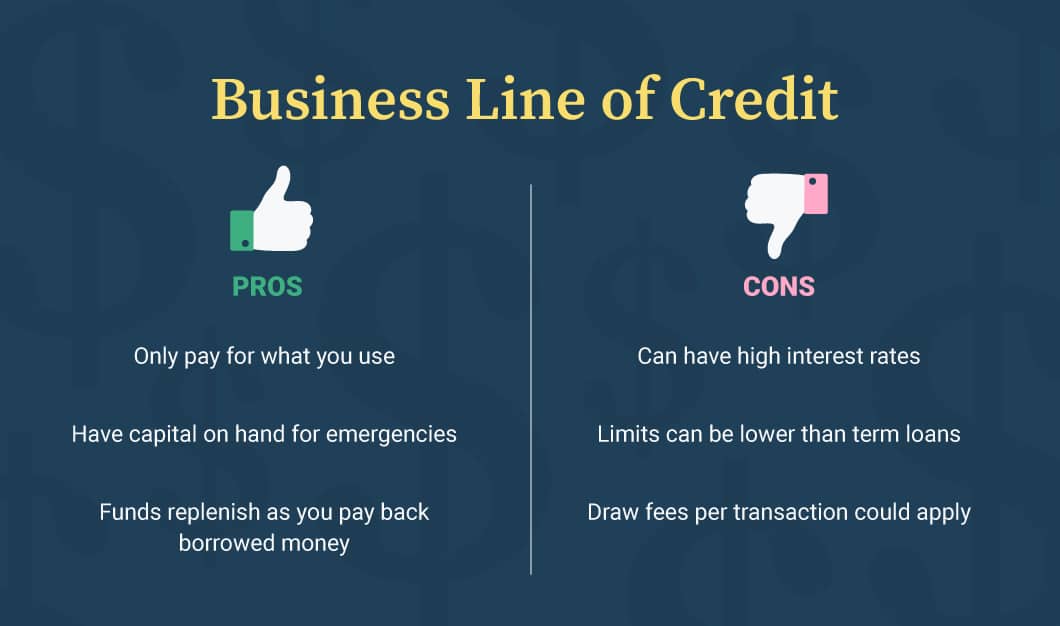

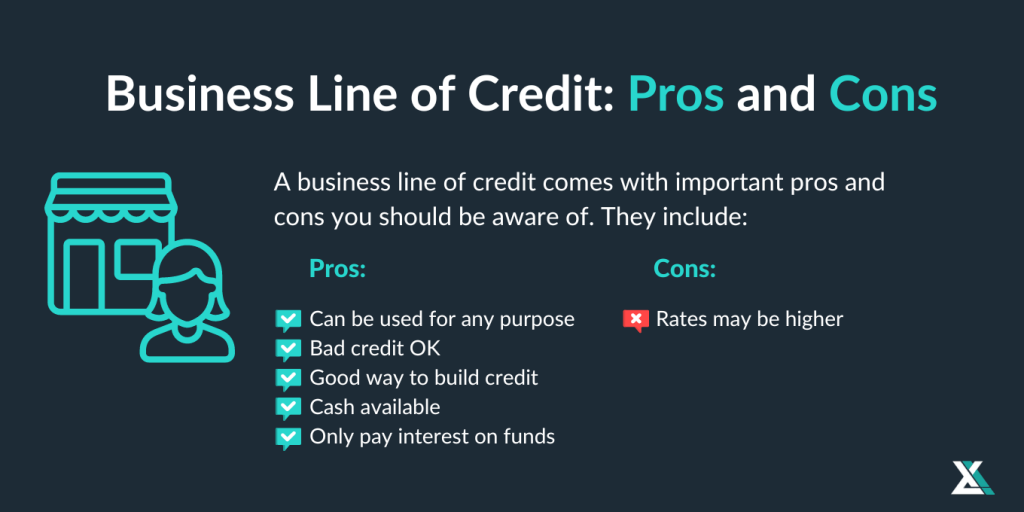

One of the primary distinctions between a business line of credit and other financing options lies in its accessibility. With a line of credit, businesses only incur interest on the amount they actually use rather than the full credit limit. This pay-per-use characteristic not only lowers expenses during periods of low demand but also provides financial agility. Businesses can draw funds for various purposes, including maintaining inventory, purchasing equipment, or covering operational costs during slower revenue cycles.

Moreover, a business line of credit can serve as a financial safety net for companies that experience unexpected expenses. For instance, if a sudden equipment failure arises or a large order needs to be fulfilled rapidly, a business can tap into its available line of credit without the lengthy application process associated with traditional loans. This timely access to funds minimizes potential disruptions and enables companies to remain productive.

In addition to enhancing cash flow management, a line of credit can also improve a business’s credit profile. Regular, responsible use of this financing option can help establish a history of positive credit behavior, which can be advantageous for securing additional financing in the future. Overall, understanding the structure and benefits of a business line of credit is essential for SMEs aiming to navigate the challenges of fluctuating cash flows and unexpected costs effectively.

Types of Business Lines of Credit

Business lines of credit serve as flexible financing options that allow businesses to borrow money as needed, up to a set limit. They can be broadly categorized into two main types: secured and unsecured lines of credit. Each type offers distinct advantages and disadvantages, enabling businesses to choose the most suitable option based on their financial circumstances and credit profiles.

Secured lines of credit require collateral, which can include business assets, inventory, or receivables. Lenders may be more willing to offer larger amounts or better terms due to the lower risk involved. However, the primary downside is that failure to repay the borrowed amount can lead to the loss of the pledged collateral. This type is ideal for businesses with valuable assets that can mitigate lender risk.

On the other hand, unsecured lines of credit do not require collateral, which provides greater flexibility and may be appealing to startups or businesses without significant assets. However, because there is no security for lenders, the interest rates tend to be higher, and qualification criteria can be stricter. This option is suitable for businesses looking for short-term financing without the need for asset-backed security.

The choice of lender also plays a crucial role in obtaining a business line of credit. Traditional banks are known for their competitive interest rates and terms, although they typically impose stringent qualification criteria. Credit unions may offer more favorable rates and personalized service, making them attractive to local businesses. Alternatively, online lenders have emerged as a popular choice due to their rapid approval processes and more lenient requirements. However, businesses must be mindful of potentially higher fees associated with these alternative financing options.

In summary, understanding the different types of business lines of credit, along with the characteristics of various lenders, is essential for businesses seeking tailored financing solutions. Evaluating these options carefully ensures that organizations can strategically address their funding needs while managing risks effectively.

Qualifications and Criteria for Approval

Obtaining a business line of credit requires meeting specific qualifications and criteria established by lenders. One of the foremost requirements is the credit score, which serves as a critical indicator of a borrower’s financial health. Generally, a personal credit score of at least 600 is preferred, though some lenders may consider scores lower than that. Businesses with higher credit scores are typically seen as lower-risk borrowers, which can lead to better terms and interest rates.

In addition to credit scores, financial statements are crucial components of the application process. Lenders often request documents such as profit and loss statements, balance sheets, and cash flow statements to evaluate the financial stability of the business. This documentation allows lenders to ascertain whether the business has sufficient revenue streams to repay the drawn amount. Providing comprehensive and organized financial records can significantly improve a business’s approval chances.

Time in business is another vital factor that lenders consider. Generally, businesses that have been operational for at least one to two years are viewed favorably. This duration indicates stability, longevity, and a proven track record, which reassures lenders of the business's reliability and ability to manage credit. Startups or relatively new businesses may face challenges in securing a line of credit unless they can provide compelling financial projections or sufficient collateral.

Lastly, revenue thresholds act as benchmarks that lenders use to gauge a company’s capability to handle a line of credit. Lenders may require a minimum annual revenue, often in the range of $100,000 or more, depending on the size of the credit line requested. Businesses can enhance their chances of approval by maintaining consistent revenue growth, improving their credit scores, and ensuring their financial statements are accurate and well-prepared. By focusing on these aspects, businesses can navigate the approval process more effectively.

Application Process Explained

Applying for a business line of credit is a systematic process that requires careful preparation to ensure a smooth experience. By taking the time to gather the necessary documentation and understanding the application process, business owners can facilitate a more efficient approval timeline.

The first step in the application process involves gathering the appropriate financial documents. Lenders typically require information about the business’s financial health, including income statements, tax returns, balance sheets, and proof of existing debt. Additionally, personal financial statements of the business owners may also be required. This documentation helps lenders assess the risk involved in extending a line of credit, thereby playing a vital role in the evaluation process.

Once the documentation is collected, the next step is to submit the application, which can often be completed online. Many lenders offer pre-qualification options, which allow business owners to see potential credit limits and interest rates without impacting their credit scores. After the application is submitted, lenders will review the financial documents along with the business's credit history and overall health.

It is essential for applicants to stay engaged throughout the process. This includes responding promptly to any follow-up requests from lenders, which may involve further documentation or clarification. The clarity and completeness of the provided information are critical to avoiding delays in processing.

Upon approval, negotiation of the terms is an essential part of finalizing the line of credit. Business owners should carefully examine interest rates, repayment terms, and any applicable fees before signing. Understanding these elements can lead to more favorable conditions that align with the business's financial strategy.

In conclusion, a well-prepared application process can significantly enhance the chances of securing a favorable business line of credit. By understanding and following the necessary steps, applicants can avoid common pitfalls and improve their borrowing experience.

Understanding Interest Rates and Fees

Interest rates on business lines of credit are crucial components that directly impact the cost of borrowing. These rates are determined by a variety of factors, including the creditworthiness of the borrower, the prevailing market rates, and the specific terms of the line of credit agreement. Lenders typically assess an applicant's credit score, business financials, and overall risk profile to establish suitable interest rates. Businesses with higher credit scores may qualify for lower rates, while those with less favorable credit histories may face higher borrowing costs.

Another influential factor is the prime rate, which serves as a benchmark for many lenders. As the prime rate fluctuates, so do interest rates on lines of credit. Additionally, the type of lender—whether traditional banks, credit unions, or alternative financing institutions—can also influence the rate offered. Understanding these factors is essential for businesses to make informed borrowing decisions.

Fees associated with business lines of credit can vary significantly. Common charges include annual fees, which are typically charged for maintaining an account, and maintenance fees, which may apply to inactive lines of credit. Late payment charges are another concern; failing to make timely payments can lead to steep penalties. Other potential fees include draw fees, which may be incurred each time the business taps into the line of credit. Borrowers should closely examine all associated fees when comparing different financing options, as these can considerably affect the overall cost of borrowing.

To effectively compare rate offers from various lenders, businesses should request detailed breakdowns of all interest rates and fees. Utilizing online calculators can also help in assessing the long-term cost implications. Moreover, engaging multiple lenders and leveraging offers can position borrowers to negotiate better terms and lower costs, facilitating a more favorable borrowing experience.

How to Use a Business Line of Credit Wisely

Utilizing a business line of credit (LOC) wisely is critical for long-term financial health and operational stability. The first step in effectively managing an LOC is ensuring robust cash flow management. Businesses should monitor their cash inflows and outflows closely, allowing them to draw on the line of credit only when necessary. For example, if a retailer anticipates a seasonal increase in demand, they might strategically use their LOC to purchase additional inventory, ensuring that they can meet customer needs without jeopardizing their cash reserves.

Timely repayments play a pivotal role in maintaining a strong relationship with the lender and preserving the business's credit score. High-interest rates typically associated with lines of credit can accumulate quickly if balances are not paid down promptly. A company that consistently pays its outstanding amount can benefit from lower interest rates in future borrowings. Setting up automatic payments or reminders can aid businesses in staying current and in good standing.

Furthermore, businesses should refrain from overextending their credit limits. It is essential to recognize how much credit is necessary for achieving specific goals without accumulating unmanageable debt. For example, consider a construction company with a line of credit of $100,000. By strategically drawing down only $30,000 for an essential project while ensuring that they can repay it in a reasonable timeframe, the company avoids the risks linked to exceeding their limit. In doing so, they maintain financial flexibility for unforeseen expenses.

In conclusion, leveraging a business line of credit can be a powerful financial tool when approached strategically. By prioritizing cash flow management, ensuring timely repayments, and avoiding overextension of credit limits, businesses can harness the advantages of their LOC while mitigating potential pitfalls associated with credit misuse.

Potential Risks and Drawbacks

While a business line of credit can provide significant advantages, it is not devoid of potential risks and drawbacks that warrant careful consideration. One of the primary concerns is the risk of over-reliance on credit. Businesses may find themselves increasingly dependent on a line of credit to manage day-to-day expenses, leading to a cycle of borrowing that can be challenging to break. This over-dependence may hinder financial planning and create a situation where the business struggles to operate independently without a credit cushion.

Another critical issue is the high-interest costs associated with business lines of credit. Although these lines often have lower rates compared to traditional loans, the interest can accumulate quickly, especially if balances are not paid off promptly. Interest rates can fluctuate, which means businesses could face rising costs over time. This volatility can complicate budgeting efforts and create uncertainty in financial forecasting.

Additionally, the ease of access to revolving credit can tempt businesses into reckless spending, diverting funds away from essential operational needs. The convenience of withdrawing cash quickly may encourage business owners to make impulsive financial decisions. Consequently, if not managed prudently, it could result in increased debt levels and long-term financial strain.

Furthermore, during difficult economic times or a downturn, businesses that rely heavily on credit may find it harder to secure funding, as lenders may impose tighter restrictions or reduce available credit lines. Therefore, it is essential for business owners to assess their capacity to manage credit responsibly and consider alternative financing solutions when appropriate. Overall, a balanced view should be adopted when evaluating the suitability of a business line of credit, ensuring that the associated risks are weighed against potential benefits.

Real-Life Success Stories

Lines of credit have become essential financial tools for businesses across various sectors, enabling them to manage cash flow, invest in growth, and navigate unexpected challenges. One notable example is a small retail business in the fashion sector that utilized a line of credit to effectively manage inventory levels during seasonal fluctuations. By drawing upon their credit line, the owner was able to purchase additional stock ahead of peak shopping periods without depleting vital operational funds. This strategic decision not only increased sales but also enhanced customer satisfaction due to the availability of popular items, illustrating how a business line of credit can facilitate timely opportunities.

In the technology sector, a startup focusing on software development faced cash flow challenges during its early growth phase. By securing a line of credit, the founders were able to cover payroll and operational expenses while pursuing client contracts that promised future revenue. This financial flexibility allowed the team to concentrate on product development, ultimately leading to securing critical partnerships and accelerating growth. The successful navigation through initial hurdles highlights the importance of having a line of credit, particularly for startups that often experience irregular income patterns.

Another success story is from a manufacturing company that leveraged its credit line to invest in new machinery. Recognizing the need to enhance production efficiency, the business accessed its line of credit to purchase state-of-the-art equipment that improved output and reduced operational costs. This investment not only positioned the company ahead of its competitors but also resulted in long-term savings, proving that a business line of credit can serve as a catalyst for innovation and expansion.

These case studies underscore the versatility of lines of credit as financial instruments that can cater to various business needs across different sectors. By showcasing such successes, it becomes evident that lines of credit, when used judiciously, can empower businesses to achieve their goals while effectively managing financial uncertainties.

Frequently Asked Questions (FAQ)

When considering a business line of credit, potential borrowers often have numerous questions regarding eligibility, terms, and optimal practices. Below are some of the most frequently asked questions along with concise answers to provide clarity.

1. What are the eligibility requirements for a business line of credit?

Eligibility for a business line of credit typically depends on several factors including credit score, business revenue, and the length of time the business has been operational. Generally, lenders may require a minimum credit score of 650 and a proven revenue stream to ensure the business can repay the borrowed amount. Additionally, some lenders might inquire about business ownership and personal credit, which can also influence eligibility.

2. What terms should I expect when applying for a business line of credit?

Terms can vary widely among lenders, but common elements include a revolving credit limit, interest rates that may be variable or fixed, and repayment structures that generally involve monthly minimum payments. The credit limit is typically determined by the lender after evaluating the financial health of the business. Borrowers should also be aware of any applicable fees, such as annual fees or withdrawal fees.

3. How can I effectively utilize a business line of credit?

A business line of credit is a flexible financial tool that can be utilized for various purposes such as managing cash flow, purchasing inventory, or funding unexpected expenses. It is recommended to borrow judiciously and pay back the drawn amount promptly to minimize interest costs. Moreover, maintaining a good credit score and a solid repayment history can enhance future borrowing capacity.

4. What are the best practices for managing a business line of credit?

To effectively manage a business line of credit, it is advisable to monitor usage regularly, keep track of repayment schedules, and maintain open communication with the lender. Additionally, borrowers should avoid maxing out the credit line to maintain a healthy credit utilization ratio, which can positively affect credit scores and future borrowing potential.

Understanding these frequently asked questions can provide a solid foundation for making informed decisions regarding business lines of credit.

Conclusion and Call to Action

Understanding the various business line of credit options available is crucial for entrepreneurs and business owners seeking to enhance their financial flexibility. Throughout this guide, we have examined key factors such as the mechanics of business lines of credit, the types available, qualification requirements, and the advantages that come with utilizing this financial tool. By securing a business line of credit, companies can better manage cash flow fluctuations, invest in growth opportunities, and navigate unexpected expenses without the stress often associated with traditional financing methods. Each type of credit line offers unique benefits and should be assessed based on individual business needs, ensuring that owners make informed and strategic decisions. As we've discussed, evaluating your financial situation and understanding credit terms are fundamental steps before committing to a business line of credit. Whether you opt for a secured or unsecured line, grasping the implications of each choice will help you make a more tailored decision that aligns with your business objectives. We invite you to reflect on your experiences with business credit options. Sharing your insights in the comments section could provide valuable information for fellow readers exploring similar paths. If you found this article helpful, consider sharing it with others who may also benefit. Together, we can create a community of well-informed business owners empowered by financial knowledge. For those eager to delve deeper, additional resources and related content are available on our site to further enhance your understanding of business financing options. Thank you for taking the time to explore this comprehensive guide on business lines of credit. Your journey towards financial empowerment starts now.

For You ✨

View All

February 16, 2025

Quick Business Lines of Credit: Fast Funding SolutionsNeed immediate funds? Discover quick business lines of credit to keep your operations running smoothly. Apply today!

Nathan Allen

February 13, 2025

Leveraging Accounts Receivable for Secured CreditLearn how to secure a line of credit using your accounts receivable. Unlock your business's potential today!

Nathan Allen

February 12, 2025

Top Strategies for Secured Business FundingDiscover effective methods to secure business funding. Learn how to finance your venture successfully.

Nathan Allen

February 20, 2025

Citizens Line of Credit: Financing Your Vivint SystemExplore how Citizens line of credit can finance your Vivint smart home system. Upgrade your home security effortlessly!

Nathan Allen

February 14, 2025

How to Apply for a Business Line of CreditStep-by-step guide to applying for a business line of credit. Enhance your financial flexibility—start your application now!

Nathan Allen

February 19, 2025

Long-Term Business Lines of Credit: Pros and ConsEvaluate the benefits and drawbacks of long-term business lines of credit. Determine if it's the right choice for your company!

Nathan Allen

Trending 🔥

View All

1

2

3

4

5

6

7

8

9

10